Bangladesh’s IEPMP raises more questions than it answers

Key Findings

As an integrated policy document, the IEPMP must ensure that Bangladesh’s key power and energy sector organisations are on board, driving them towards sustainability. However, the IEPMP has no answer to the Bangladesh Power Development Board’s diminishing financial strength.

While the IEPMP concludes that carbon capture storage (CCS) and ammonia co-firing technologies are in their infancy and must undergo a rigorous evaluation, it considers the likely contribution of CCS with natural gas-fired plants ranging from 6% to 7.4% in the country’s power system in 2050. IEEFA’s assessment casts serious doubt on CCS projects’ technical and economic feasibility and effectiveness. In the same breadth, ammonia co-firing with coal-fired plants, a solution suggested by the IEPMP, would require significant investments that may not yield the desired emission reduction results.

The IEPMP is overly conservative on the possibility of achieving success in renewable energy. The master plan anticipates that solar and wind will remain variable even in 2050, as it has excluded the potential role of battery storage. As such, renewable energy will only meet 5.4% of Bangladesh’s total primary energy requirement in 2050.

With varying directions from different energy policies, Bangladesh approved its first Integrated Energy and Power Master Plan (IEPMP) in June 2023 to streamline the pathway for the energy and power sectors. There were high hopes that the IEPMP would accelerate the renewable energy transition and enhance national energy security. However, the master plan has thus far given little signal in that direction.

The IEPMP provides no roadmap to contain the Bangladesh Power Development Board’s (BPDB) deepening revenue shortfall. Further, it puts the country at the risk of imported fossil fuel lock-in and a disorderly energy transition relying on unproven technologies, such as carbon capture and storage (CCS) and ammonia, raising more questions than addressing concerns.

IEPMP does not offer a solution to BPDB’s revenue shortfall

As an integrated policy document, the IEPMP must ensure that Bangladesh’s key power and energy sector organisations are on board, driving them towards sustainability. This call becomes louder on the back of the BPDB’s annual revenue shortfall, which compelled the Bangladesh government to pay a cumulative subsidy of Bangladeshi Taka (Tk) 809.7 billion (US$6.88 billion) during the fiscal year (FY) 2020-21 to FY2022-23. However, the IEPMP has no answer to the BPDB’s diminishing financial strength.

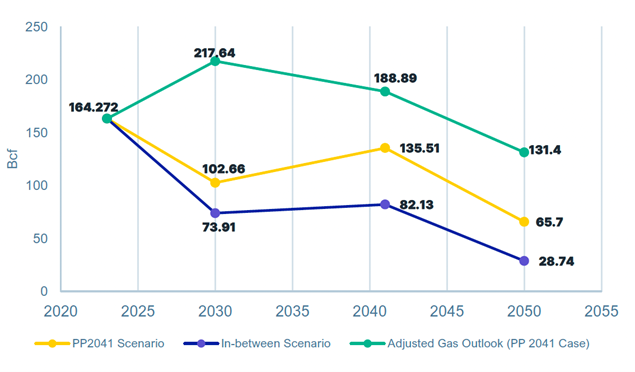

One of the key reasons behind BPDB’s revenue shortfall is the industry sector’s tepid demand growth in the grid electricity consumption. Due to a lack of reliable grid electricity, industries combined operate around 3,000 megawatts (MW) of gas-fired captive generators even as grid electricity remains underutilised. The IEPMP’s natural gas demand outlook suggests industries may significantly depend on gas-fired captive generation beyond 2040 (see Figure 1).

With nuclear power plants and several fossil-fuel-fired baseload plants scheduled to be online by 2027, the BPDB will continue to incur heavy revenue shortfall from underutilisation of power capacity unless industries gradually shift to grid electricity.

Figure 1: Future Gas Outlook for Captive Power Generation*

Source: IEEFA, 2024.

*PP2041 scenario assumes an economic growth rate of 8% in 2025, which will rise to 9.8% in 2040 and eventually reduce to 6.8% in 2050; the in-between scenario considers the economic growth rate to reach 8.6% in 2040 and then coming down to 5.6% in 2050.

