Consumers may pay too high a price for virtual LNG ‘pipelines’ in Pakistan

Key Findings

At least two virtual liquefied natural gas (VLNG) supply projects are being planned in Pakistan, with a combined capacity of 6.23 mtpa. However, the future of a virtual LNG pipeline network in Pakistan remains highly uncertain due to the complex economics and the need for strict safety and environmental regulations.

There is a risk of unutilized terminal capacity and idle supply infrastructure due to a supply-demand mismatch. In addition, the loss of a high-paying customer base may jeopardize the financial health of Pakistan’s already struggling gas utilities.

IEEFA finds that the end-consumer price of LNG delivered via tanks or trucks in Pakistan would range between US$17/MMBTU and US$19/MMBTU.

Affordability remains a prime concern. Although LNG prices are expected to come down in the future as a massive flood of supply enters the market post 2025, Pakistan is expected to continue paying higher prices due to oil-indexed contracts and a high credit risk. Locking in additional supply carrying the same risk may be unaffordable for consumers.

Pricing LNG by truck and rail into Pakistan’s gas market may prove overly challenging

In a move aimed at diversifying its natural gas supply options, Pakistan appears to be considering setting up virtual liquefied natural gas (VLNG) ‘pipelines’ across the country. At present, the country has at least two VLNG projects underway, yet the economic viability of such ventures and their impact on the local consumer base remains unclear.

Demand for natural gas including LNG remains strong in the country due to the inherent and widespread dependency of domestic, commercial, industrial, and power sectors on the fuel. However, dwindling domestic gas reserves and difficulties securing LNG cargoes on the spot market has led Pakistan to seek an alternative means of securing gas supply to ensure energy security – LNG virtual pipelines.

Proposed virtual LNG supply chains in Pakistan

Virtual LNG supply chains, also referred to as trucked LNG in certain scenarios, are an alternative to the traditional means of supplying natural gas through pipeline infrastructure, typically involving the transportation of LNG using cryogenic trucks/tanks or rail.

In December 2023, the China National Chemical Engineering Company (CNCEC) and LNGFlex Limited signed a Master Engineering Procurement Construction and Finance (EPCF) contract worth more than US$500 million to set up a virtual LNG supply network and a long-distance pipeline gas supply chain in Pakistan. CNCEC is a Chinese contractor with decades of experience in China’s LNG market, while LNGFlex is a subsidiary of the United Arab Emirates-based Bison Energy Group, which recently acquired the Tabeer LNG project, situated in Port Qasim.

Together, the consortium will carry out the project in two phases. The first includes construction of a VLNG network complete with an LNG receiving terminal, on-shore LNG storage, and procurement of a fleet of ISO trucks. The VLNG network is expected to commence construction by the last quarter of 2024. The second phase, which involves a gasification facility and long-distance pipeline along with other associated infrastructure, is expected to receive a Final Investment Decision (FID) by 2025. Upon completion of the project, the virtual LNG pipeline will have a peak supply capacity of 750 million cubic feet per day (mmcfd) or 5.23 million tons per annum (mtpa).

Other contenders include LNG Easy, a subsidiary of the Singapore-based LNG Easy Pte Ltd, which was awarded a provisional license in 2021 by the Oil and Gas Regulatory Authority (OGRA) for the supply of trucked LNG to off-grid consumers in Islamabad, Lahore and Karachi. Since then, the company has brought in a local partner called the Punjab Group, a Pakistan-based provider of education services not previously involved in the energy sector, and in September 2022 the consortium submitted an application to OGRA for a construction/operation license. In June 2023, OGRA conducted a public hearingregarding the provision of a license to the joint venture (JV), although no specific progress on the outcome of the hearing has been reported to date.

According to the original announcement from LNG Easy, the project was expected to begin importing around 1 million tons per annum (mtpa) of LNG in 2023, but clearly the project has yet to materialize. It is speculated that the volatile nature of global LNG supply, resulting in a high-priced supply environment in Asia, has prevented the project from making much headway.

