Accelerating India's electric bus adoption: Fuelled by a strategic financing facility

Key Findings

Establishing a central government-owned electric bus financing facility can both shield e-bus Original Equipment Manufacturers (OEMs) from balance sheet and payment security risks emanating from the financially ailing State Road Transport Undertakings (SRTUs).

The facility can finance other zero-emission vehicles as well, including private-sector ones, making it a one-stop zero-emission vehicle financing institution in India.

Public financing can come from domestic and international finance institutions, and donors. Private financing could come from commercial banks and the sustainable bond market. This blend can minimise capital cost for the financing facility.

India launched an ambitious National Electric Bus Program (NEBP) in 2022 with an aim to deploy an additional 50,000 electric buses over five years, backed by a significant investment of US$10 billion (Rs820 billion).

Progress has been slow thus far. As of May 2023, out of the total 359,432 registered buses in India since the inception of the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme in April 2015, only 4,506 or 1.25% of the total, are electric.

To achieve the NEBP target, the government has adopted a two-fold approach. Firstly, the demand aggregation model, implemented through the state-owned Convergence Energy Services Limited (CESL), aims to leverage economies of scale and negotiate competitive prices for electric bus procurement. Secondly, the gross cost contract (GCC) model involves e-bus original equipment manufacturer (OEM) providing electric buses on a lease basis, with payment determined per kilometre.

But there are challenges in the existing approach, particularly concerning the weak financials of State Road Transport Undertakings (SRTUs), who will need to operate these buses. A central government-owned dedicated e-bus financing facility, mobilising concessional loans, grants and funding from various sources by leveraging central government ownership, can help overcome these challenges.

Challenges for OEMs

The recent CESL electric bus tender, valued at Rs50 billion (US$0.61 billion), has encountered setbacks as major automotive OEMs refrained from submitting bids.

The primary hesitation for OEMs is the risk of delayed payment by SRTUs, attributed to their poor financial health and operating performance. According to the latest financial data from the Ministry of Road Transport and Highways (MoRTH), the 56 SRTUs collectively have a debt of Rs380 billion (US$4.6 billion). Additionally, they reported a combined net loss of approximately Rs180 billion (US$2.2 billion) in the fiscal year (FY) 2018-19.

OEMs as bus operators?

OEMs playing the role of bus operators under the current GCC model may not be a desirable proposition for them as it does not align with their core business. Furthermore, in addition to the cash flow risk, OEMs will have to hold electric buses on their balance sheet and source capital to finance them, which can impede their ability to ramp up manufacturing capacities. Therefore, even with the government implementing a payment security mechanism (PSM) to address cash flow concerns, the balance sheet risk for OEMs remains unresolved. This calls for a re-evaluation of the financing approach.

Introducing the electric bus financing facility

Establishing an electric bus financing facility can mitigate these challenges and ensure that the SRTUs do not have to pay the high upfront cost as in the case of outright purchase models. A central government-owned financial institution would own and operate this facility. The financial institution for public electric bus financing will be similar to what the Indian Railway Finance Corporation (IRFC) does for railway infrastructure financing and the Indian Renewable Energy Development Agency (IREDA) does for renewable energy financing.

