Australia can and should eradicate its gas supply gap – but not with more gas

Key Findings

The 2023 Gas Statement of Opportunities (GSOO) finds that action in line with the global 1.5°C goal and the legislated Victorian emissions reduction targets could halve domestic gas demand by 2042 and minimise the gas supply gap.

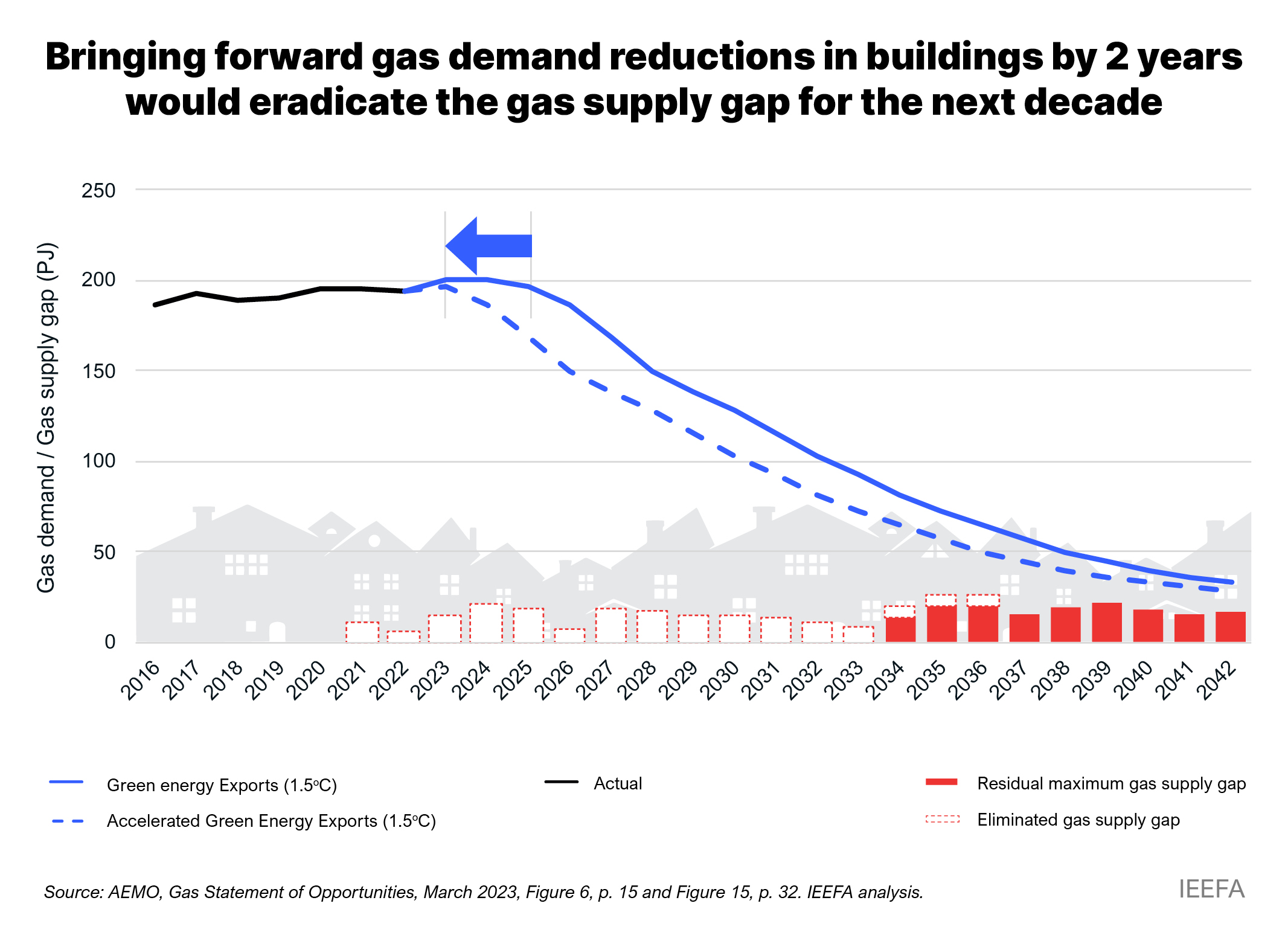

Bringing forward action to reduce gas use and improve energy efficiency and electrification in buildings by just two years to 2024 could eradicate the gas supply gap in the next decade and help alleviate the cost of living crisis.

