As Coal Falls, Indications of a Long-Term Trend

I love data. Call me a geek but there’s something both satisfying and reassuring about hard numbers.

I also spend a lot of time keeping up on what’s happening on energy issues in the U.S. I go to conferences, watch webinars, talk to people in the industry, read blogs, trade publications, government notifications and court cases. What I find most telling about what’s happening, however, comes from the Energy Information Administration’s Electric Power Monthly.

While EIA’s predictions—as many critics have noted—can be less than reliable, there’s no reason to question the agency’s data on actual electric generation. The numbers along those lines tell a story that is especially compelling in the most recent report, from April. For the first time in history, electricity generated by natural gas surpassed electricity generated by coal (here’s a table that distills the data from the past 10 years).

It’s more than a story about natural gas replacing coal, a phenomenon that is responsible for much of the change but that doesn’t explain the whole picture. While coal-fired generation accounted for 30.2 percent of U.S. electricity generation in April and natural gas accounted for 31.5 percent, renewables are taking a growing share of the market (16.7 percent in April, half of that from non-hydro sources like solar and wind). So natural gas can’t claim all the credit for the slide of coal. If that were the case, gas would be producing half of the country’s electricity generation, which is what coal used to do.

A decade ago coal provided 49.6 percent of U.S. electricity, gas 18.7 percent, nuclear energy 19.2 percent and renewables 8.8 percent, and non-hydro renewables accounted for only a quarter of renewable generation.

When you compare the most recent numbers to those logged in 2005, in other words, gas has picked up about 60 percent of the market lost by coal, and renewables have taken about 60 percent.

Also of note: total generation is about the same today as it was in 2005 even though population and the economy have grown, a sign that energy efficiency programs are helping shape the new energy economy.

Some may argue that April was atypical. After all, April is what energy analysts call a “shoulder” month, meaning that total generation is down because heating and cooling demands are low compared to winter or summer. In addition, April tends to be the windiest month, so wind-generated power is typically at its highest, and wind power is by far the largest source of non-hydro renewables. Skeptics might also point out that one month does not make a trend.

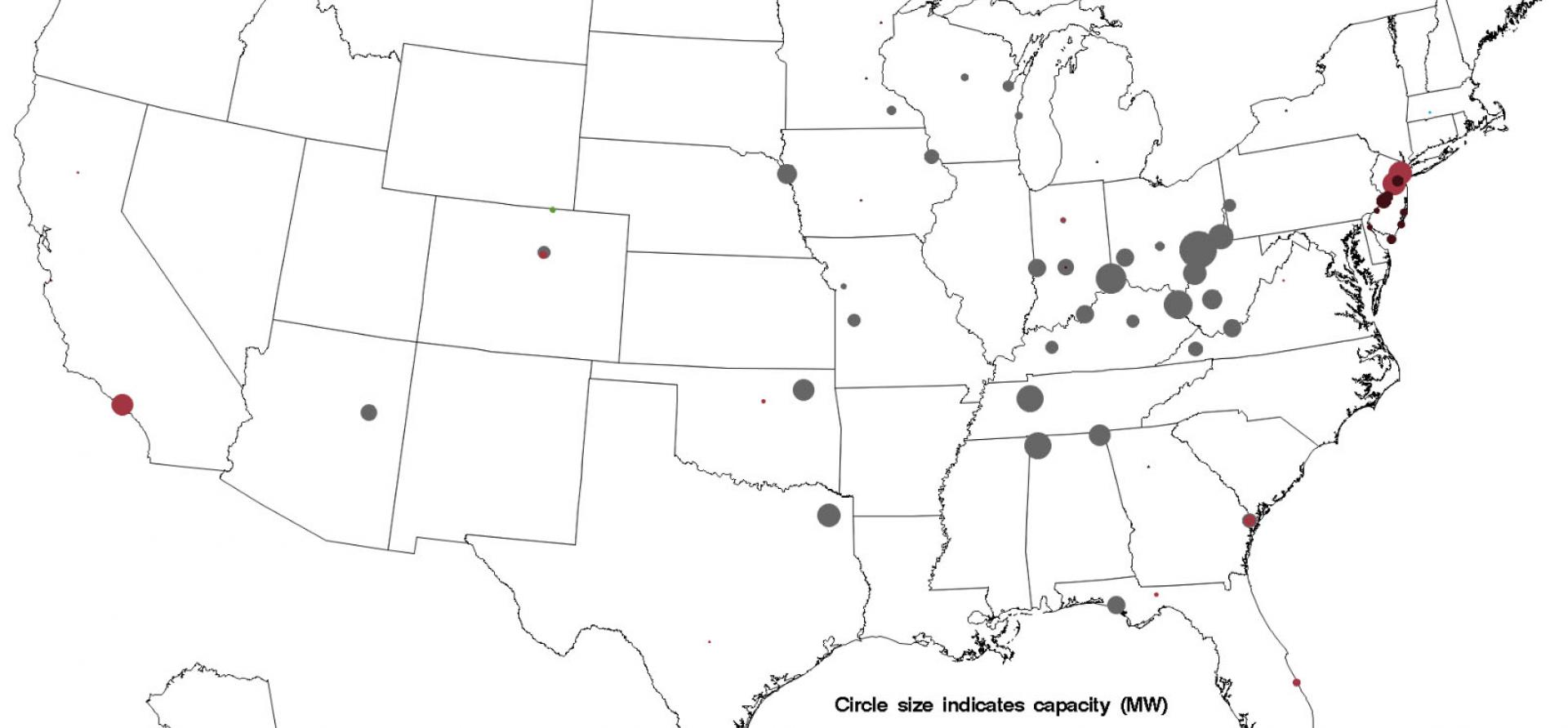

But the agency in its monthly report also provides data on likely new and retiring power plants. This is no generic prediction but rather a list of specific plants slated for closure or new construction based on information provided by the plant owners themselves. If you look at all the new renewable energy projects and natural gas plants under construction alongside all the coal plants scheduled for retirement, a clear trend emerges. The EIA reports also that coal’s share of electricity in general this year will come out to 35.6 percent, down from 38.7 percent in 2014.

It’s possible that coal will bounce back and reclaim the No. 1 spot for electricity generation in the near term, but it seems inevitable that coal will slip on a permanent basis from being the country’s largest source of electricity generation.

Coal-fire electricity generation doesn’t have much going for itself these days. It is dirty and it is expensive. The coal industry’s trump card has always been that it was “too big to fail” because it supplied such a large portion of electricity that the economy couldn’t do without it.

Those days are fading. The decline of coal is well under way.

Robert Ukeiley is a Boulder-based attorney and consultant who coordinates a campaign to increase Colorado’s renewable portfolio standard.