Gas networks are making persistent and significant supernormal profits

Download Full Report

View Press Release

Key Findings

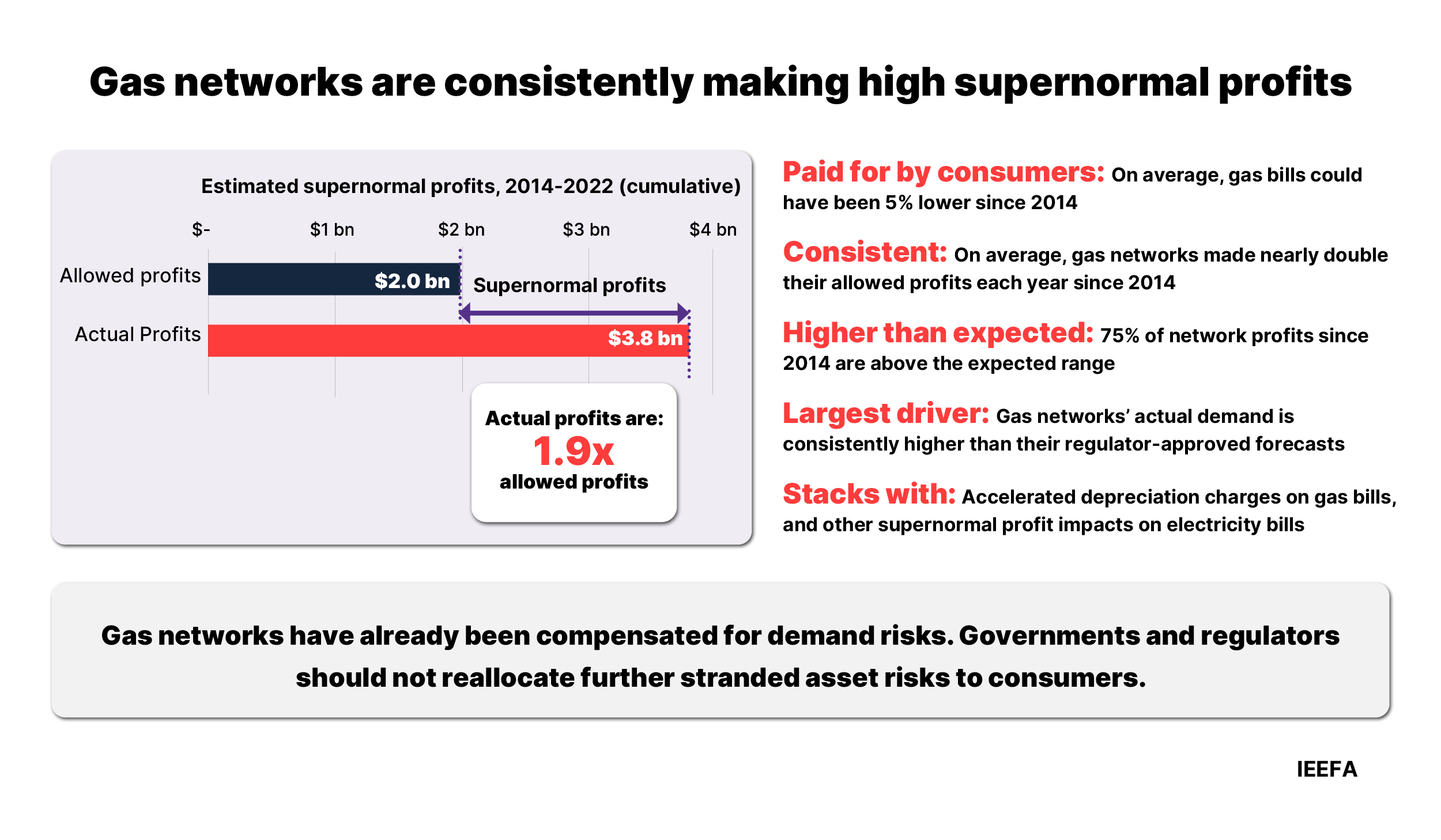

Fully regulated gas networks made $1.8 billion in supernormal profits from 2014 to 2022. This contributed to higher gas bills, and resulted in total profits that were nearly double networks’ regulator-approved allowance.

Gas networks are exposed to demand risks and, in aggregate, have benefitted from higher than forecast gas demand since 2014. This is the largest driver of supernormal profits, and is likely related to under-forecasting errors.