Both projects will be independent of government regulation and carried out entirely by the private sector, including the marketing of LNG to end-users.

Is VLNG in Pakistan economic?

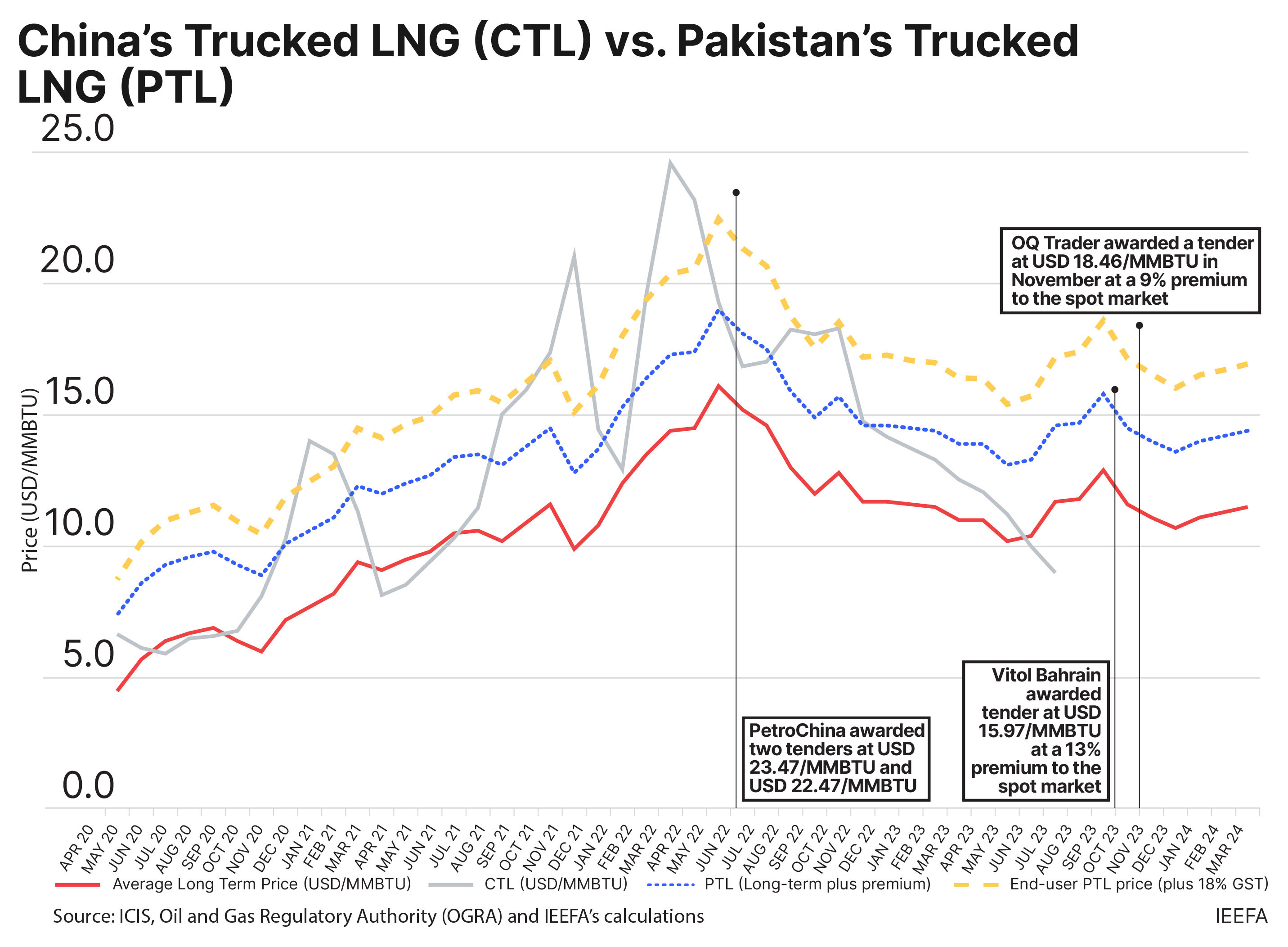

The virtual LNG pipeline projects by LNG Easy and Tabeer Energy will be pioneering projects in off-grid natural gas supply in Pakistan, and therefore an exact benchmark pricing for the commodity may not be available at present. However, other regional markets, such as China’s trucked LNG business, may offer a predictive range for what the price could be. According to S&P, the average price of China’s trucked LNG (CTL) closed at around US$600.82/mt or US$12.7/MMBTU on February 28 2024. China’s trucked LNG market relies on both spot and long-term cargoes. Since the sector is unregulated by the state, the prices broadly reflect the spot market plus a transportation premium, as importers allow the prevailing trends of the open market to dictate the retail price.

By virtue of the same principles, LNG importers in Pakistan can procure on the spot market or rely on oil-indexed long-term contracts. Due to Pakistan’s recent poor performance on the spot market – the country has only procured two spot cargoes since June 2022 and at too high a premium – VLNG developers have suggested they would prefer long-term supply contractswith oil majors. Long-term supply contracts for LNG are usually indexed to