Growing risk of import dependence

Under different scenarios, the IEPMP’s proposed energy mixes will make Bangladesh more import-dependent, exposing it to the high price volatility of the international energy market and raising concern over foreign currency reserves. These are evident from the outlook of the natural gas supply balance, which estimates Bangladesh’s liquefied natural gas (LNG) demand to reach between 2,845 million cubic feet per day (MMcfd) and 6,442MMcfd in 2050 under the Perspective Plan (of Bangladesh 2021-) 2041 and in-between scenarios, respectively, locking-in high import dependence. IEEFA’s calculation, based on IEPMP’s projections, shows that LNG imports will soar between 4.35 and 9.85 times in 2050 compared with the 2023 level. As such, Bangladesh will incur annual LNG import costs between US$8 billion and US$18.2 billion in 2050 (taking a low LNG price of US$8 per metric million British thermal units (MMBtu)). The economic burden will drastically increase if the LNG price spikes to US$40/MMBtu. Notably, Bangladesh suspended LNG purchases from the spot market when the price crossed US$40/MMBtu in 2022.

The IEPMP also predicts that Bangladesh will start using hydrogen in 2040, with the likelihood of its share reaching between 7.6% and 8.5% of the country’s total primary supply in 2050. The master plan states that the country will mostly rely on imported hydrogen, intensifying energy security risks further.

Unproven technologies may derail the country’s energy transition

While the IEPMP concludes that CCS and ammonia co-firing technologies are in their infancy and must undergo a rigorous evaluation, it considers the likely contribution of CCS with natural gas-fired plants ranging from 6% to 7.4% in the country’s power system in 2050. IEEFA’s assessment casts serious doubt on CCS projects’ technical and economic feasibility and effectiveness. This raises the question of whether Bangladesh should take the risk of its aspiration to bury carbon dioxide underground in place of harnessing some easy and proven renewable energy and energy efficiency solutions.

In the same breadth, ammonia co-firing with coal-fired plants, a solution suggested by the IEPMP, would require significant investments that may not yield the desired emission reduction results.

Furthermore, the IEPMP charts four hydrogen options:

- grey hydrogen from fossil fuels

- blue hydrogen from grey hydrogen with CCS

- pink hydrogen from the surplus electricity produced by nuclear plants

- green hydrogen from surplus electricity produced by renewable energy systems

Notably, the IEPMP admits these hydrogen technologies are economically inconvenient for Bangladesh. When Bangladesh struggles to shore up renewable energy capacity, it is unlikely that the country will have surplus electricity from renewable energy to produce hydrogen in the foreseeable future. Instead, it should work on ramping up renewable energy.

Therefore, Bangladesh needs to factor all risks associated with these technologies into investment considerations.

Limited focus on Renewable Energy

The IEPMP seems overly conservative on the possibility of yielding great success in renewable energy. The master plan anticipates solar and wind to remain variable even in 2050, as it has excluded the potential role of battery storage. As such, renewable energy will only meet 5.4% of Bangladesh’s total primary energy requirement in 2050 against the clean energy’s share of up to 30%. The master plan’s caution about land scarcity does not portray the reality because a combination of distributed and utility-scale renewable energy may unleash immense opportunity in Bangladesh.

The IEPMP should be a blueprint, with projections of rational demand and supply sources, to guide Bangladesh’s energy and power sectors towards sustainability, slashing imported fossil fuel dependence. As renewable energy and battery storage continue to experience cost drops and BPDB faces a hefty annual revenue shortfall, there is potential for the IEPMP to evolve to address its shortcomings. Moreover, the IEPMP should avoid unreliable technologies that may land Bangladesh at a far greater risk.

As the IEPMP is a living document that mentions “the plan is not the end of product”, Bangladesh should revisit the document to design a clear pathway for improving BPDB’s financial strength and Bangladesh’s energy security, avoiding unproven technologies. More importantly, the revised IEPMP should help enhance the country’s resilience against sudden price spikes and supply issues in the international fuel market by directing towards utilising local energy resources, including renewables.

This article was first published in SANEM's Energy Outlook - October 2024.