Competing for Green Steel: National advantages and location challenges

Key Findings

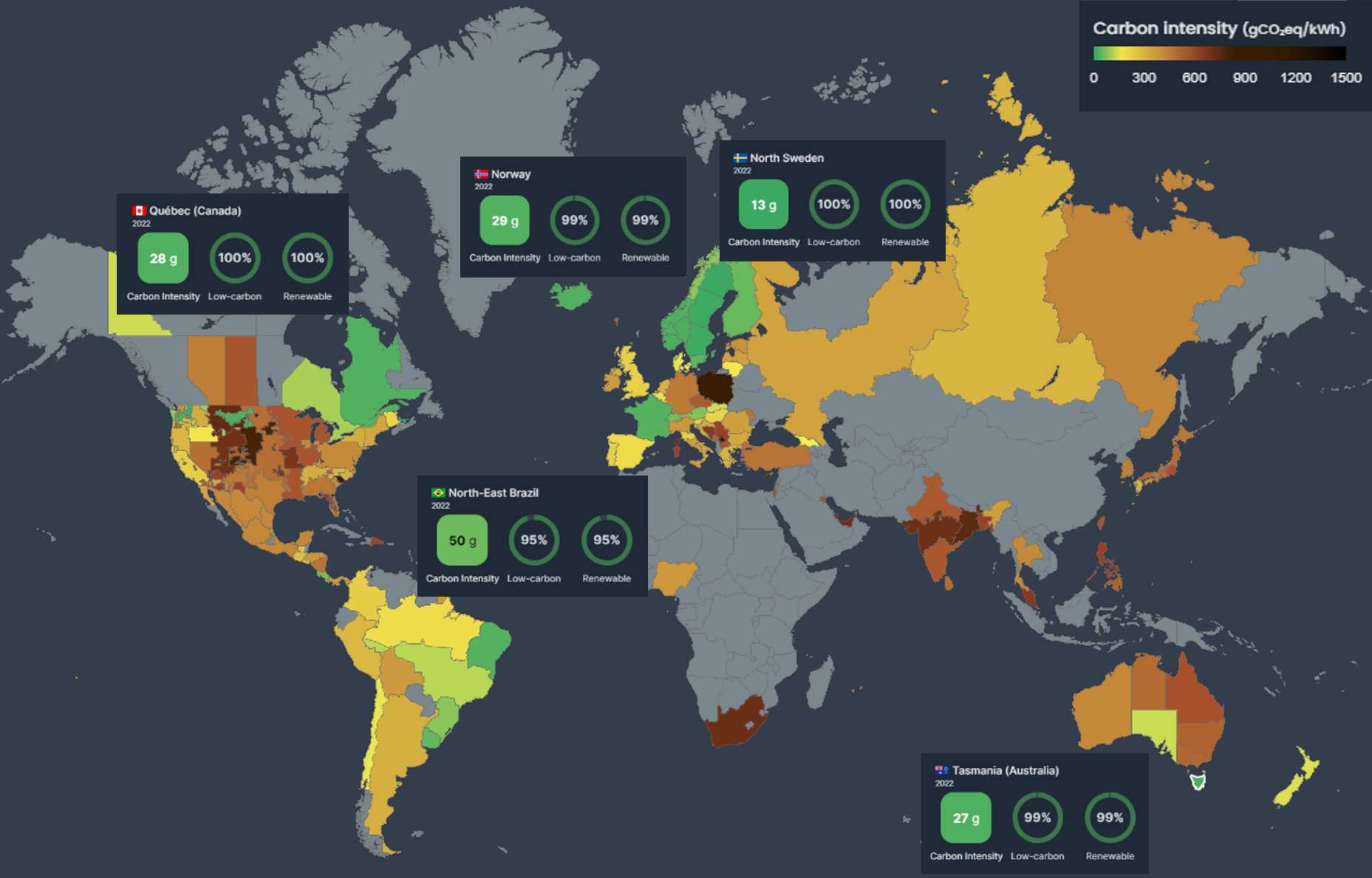

The first wave of green iron and steel initiatives appears likely to be focused on regions that already have power grids dominated by low-emissions electricity generation.