the price of crude oil, which is routinely subject to price volatility. This means that LNG importers in Pakistan will have to contend with the landed price of LNG varying with any fluctuations in international oil prices.

In addition to the delivered price of LNG through these means, there will be a marketing, distribution and transportation margin that each trucked LNG supplier will charge the end-users. If Pakistan’s regulated liquefied petroleum gas (LPG) market, which routinely supplies LPG to consumers across the country through bowsers, is any indication, this margin is likely to be around Rs. 35/Kg of LPG or US$2.98/MMBTU in terms of energy content. However, given LNG’s much lower temperature requirements (-162°C vs LPG’s -42°C), equipment requirements, gas management and handling costs potentially may be higher.

Currently, Pakistan has access to long-term LNG cargoes at US$11.4/MMTBU to US$ 13.3/MMBTU, which is based on an indexed pricing formula that includes 10.2% to 13.37% of Brent Crude. If the same arrangement is available to the virtual LNG market (although it is likely that any new contracts signed will be upwards of 13% of Brent crude plus a risk premium due to Pakistan’s high-risk investment environment), the end-consumer price of LNG delivered via tanks/trucks in Pakistan would range between US$17/MMBTU and US$19/MMBTU, according to IEEFA’s calculations.

Is there demand for VLNG in Pakistan?

