Gas networks pocket $1.8 billion in supernormal profits over eight years

Key Takeaways:

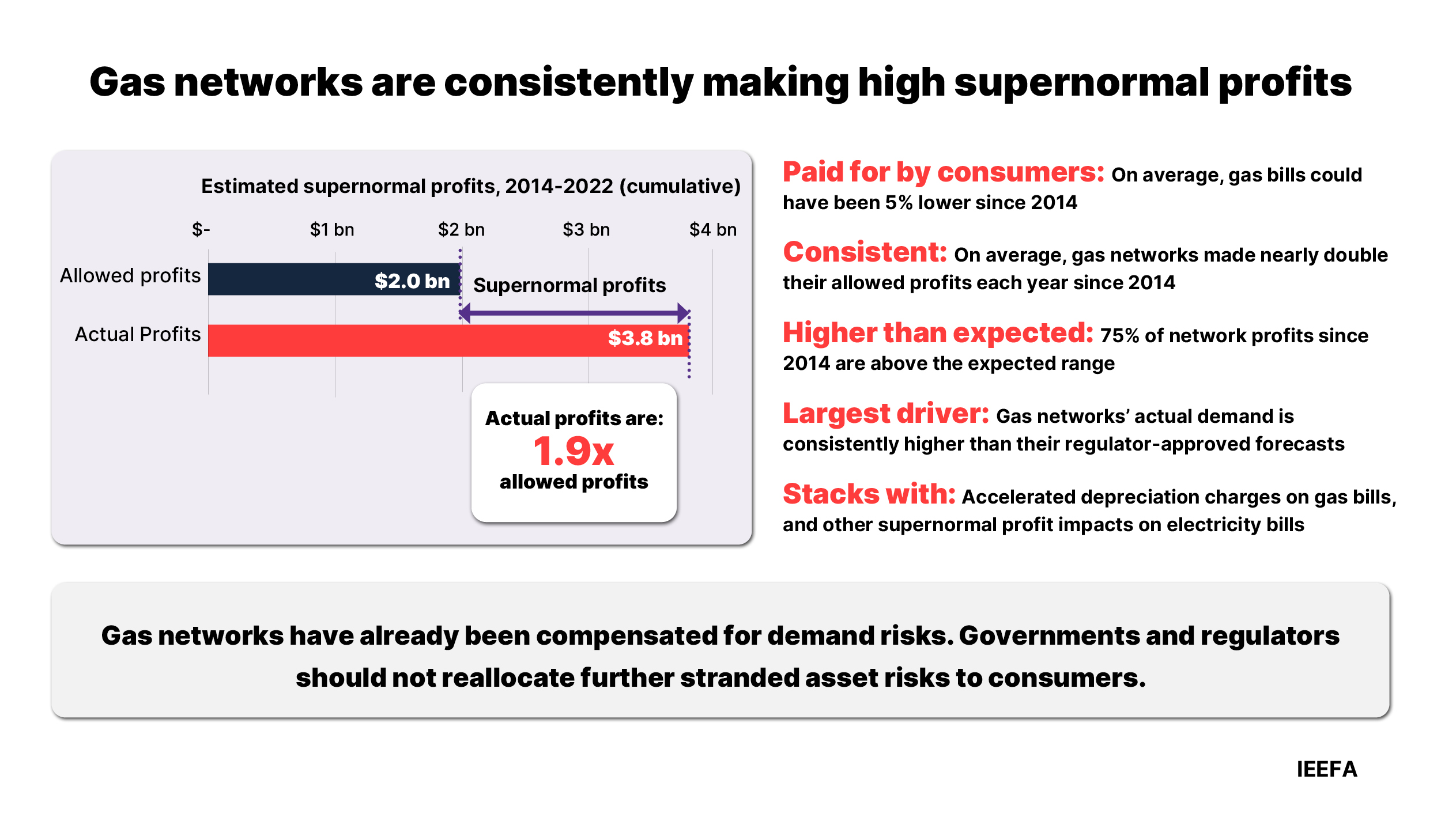

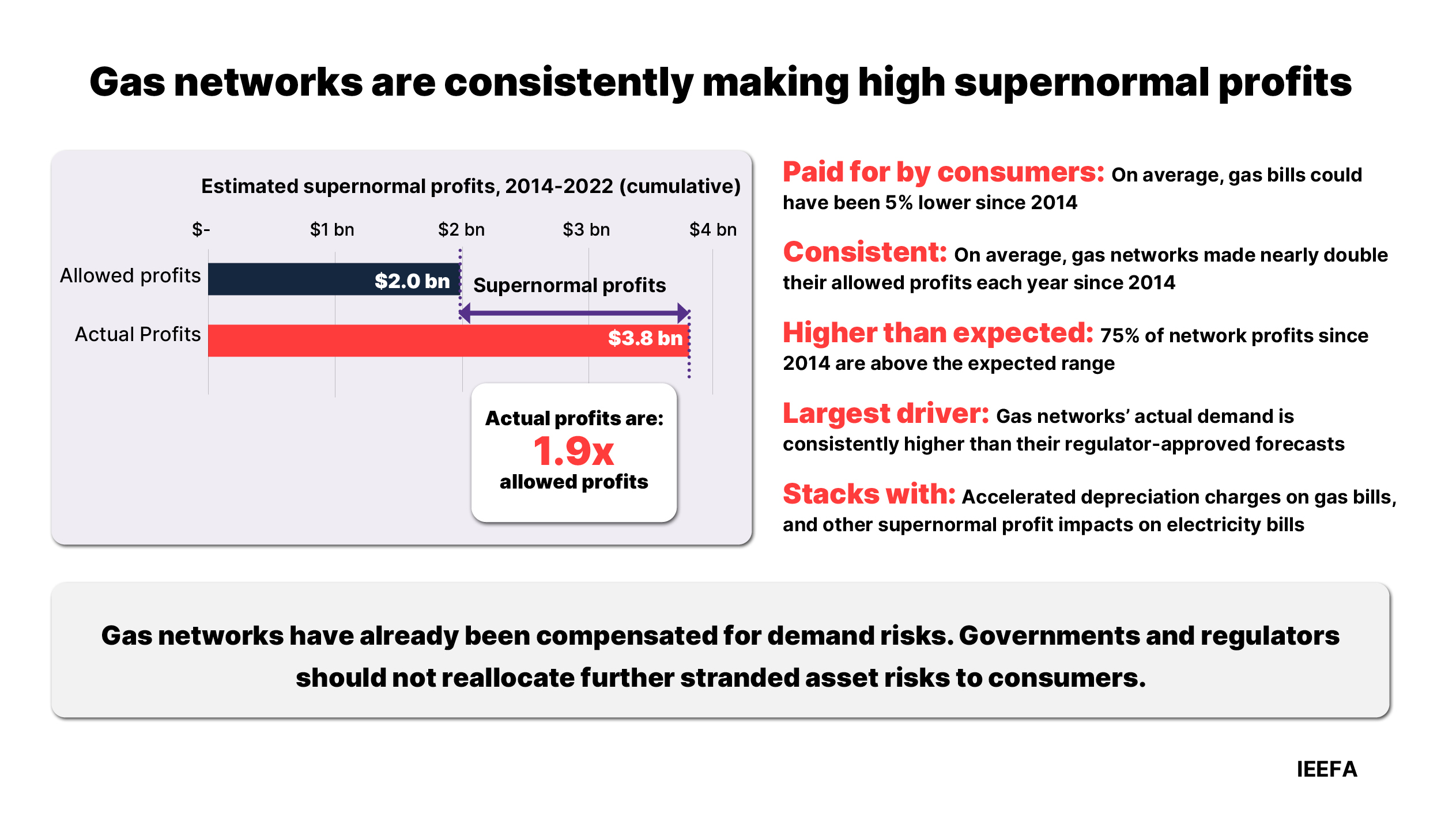

Fully regulated gas networks made $1.8 billion in supernormal profits from 2014 to 2022. This contributed to higher gas bills, and resulted in total profits that were nearly double networks’ regulator-approved allowance.