The variability of renewable energy sources, such as solar and wind, necessitates oversizing of capacity and the implementation of energy storage solutions to ensure a continuous energy supply for steel mills. Power grids dominated by hydropower offer an advantage.

While tapping into clean grid electricity – rather than constructing dedicated renewable energy installations – presents cost-effective advantages in capital expenditure, it doesn't offer a universal solution for steel decarbonisation as it is not currently available worldwide.

Going forward green iron and steel plants will need to be placed in regions with low-cost renewable energy sources. Australia could become a leading green iron hub by developing dedicated renewable energy infrastructure close to iron ore production centres.

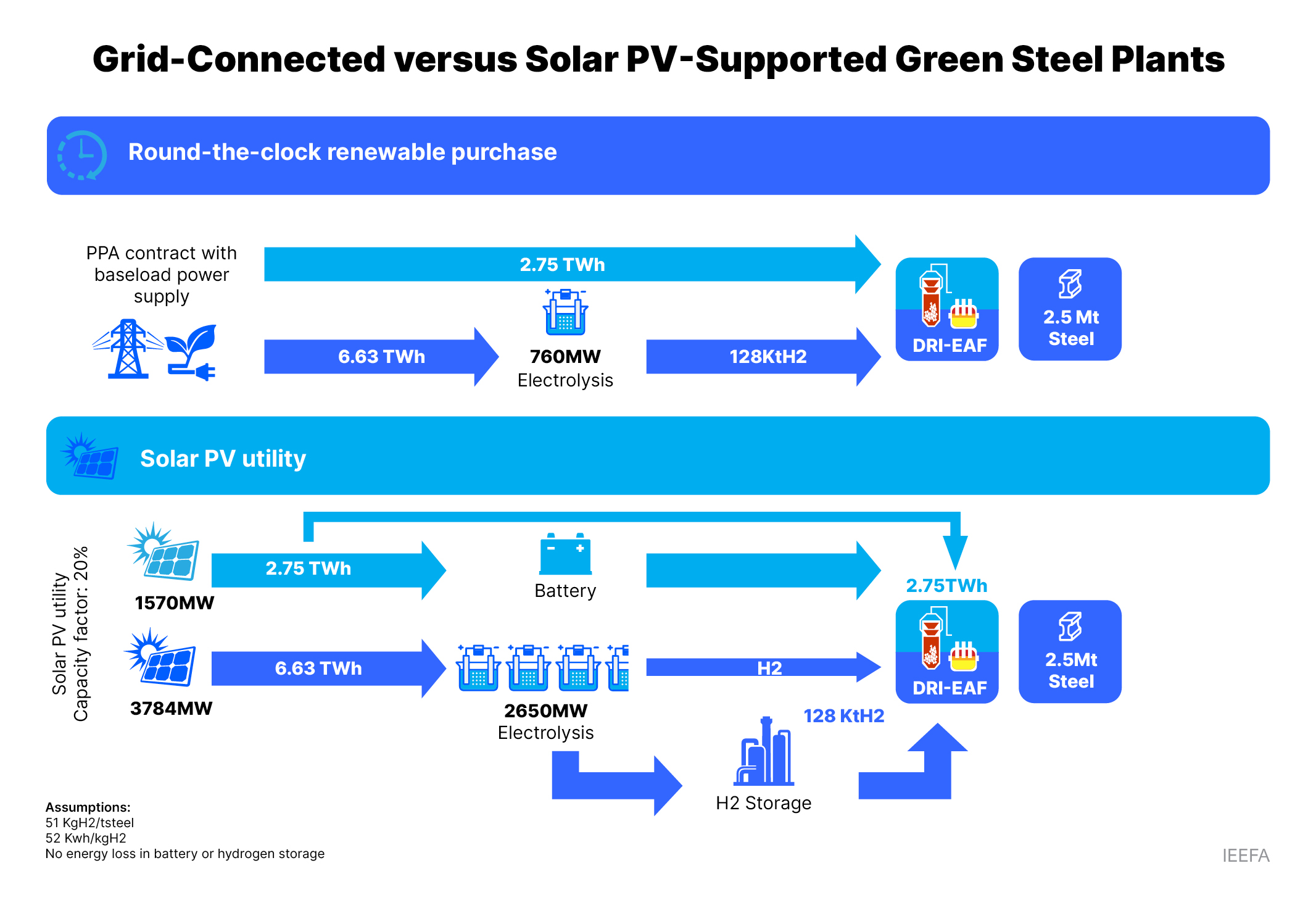

To produce green steel using low-emissions H2-DRI-EAF technology, a substantial quantity of green hydrogen and continuous zero-emission electricity are required.

H2-DRI-EAF involves the use of hydrogen (H2) to produce direct reduced iron (DRI) which is then consumed in an electric arc furnace (EAF) to produce steel. Regions with strong renewable energy resources will be able to produce cheap green hydrogen in the future, but they will require considerable investment in dedicated solar and wind installations.

In the short term, the need for non-stop zero-emissions electricity is enticing steelmakers to regions where lower-emissions grid electricity is already available, including locations in Norway, Brazil, northern Sweden, and the Canadian province of Quebec.

Nordic countries are leading the way in the deployment of renewable energy and boast some of the lowest carbon intensity levels in their power generation.

With the majority of their electricity generated from hydro sources, countries such as Norway or regions like the north of Sweden enjoy a distinct advantage – the ability to provide a continuous, uninterrupted low-emissions electricity. This consistent energy supply can effectively meet the electricity demands around the clock of both steel mills and the electrolysis process needed to make green hydrogen.