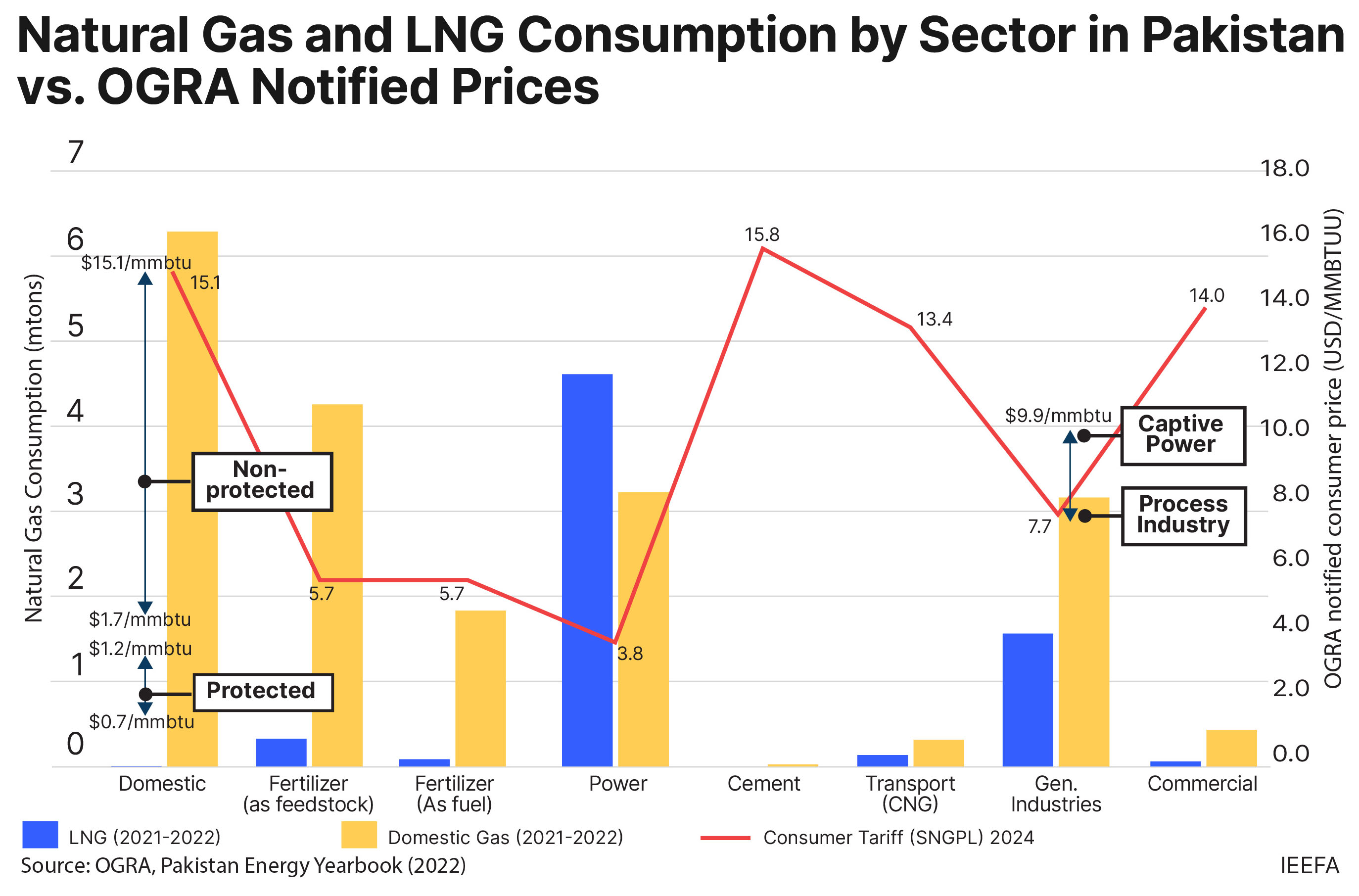

Natural gas consumers in Pakistan have been served predominantly by the two state-owned gas utilities, Sui Northern Gas Pipeline Ltd. (SNGPL) and Sui Southern Gas Company Ltd. (SSGC), through an OGRA-notified slab-wise pricing system. Within this pricing mechanism, the fertilizer and domestic sectors are cross subsidized by the industrial and cement sectors. Some protected domestic consumers pay as little as US$0.7/mmbtu, while the cement sector pays the highest prices of US$15.8/mmbtu. In addition to piped domestic gas supply through SNGPL and SSGC, a certain portion of the power, industrial and domestic housing sectors is also supplied with regasified LNG (RLNG) by SNGPL at approximately US$12.5/mmbtu, though this supply is on an ‘as and when basis’, with high-efficiency RLNG power plants in Punjab given priority.

It remains unclear whether Tabeer LNG has secured any firm agreement with a customer base for its trucked LNG supply. However, if the hope is to switch on-grid industrial or domestic consumer categories to a virtual LNG supply chain, this may pose some challenges.

Firstly, with an industrial gas supply price slab of US$7.7-9.9/mmbtu, industrial consumers may not be able to pay US$17-19/mmbtu for trucked LNG. In fact, industries in Sindh and Punjab have routinely opposed the government’s attempts to raise gas tariffs, saying this would hurt the competitiveness of their products in regional markets and force the closure of facilities, leading to lay-offs and potentially even civil unrest. Admittedly, inadequate gas supply during peak demand seasons has hurt industries as well in the past. However, if reliable supplies come at such a high cost, would there be local willingness to pay for it? Or would the industries prefer to operate when they’re able to on intermittent supply? That’s a question that remains to be answered.

