Bangladesh’s interim government should prioritise energy sector issues

Key Findings

People are hopeful that the interim government will initiate the much-required overhauling to help the country transition to a sustainable pathway. However, with another scorching summer likely approaching, the imminent concern of this government is managing energy supply, which has been erratic in the last three years.

The interim government should ensure uninterrupted energy and power supply during the upcoming summer. As power demand typically increases in March and peaks in April, the interim government has time to plan and release funds for sufficient energy and power supply.

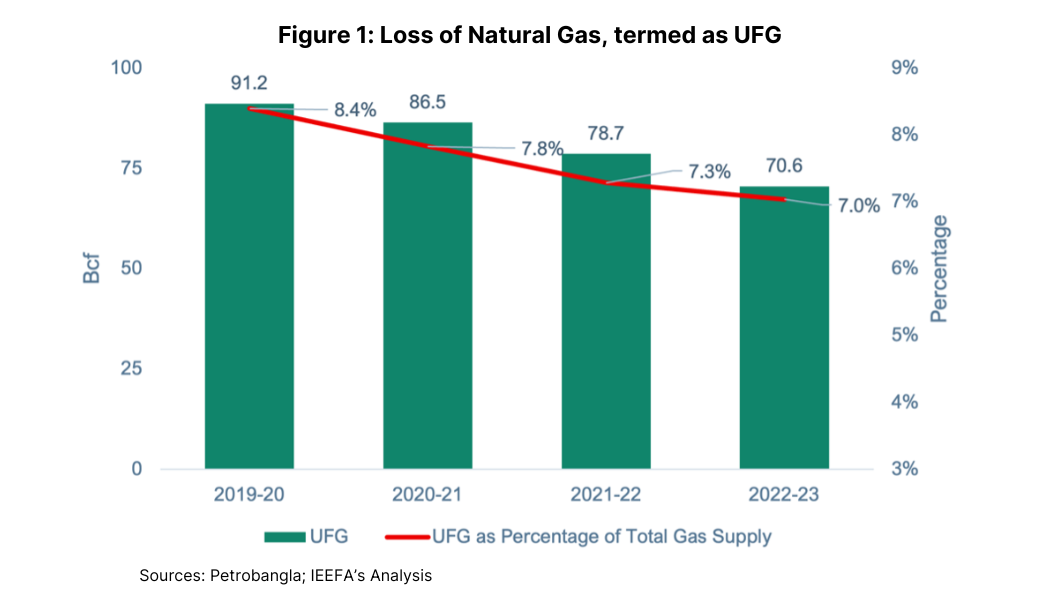

Petrobangla recorded 7.04% of the total natural gas supply as Unaccounted for Gas (UFG) in fiscal year (FY) 2022-23 due to system loss and pilferage. Illegal gas connections and leakages contribute significantly to this huge UFG. Like previous governments, the interim government has launched drives against illegal gas connections. This initiative must not end before results are achieved.

The Sustainable and Renewable Energy Development Authority is preparing a new renewable energy policy to send a clear signal to stakeholders on the country’s renewable energy ambitions. As the country is yet to see great success in renewable energy, the interim government can finalise the new policy, fixing a modest and achievable goal for 2030.

In August 2024, Dr. Muhammad Yunus took over as Chief Adviser of the interim government of Bangladesh. Given that the Nobel Laureate coined the idea of “A World of Three Zeros”, namely, zero poverty, zero unemployment and zero net carbon emissions, his entry sparked optimism among the stakeholders of Bangladesh’s power and energy sectors. People are hopeful that the government will initiate the much-required overhauling needed to help the country transition to a sustainable and cleaner pathway.

However, with another scorching summer likely approaching, the imminent concern of this government is managing energy supply, which has been erratic in the last three years.

Further, as the interim government has floated the idea of conducting the next general election in December 2025 or January 2026, can it fix loopholes in the energy and power sectors and provide an impetus for clean energy expansion for the next government to follow?

What do people want?

People want affordable, reliable and uninterrupted energy supply. While there is pressure from the International Monetary Fund to raise both power and energy tariffs as part of its covenants to the loan of US$4.7 billion to Bangladesh, price hikes between January 2023 and February 2024 have delivered limited results in terms of reducing the subsidy burden and ensuring sufficient energy supply. Instead, price hikes were a double whammy – people battled high inflation and industries could not operate at optimal capacity due to energy shortage. The government should initiate an inclusive national discussion before raising the price of gas or power.

What can the interim government do?

The interim government should work on key areas, such as providing uninterrupted energy supply, minimising loss in the gas transmission system, increasing budgetary allocation to the energy sector and devising favourable policies for renewable energy.

- The interim government should ensure uninterrupted energy and power supply during the upcoming summer. Barring the impact of the Russia-Ukraine war in 2022, both the power and energy divisions had sufficient time to prepare for meeting demand in 2023 and 2024, but could not manage the situation. As power demand typically increases in March and peaks in April, the interim government has time to plan and release funds for sufficient energy and power supply. A delay in releasing funds can create payment backlogs and compel private power producers to operate at lower capacities, reducing the quantity of power supplied. Besides, a delay in clearing payments results in additional surcharges that the government needs to pay to private power producers. On the other hand, load-shedding is a counterproductive measure for two reasons – capacity charges accrue, and it affects industrial production and exports, leading to a shortage of foreign currency reserves.