The rest of the gas supply gap could be filled by a small increase in industrial gas demand reduction, well within the identified technological and economic potential, eliminating the need for highly emissions intensive and costly new gas fields.

The Australian Energy Market Operator (AEMO) recently published its annual Gas Statement of Opportunities (GSOO), which found that southern Australia was at a high risk of long-term gas supply gaps. While AEMO noted demand reductions could assist, much of the public commentary has inferred that bridging the gap will require new gas supply via either new gas fields, LNG import terminals, pipelines or a combination of these three. Our analysis finds that accelerating action to improve energy efficiency and electrification in buildings could eradicate the gas supply gaps for the next decade while also alleviating the cost of living crisis for households.

Accelerating action to improve energy efficiency and electrification in buildings could eradicate the gas supply gaps for the next decade while also alleviating the cost of living crisis for households.

AEMO’s 1.5°C aligned scenario presents a path forward that limits gas supply gaps considerably

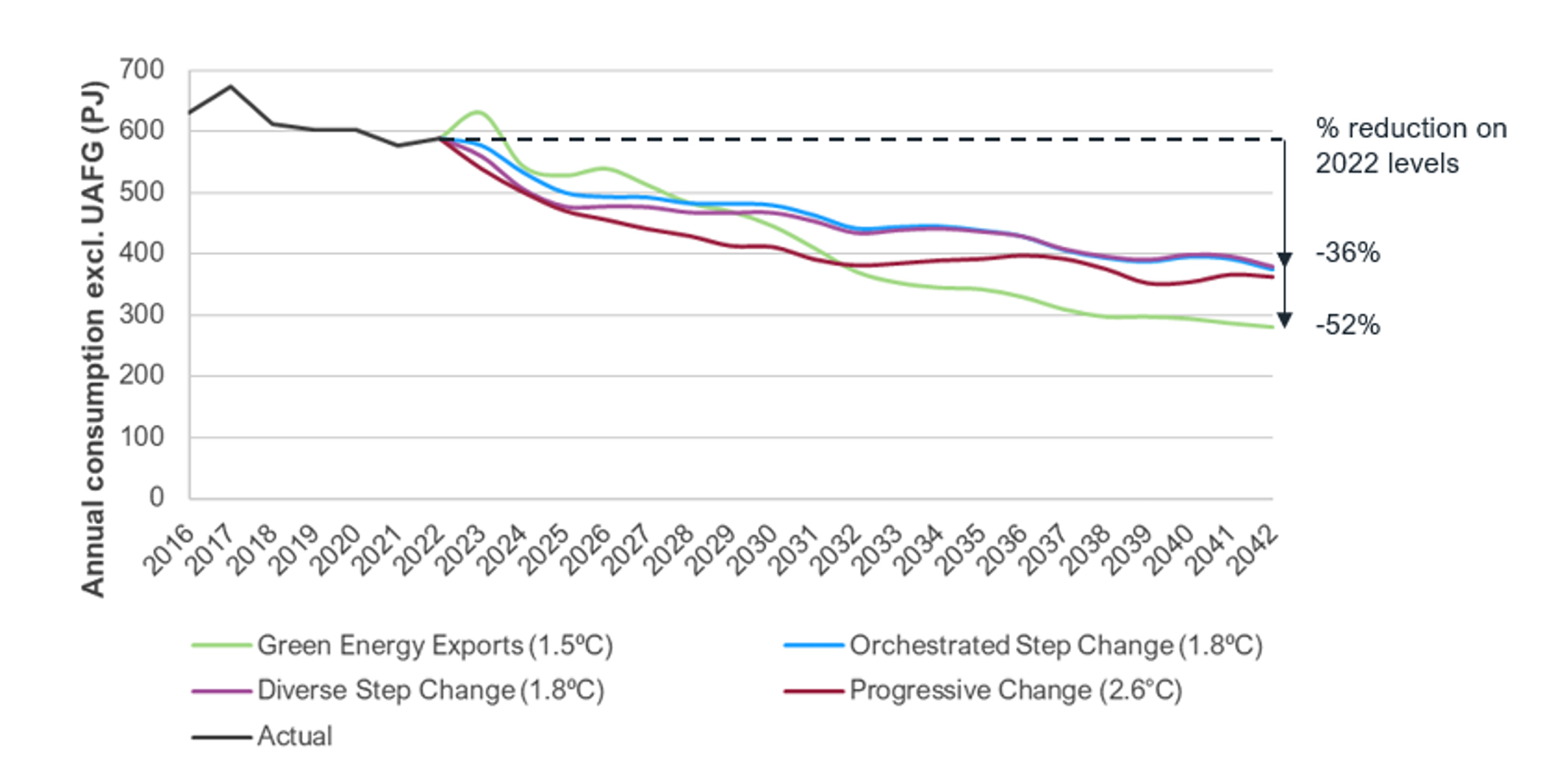

The 2023 GSOO finds that in all future scenarios, domestic gas demand is expected to decrease substantially between now and 2042 (between 36% and 52% reduction). In electricity, this is because gas generation will continue to be used less often as a complement to cheaper renewable technologies. In buildings, electrified equipment will progressively replace gas powered heaters, water heaters and ovens.

Figure 1: Actual and Forecast Domestic Gas Consumption, All Scenarios (PJ)

Source: AEMO, Gas Statement of Opportunities, March 2023, Figure 9, p. 26. IEEFA analysis.