H2 Green Steel (H2GS) is constructing its first plant in Boden, north Sweden, where access to cheap, dependable clean energy from the grid means it can procure electricity via power purchase agreement (PPA) contracts with renewable power providers. This set-up delivers significant cost savings in capital expenditure, as there is no requirement for investments in renewable energy infrastructure and excessively large electrolysis.

In June 2022, H2GS signed a seven-year supply contract for 2 terrawatt-hours (TWh) per year of fossil-free electricity with Statkraft, to commence in 2026. Norway’s Statkraft, one of the frontrunners in supporting industry transition, will supply nearly 30% of the energy that H2GS requires for electrolyser. The deal includes Guarantees of Origin for power sourced from Statkraft’s hydropower plants in northern Sweden.

H2GS and Fortum have established a partnership to supply carbon-free electricity. This includes an index-based PPA of 1.3TWh starting in 2026, with a five-year hedging horizon, and a fixed-price PPA of 1TWh lasting up to nine years from 2027.

Blastr Green Steel is another Nordic green steel initiative. In October it signed a Letter of Intent (LOI) with power supplier Sogn og Fjordane Energi (SFE) to power its planned pelletising plant in Norway. The clean electricity will be based on hydro and wind power.

For many years, locating models have focused on minimising the distance to the end users or raw material sources, but now proximity to renewable energy sources is shaping a new paradigm in the steel sector.

H2GS is exploring plans to build a new green iron facility in Quebec, which enjoys rich hydropower capacities. Quebec’s power grid is 94% hydro and 5% wind power. H2GS is negotiating for hydroelectricity allocation to its potential green iron project in Quebec. While the 700MW of electricity capacity it requires is only 1.5% of the total 46GW capacity in that province, peak demand during winter is a bottleneck that can necessitate consumption of some gas-fired power. H2GS executive vice-president, Kajsa Ryttberg-Wallgren has emphasised: “No green power, no project.”

In its search for other geographies, the company has also signed an agreement with Vale to investigate opportunities in the green iron ore value chain in Brazil and North America, focusing on locations that have access to green electricity.