There is no strong case for the regulator to transfer stranded-asset risks from networks to consumers via accelerated depreciation or other forms of regulation. Federal and state governments should develop guidance on how to allocate these risks equitably.

Executive Summary

IEEFA has compared the actual profits of Australia’s fully regulated gas pipelines against their regulator approved profits (allowed profits) from 2014 to 2022, finding an estimated $1.8 billion in supernormal profits – nearly double their allowed profits.

These profits are persistent, and were found to be significant in every year across the analysed period. They are also excessive, with 75% of profits above the expected reasonable range.

While the incentive-based form of regulation for gas networks permits actual profits to differ from allowed profits, the unusually large scale and persistence of these profits raises doubts about the effectiveness of the regulatory regime in protecting consumers’ interests.

Supernormal profits on average contribute to 5% of a typical household gas bill, placing additional pressure on already high energy costs.

The most significant driver of supernormal profits is “revenue over-recovery”. Under their price cap form of regulation, gas networks are able to keep any additional revenue they make if their actual demand exceeds forecast levels. Conversely, they are expected to bear the costs if demand falls below forecast levels. In other words, gas networks are exposed to demand risks.

Unexpectedly, gas networks have persistently benefited from their exposure to demand risks, with actual demand exceeding forecast demand every year since at least 2011. Under the price cap form of regulation, networks have incentives to under-forecast demand, and it is likely that under-forecasting has contributed significantly to supernormal profits.

Persistent under-forecasting is not an intended feature of gas network regulation. If the Australian Energy Regulator (AER) were to correct under-forecasting errors in upcoming forecasts, gas networks could be exposed to downside risks. There is no regulatory requirement for networks to be compensated for any losses arising from these risks.

These findings raise key questions about how gas pipelines are regulated. While gas demand has consistently exceeded expectations, pipeline operators have been able to keep extra profits. In the long-term, networks and the market operator agree that gas demand is likely to decline due to a combination of consumer financial decisions and government policies. In a non-regulated market, suppliers would be expected to accept not only the upside risks from rising demand, but also the downside risks associated with demand falling faster than expected.

However, gas pipelines have been granted accelerated depreciation allowances by the regulator to shield them from future losses associated with lower demand and stranded-asset risks. This is inequitable from a consumer perspective as there is no strong case for risks to continue to be reallocated to consumers.

Other factors including outperformance in cost of debt and operational expenditure (opex) have also contributed to supernormal profits. The regulatory framework incentivises networks to outperform in these areas, with the expectation that it will lead to long-term efficiency benefits for consumers. However, there does not appear to be clear evidence that consumers have benefited from these profits through productivity improvements.

It is likely that most fully regulated gas networks are generating supernormal profits. The actual return on equity for most pipelines is consistently above the regulator’s allowance, in some cases exceeding 20% a year.

Similarly, all fully regulated pipelines have experienced net revenue over-recovery from 2014 to 2022, with Jemena alone extracting more than $490 million above its target revenue levels since 2014.

Financiers should be aware that the persistently high returns experienced by networks since 2014 are not guaranteed to continue, and networks are also exposed to downside risks if demand forecasting errors are corrected.

Additionally, the outlook for domestic gas consumption in Australia continues to shift at a rapid pace. Forecasts broadly agree that domestic gas demand is likely to decline, but an increasing number of developments are creating uncertainty about the rate of decline.

The persistence of supernormal profits related to demand risk exposure has implications for the future allocation of risks between gas networks and consumers. There is no clear basis in the National Gas Laws or National Gas Rules for risks to be reallocated from consumers to networks via accelerated depreciation or changes to the form of regulation. In fact, consumers have already provided significant compensation to networks for their risk exposure in the form of supernormal profits.

As such, IEEFA makes the following recommendations for governments and market bodies:

1. IEEFA recommends that the Department of Climate Change, Energy, the Environment and Water (DCCEEW)’s upcoming electricity and energy sector plan includes, as a priority, steps to phase-down gas distribution networks equitably. These could be developed in co-operation with state governments, and must consider the current allocation of demand and stranded-asset risks, including how the benefits and costs have flowed through to pipeline owners and customers over time.

2. IEEFA recommends that the AER update its approach to assessing demand forecasts, to explicitly analyse the drivers of differences between actual and forecast demand in previous regulatory periods.

3. IEEFA recommends that for upcoming access arrangements, the AER:

- Does not approve any further proposals for accelerated depreciation;

- Maintains the price cap form of regulation for gas networks; and

- Does not approve any decrease to demand forecasts in an existing access arrangement.