The Green Energy Exports (1.5°C) scenario achieves a much lower gas supply gap than the other scenarios presented, with annual gaps peaking at 40 petajoules (PJ) between 2027 and 2042. This compares with supply gaps between 100PJ and 150PJ for the 1.8°C aligned step change scenarios and of more than 200PJ for the Progressive Change (2.6°C) scenario from the 2030s. The Green Energy Exports (1.5°C) scenario is not presented as the most likely scenario, but it is the only scenario that achieves emissions reductions in line with the legislated Victorian emissions reduction targets. It is also the only scenario that meets the recommendations from the recently released IPCC Synthesis Report, which calls for urgent global action to accelerate emissions reductions this decade to limit global warming to 1.5°C if the world wants to avoid catastrophic climate impacts.

Slightly accelerating action to reduce gas consumption in buildings could eradicate the gas supply gap in the coming decade

While the Green Energy Exports (1.5°C) scenario achieves an 83% reduction in gas consumption by 2042, it does not see any reduction happening before 2026. Bringing forward the gas demand reductions by just two years to start in 2024 instead of 2026 would eradicate the gas supply gaps for the next decade.

Figure 2: Impact of Bringing Forward Gas Demand Reductions in Buildings by 2 Years on Gas Consumption and Gas Supply Gap (PJ)

To bring forward gas demand reductions, work should start on upgrading the energy efficiency of buildings in southern Australia and electrifying their equipment this year. This would likely see impacts on next year’s gas demand. The solutions are all mature and ready to be deployed, including improving building insulation and draught proofing, rightsizing of equipment, shifting from gas heaters to electric heat pumps (or simply using existing split-system air conditioners for heating), and shifting from gas water heaters to solar or heat pump water heaters. They are particularly cost effective to implement in new housing, yet currently new homes can still be built with gas appliances.

Those solutions can not only deliver reductions in gas consumption, but also reduce net energy bills for businesses and households. Upgrading low-income households first could help alleviate the cost of living crisis in the context of increasing energy prices.