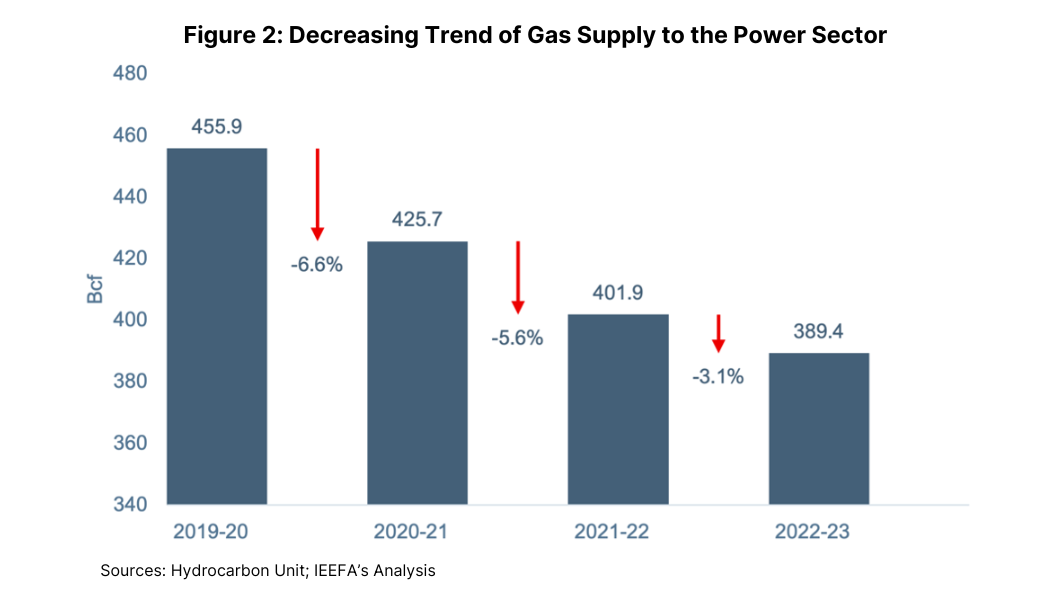

- Bangladesh Oil, Gas and Mineral Corporation (Petrobangla) recorded 7.04% of the total natural gas supply as Unaccounted for Gas (UFG) in fiscal year (FY) 2022-23 due to system loss and pilferage. Illegal gas connections and leakages contribute significantly to this huge UFG. While the trend analysis indicates that the UFG improved from 8.4% to 7.04% between FY2019-20 and FY2022-23, a mammoth 70.6 billion cubic feet (Bcf) of gas did not reach the intended consumers in FY2022-23 (see Figure 1). Besides, the government reduced gas supply to the power sector by 66.5Bcf between FY2019-20 and FY2022-23, which was attributed to decreased local production (see Figure 2).

By reducing UFG, Bangladesh can increase gas supply to the power sector to minimise load-shedding. A rough assessment indicates that limiting UFG to 3% will save Bangladesh 40.51Bcf of natural gas, which can increase power generation by around 10% from gas-fired plants. Alternatively, by reducing 40.51Bcf natural gas, Bangladesh can save liquefied natural gas (LNG) imports worth US$442 million per annum, taking a conservative spot market price of US$10.5/MMBtu (the spot market price of LNG was over US$10.5 per MMBtu in more than seven months in 2024).

Like previous governments, the interim government has launched drives against illegal gas connections. This initiative must not end before the intended results are achieved. On the other hand, fixing gas leakages will require investment in the distribution network and establishing a proper monitoring mechanism. The interim government should review the existing distribution network improvement projects and seek funding for new projects, which the next government can continue. These projects have economic and safety relevance as they will not only save gas but also reduce the risk of life-threatening accidents. In addition, these projects will curb methane emissions, a greenhouse gas 28 times more potent than carbon dioxide (CO2) over a 100-year lifecycle.

- A limited annual budget affected Bangladesh’s key energy sector organisations in the last decade, triggering a fossil fuel import spree. With surging demand for costly LNG imports and resulting knock-on effects on the economy, the country needs to utilise local gas and renewable energy. It should also ensure energy efficiency and conservation to avoid energy wastage, and reduce fossil fuel imports. These measures will require budgetary support. As the interim government announces the next budget in June 2025, it should consider increasing allocation to the energy sector instead of the power sector, altering the trend. This is an opportunity for the country to move towards enhanced energy security and embark on long-term competitive advantage by reducing dependence on external sources.

- Bangladesh’s renewable energy policy expired in 2021. The Sustainable and Renewable Energy Development Authority is preparing a new policy to send a clear signal to stakeholders on the country’s renewable energy ambitions. As the country is yet to see great success in renewable energy, the interim government can finalise the new renewable energy policy, fixing a modest and achievable goal for 2030. This government can further work on developing guidelines for reverse auctions, drawing lessons from other countries. Earmarking public land for renewable energy projects closer to some of the substations will help expedite projects under reverse auctions once the elected government takes charge.

The interim government can also prepare guidelines for battery energy storage systems, which will play a major role in Bangladesh’s power sector. Likewise, the government can develop a pathway for reducing dependence on oil-fired plants that are inflationary, with the average generation cost increasing each year. The power sector’s latest annual report substantiates that the average generation cost of private oil-fired plants was around Bangladeshi Taka (Tk) 25/kilowatt-hour(kWh) (US$0.21/kWh) in FY2023-24 against the average cost of utility-scale renewable energy of Tk16.4/kWh (US$0.13/kWh).

With its tenure likely to be short, the interim government might not be able to pursue sweeping changes in the power and energy sectors. However, it can strive to shift the energy sector towards sustainability and design a way forward for the next elected government.

This article was first published in The Business Standard.