Secondly, SNGPL is now considering applications for the supply of RLNG to new connections in housing societies. This could create new off-grid connections and cut into the expected customer base for VLNG projects in the country.

LNG Easy, on the other hand, seems to be cognizant of the large price difference the trucked LNG business will have to contend with in Pakistan. The joint venture will target off-grid consumers in rural areas that rely on LPG and firewood for their gas needs, in addition to reportedly securing term purchase contracts with 30 industrial and residential customers.

While affordability remains a concern for informal sectors dependent on firewood, trucked LNG supply may be more competitive by a slight margin given OGRA’s recently notified prices of US$21/mmbt for LPG users. However, setting up the necessary regasification infrastructure at the retail end would still be a challenge. Unlike LNG, which requires cryogenic temperatures (-162°C) for transportation, LPG can be stored and transported as a liquid at moderate pressure and higher temperatures. While LPG cylinders are now commonplace in Pakistani households, trucked LNG would need to be regasified and supplied through piped infrastructure to end-users, raising the overall distribution costs of the fuel.

Investors would also want assurance against the credit risk emanating from a consumer base in rural or off-grid areas. It is understood that these projects will operate without any sovereign guarantees, hence a firm off-take commitment would be needed for a 100% nameplate capacity to ensure that the projects reach FID on time. For LNG Easy, which intends to import in smaller parcels of 15,000 cubic meters, there may be a consumer base, but Tabeer LNG’s much larger setup of 5.23 mtpa would warrant rounding up consumers who may not exist at present.

The combined capacity of the two VLNG projects will be 6.23 mtpa, with a majority attributable to Tabeer LNG, even though the cement and industrial sectors together consume only 4.7 mtons of natural gas annually. Pakistan already has around 9.8 mtpa of regasification and import capacity at its two existing LNG terminals. Unless Tabeer LNG is able to create significant off-grid demand for its LNG supply and shift a major portion of the existing industrial demand to a virtual supply network, there may be a supply-demand mismatch resulting in unutilized terminal capacity and idle supply infrastructure.

Environmental and safety concerns must be taken into account

The focus of the two VLNG projects seems to be on trucked supply at present, but LNG Easy mentions expansion of the network usingrailway links in the future, which must be approached with caution. Since LNG is highly combustible in nature, a derailment or a crash could lead to a fire hazard or explosion that would endanger lives in communities located along the rail tracks.

The extremely cold temperatures at which LNG must be transported is also a cause for safety concern, requiring enforcement of stringent health and safety protocols at regasification facilities at the consumer end. This is why the US Department of Transport recently suspended a regulation that allowed for the transportation of LNG via rail.

All things considered, the future of a virtual LNG pipeline network in Pakistan remains highly uncertain, caught between complex economics and the need for strict safety and environmental regulations. Allowing private entrants to bring in new gas supply might be seen as a low risk strategy for government as it has struggled to identify new sources of domestically produced gas. However, losing a high-paying customer base may jeopardize the financial health of its already struggling state-owned gas utilities.

Unreliable gas supply amid Pakistan’s chronic gas shortages might tempt consumers to diversify their supply options, but affordability remains a prime concern. Although LNG prices are expected to come down in the future as a massive flood of supply enters the market post 2025, Pakistan still has to compete with larger consuming countries for that extra supply and may continue to pay higher prices due to oil-indexed contracts and a high credit risk. This already happened in 2020, when LNG spot prices collapsed due to the economic impact of COVID-19. However, bound by its long-term supply contracts, Pakistan still paid a higher price compared to the market. Locking in additional supply carrying the same risk may come at too high a price for consumers to bear.