Gas networks have benefited from higher than expected gas demand since 2014. This is the largest driver of supernormal profits, and is likely related to errors in forecasting which underestimated gas demand.

While gas networks have been able to capture substantial supernormal profits from gas demand being higher than expected, now demand is likely to decline, the Australian Energy Regulator (AER) has taken decisions to protect some networks from potential losses.

The AER should not be transferring stranded-asset risks from gas networks to consumers via accelerated depreciation, as it is now doing. Federal and state governments should step in to develop guidance on how to allocate these risks more equitably.

6 June 2024 - (IEEFA Australia): The Institute for Energy Economics and Financial Analysis (IEEFA) is calling for Federal and state governments to step in to develop guidelines on how to allocate stranded asset risks between gas networks and their consumers. This comes following their latest report which has found unchecked under-forecasting of demand has contributed to Australia’s fully regulated gas networks almost doubling their prescribed profits since at least 2014.

These supernormal profits totalled $1.8 billion from 2014 to 2022. These were on top of a profit allowance of $2 billion, adding 5% to the average household gas bill each year, according to the report, Gas networks are making persistent and significant supernormal profits.

The Australian Energy Regulator (AER) approves reference tariffs for gas networks every five years, based on their forecast revenue requirements and demand. However, if demand exceeds that forecast, consumers are charged more than necessary to supply their gas, and the networks can bank the extra revenue.

IEEFA’s report found that this effect was the largest driver of supernormal profits, followed by other drivers such as networks spending consistently below their opex allowance, or accessing lower cost of debt than forecast.

“Supernormal profits are persistent across every year in the analysed period, and on average were double the regulator-allowed profits,” says Jay Gordon, Energy Finance Analyst at IEEFA Australia and the report’s author.

“While some supernormal profits are expected, we estimate 75% of profits made by gas networks since 2014 were above the expected reasonable range.”

The form of regulation applied to gas networks creates an incentive for networks to make overly conservative demand forecasts.

“While the incentive-based form of regulation for gas networks permits actual profits to differ from allowed profits, the unusually large scale and persistence of these profits raises doubts about the effectiveness of the regulatory regime in protecting consumers’ interests,” Mr Gordon says.

Recurrent errors in forecasting should have been corrected by the AER in subsequent years but they have gone unchecked for almost a decade, according to the available data.

“Unexpectedly, gas networks have persistently benefited from their exposure to demand risks, with actual demand exceeding forecast demand every year since at least 2011,” Mr Gordon says.

“Persistent under-forecasting is not an intended feature of gas network regulation. Under the price cap form of regulation, networks have incentives to under-forecast demand, and it is likely that under-forecasting has contributed significantly to supernormal profits.”

The report found that all fully regulated gas pipelines had recovered excess revenue from 2014 to 2022, with Jemena’s distribution network in New South Wales alone extracting more than $490 million above its target revenue.

The AER and networks expect gas demand to decline in the long term as consumers transition towards all-electric homes. However, some gas pipelines have already been granted accelerated depreciation allowances, shielding them against future losses associated with lower demand and stranded-asset risks, at the expense of consumers.

“In a non-regulated market, suppliers would be expected to accept not only the upside risks from rising demand, but also the downside risks associated with demand falling faster than expected,” Mr Gordon says.

“Consumers have been paying higher gas bills than necessary since at least 2014 – compensating networks to the tune of $1.8 billion for their exposure to demand risks. There is no strong case for risks to now be reallocated to consumers, at a time when gas is likely to be in decline as a household fuel.”

IEEFA recommends that the federal government’s upcoming electricity and energy sector plan includes steps to phase down gas distribution networks equitably without allocating additional costs and risks to consumers.

In the meantime, the AER should review its process for approving demand forecasts to account for under-forecasting errors. There is no strong case for the AER to continue to approve accelerated depreciation allowances, or make changes to the form of regulation that would see further risks allocated to consumers.

Read the report: Gas networks are making persistent and significant supernormal profits

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Jay Gordon, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)