Grid carbon intensity of selected regions around the world

Source: Electricity Maps, Display data for 2022

Although building new green iron or green steel plants in locations with existing hydropower plants is advantageous, it is not the ultimate solution for green steel transition. Hydropower availability located close to iron ore reserves is limited, and more renewable development based on solar and wind is needed to supply the energy for the green steel transition.

For one tonne of steel produced via H2-DRI-EAF, nearly 3.6MWh of electricity is required. To produce green steel of the same scale as H2GS using a solar photovoltaic (PV) utility with a 20% capacity factor – irrespective of the plant’s location, and without relying on battery storage for hydrogen production – the electrolyser’s size should be increased by a factor of 3.5, and this augmentation must be supported by solar utility oversized by a factor of 5. In this configuration, hydrogen storage and batteries are essential to ensure seamless operation. This inevitably requires increased capital expenditure.

Studies by the Minerals Research Institute of Western Australia (MRIWA) show that scaling up power facilities (including 50/50 solar and wind plus batteries) for 1Mtpa of crude steel capacity requires A$5.6 billion (almost US$3.6 billion) which is more than cumulative investments needed for pelletising, DRI plant, EAF and even electrolysers to produce hydrogen.

The forthcoming wave of green steel initiatives can be strategically situated in areas with access to very low-cost renewable energy sources. Each of these green steel projects can adopt a tailored configuration to minimise investments in renewable energy and hydrogen infrastructure, while also maximising the utilisation of existing capacities.

At the COP28 global climate summit, 116 countries endorsed the Global Renewable and Energy Efficiency Pledge, making a commitment to tripling renewable energy generation capacity by 2030. If realised, this commitment has the potential to pave the way for dedicated green hydrogen production for green steelmaking.

Countries in the Middle East and North Africa (MENA) region can increasingly transition to green iron and steel production, leveraging cost-effective energy from solar and wind sources.

Even presently, several areas in Australia have the capacity to meet most of their energy needs through renewable sources – such as South Australia and Tasmania.

South Australia has set an ambitious goal to achieve 100% net renewable energy by 2030. By 2022, it had reached nearly 70% reliance on renewables. The state will likely achieve 100% years before its target, maintaining an average 99.8% renewable supply over a seven-day period in October. However, an opportunity is arising as some of the generated electricity is currently being curtailed in the middle of the day when solar generation is at its maximum, due to low demand in the market.

The state has a strategy to harness this energy for generating hydrogen, which can then be utilised to produce electricity when demand arises. While generating electricity from hydrogen incurs high energy loss and has nearly 30% round trip efficiency, given the proximity of the hydrogen electrolyser to the Whyalla steelworks – currently transitioning from coal-consuming blast furnaces to the DRI-EAF pathway – the hydrogen can be employed in ironmaking processes more efficiently than electricity generation.

Moreover, given their declining cost, batteries present the capacity to address any supply gaps and ensure the continuous delivery of green energy from renewables to end-users. BHP has signed a PPA with Neoen, guaranteeing a 24/7 supply of 70MW electricity from wind farms firmed by batteries to the Olympic Dam mine. Synergy, a state-owned utility, has received approval to build Australia’s largest battery in Western Australia, featuring a substantial 500MW, four-hour (2,000MWh) storage capacity.

Tasmania stands out as another promising candidate for the iron and steel transition, boasting the most dependable renewable power supply in the country. The state depends mostly on dispatchable hydro power, without any reliability gap issues in coming year. The state is home to the Savage River magnetite iron ore mine and the 2.2 million tonne pelletising plant at Port Latta, both operated by Grange Resources. By adopting the strategy employed by H2GS, Tasmania has the potential to become a pioneering Australian green iron producer.

Producing green steel is an energy-intensive process, posing a challenge for steelmakers striving to embrace low-emission technologies like H2-DRI-EAF. The shift toward truly green steel using green hydrogen is expected to start in regions where the power grid is already dominated by clean electricity production. This will see such steelmakers set a high green steel benchmark that other countries and regions will need to compete with.

This article first appeared in Renew Economy as “No green power, no project:” Can Australia compete on green steel?