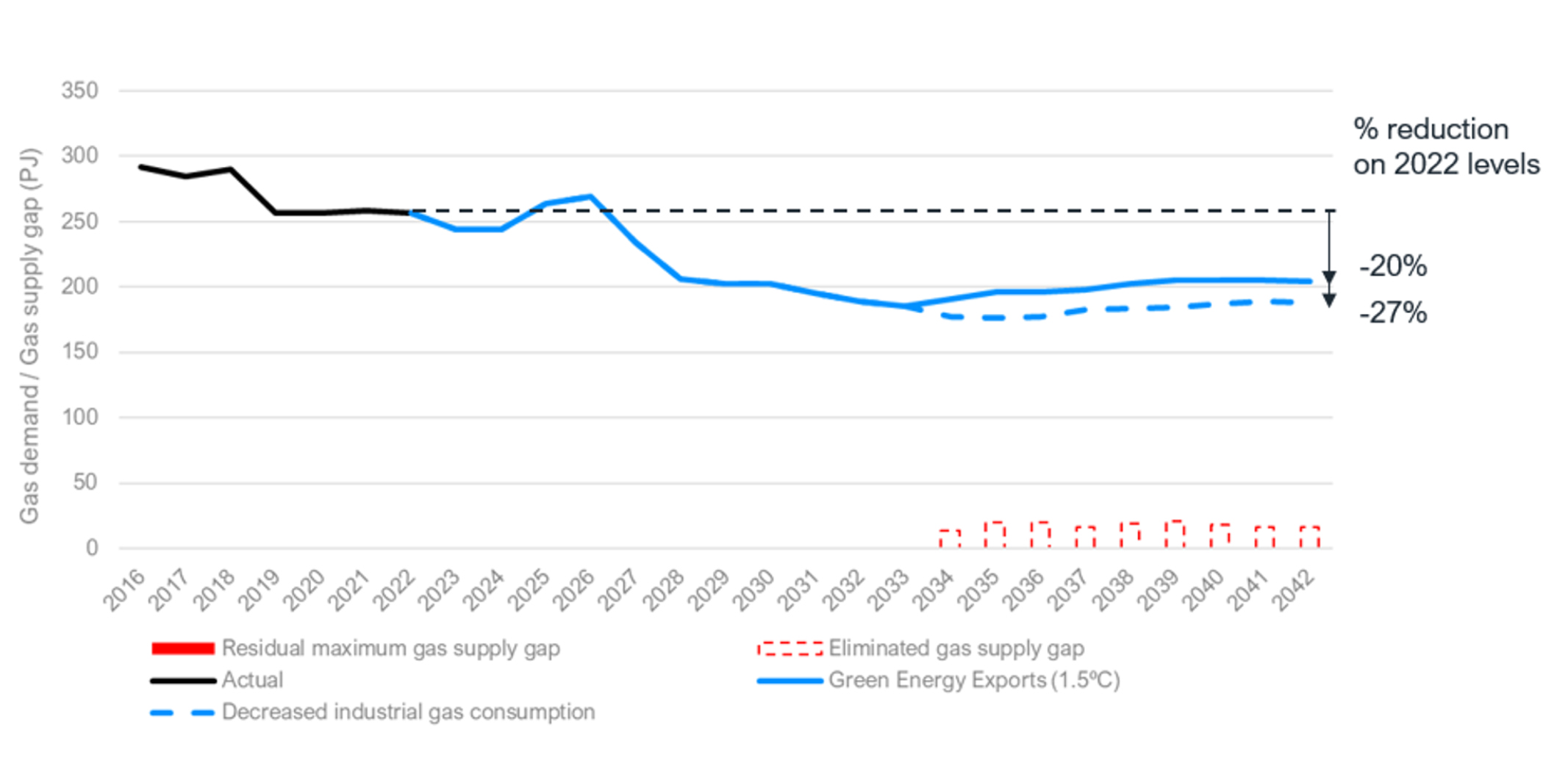

The rest of the gas supply gap could be filled by a small increase in industrial gas demand reduction, well within the identified technological and economic potential

Gas consumption in industry does not reduce much across all scenarios with just 20% reduction by 2042 compared with 2022 in the Green Energy Exports (1.5°C) scenario. This contrasts with recent credible modelling which showed much larger potential for gas demand reduction in industry through energy efficiency, electrification and fuel shift. Those modelling exercises include the CSIRO/Climateworks 2022 multi-sector modelling commissioned by AEMO and used as an input into the GSOO, as well as the pathways developed for the industry-backed Industry Energy Transition Initiative supported by the Australian Renewable Energy Agency. Both showed that industrial gas demand can be more than halved between now and 2042.

Increasing industrial gas demand reduction by just 7% by 2042 could help eradicate the remainder of the gas supply gap.

Figure 3: Required Decrease in Industrial Gas Demand to Fully Eradicate the Gas Supply Gap (PJ)

Source: AEMO, Gas Statement of Opportunities, March 2023, Figure 16, p. 34. IEEFA analysis.

Analyses show that the majority of this decrease could be delivered by energy efficiency improvements. Indeed, best practice energy management and energy efficiency upgrades can deliver about 1.2% energy savings each year in manufacturing. Over a 20-year period this adds up to over 20% energy savings. The remainder of the gas demand decrease could be delivered via electrification, especially of heating processes, and deploying green hydrogen for targeted applications.

Eradicating the gap supply gap would avoid tapping into highly emissions intensive and costly new gas fields

The largest proposed gas project aimed at supplying the Victorian gas market is the 137 terajoule (TJ) a day Kipper gas expansion in the Gippsland Basin, part of a joint venture between ExxonMobil and Woodside. Some of the Kipper gas wells have yielded high carbon dioxide (CO2) levels. One of the wells had a CO2 content of 25.65%, another two 18.25% and 14.61%, and at least another three wells had CO2 readings of more than 10%. This compares to CO2 levels up to 22.8% at the Gorgon gas field, the dirtiest gas field used for LNG exports in Australia.

This high CO2 reading is not an isolated case in Victorian gas fields.

Fugitive emissions from energy production amounted to about 10% of Australia’s total greenhouse gas emissions in the year to September 2022. They were also one of the fastest growing sources of emissions with a 11.4% increase since 2005, mostly driven by growth in LNG exports in the last decade. The only technology available to abate them is carbon capture and storage (CCS), which has a history of failure and underperformance. An IEEFA review of 13 of the largest CCS projects in the world found that failed and underperforming projects considerably outnumbered successful experiences. In Australia, the Gorgon CCS project has failed to deliver, underperforming its targets for the first five years by about 50%.

The alternative to developing those CO2-intensive Victorian gas fields is to transport new gas all the way from Queensland.

Data accompanying the 2023 GSOO shows that around two-thirds of the commercial gas reserves, also known as proven and probable (2P), in eastern Australia comes from the onshore Bowen/Surat basins in Queensland. In another set of data accompanying the 2023 GSOO, the cost of extracting gas from the Bowen/Surat basins was an average of A$4.75/gigajoule (GJ) before transmission costs.

Gas flow from Queensland to Victoria has a convoluted journey. Gas from the Surat Basin will first flow westward from the Wallumbilla hub in southern Queensland through the South West Queensland Pipeline to Moomba at an average cost of A$1.34/GJ. From Moomba it is sent southeast to Sydney via the Moomba Sydney Pipeline at a cost of A$1.23/GJ until it reaches Young in southern New South Wales where it will finally travel southwards into Victoria via the Victorian Northern Interconnect at a cost of A$2.37/GJ. This equates to a total cost of gas from Queensland to Victoria of A$9.69/GJ.

This long transport journey would not only be expensive, it would also be emissions intensive due to the compression infrastructure required to force the gas to flow more than 1,000km and the risk of methane leakage on gas transmission networks.

Instead of investing in the development of these new gas fields and gas infrastructure, Australia could invest in delivering the energy efficiency and electrification upgrades required to eradicate the gas supply gap. This would help not only lower consumers’ energy bills but also deliver Australia’s ambitious emissions reduction targets.

This article first appeared in Renew Economy.