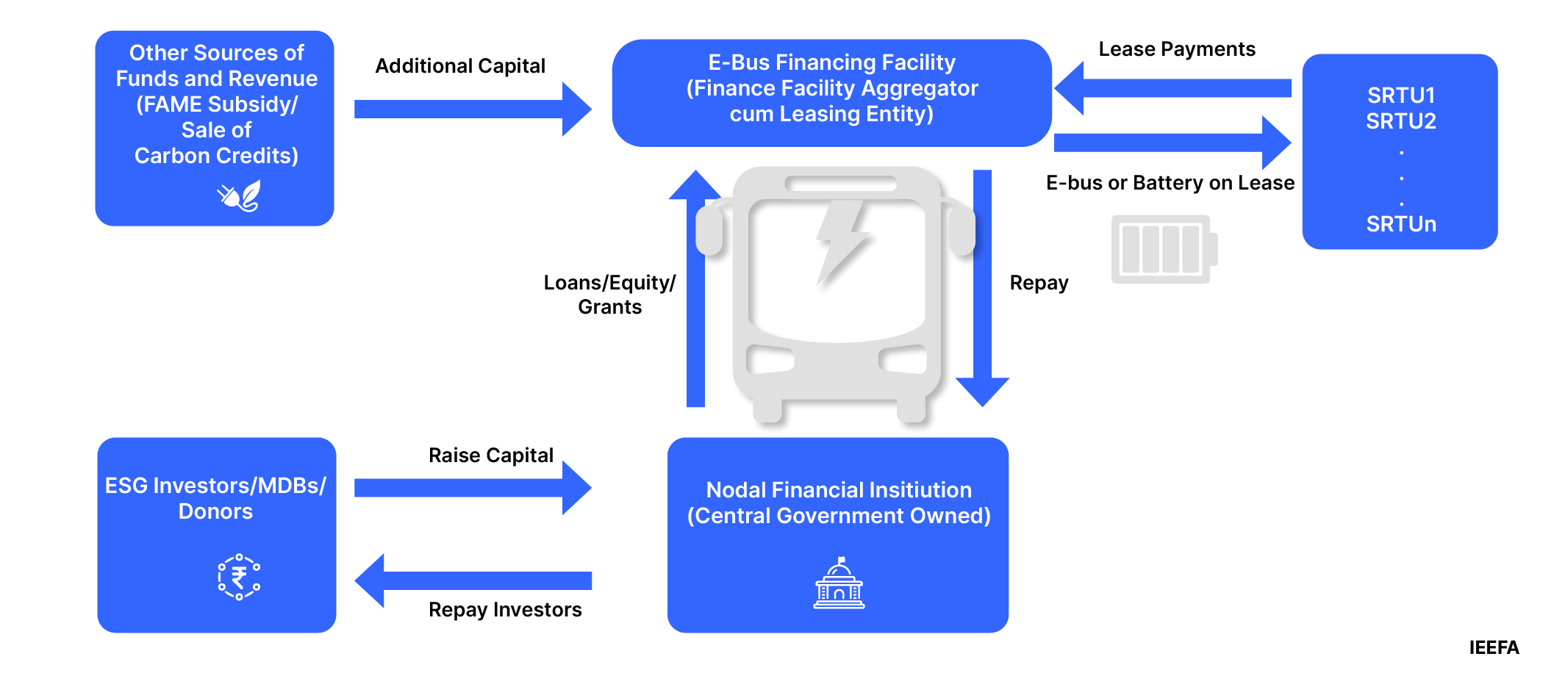

Figure 1: Proposed model for electric bus financing facility

The financing facility would aggregate the funds for electric buses for SRTUs across states. The facility will procure the e-buses from OEMs via a tender process managed by CESL. The selected SRTUs will enter into operating lease agreements with the facility, allowing them to lease the entire bus or solely the batteries. The SRTUs will also establish separate service and maintenance contracts with OEMs to ensure efficient operation and upkeep of electric buses that will keep the collateral value intact. Moreover, the facility can finance other zero-emission vehicles, including private-sector ones, making it a one-stop zero-emission vehicle financing institution in India.

Capitalisation and financing sources for the facility

The capitalisation facility would be the responsibility of the nodal financial institution, which would secure capital from a combination of public and private sources. Public financing would come from the central government's FAME subsidy, domestic development finance institutions and international public finance, including multilateral and bilateral development banks (MDBs), development finance institutions (DFIs), and donors. Private financing could come from commercial banks, the sustainable bond market and other private financiers. This blend of public and private financing can significantly reduce the cost of capital for the financing facility, which is crucial for capital-intensive electric buses. Lastly, in addition to lease income, the financing facility can generate additional revenue by selling carbon credits derived from the emissions avoided by leasing electric buses.

Advantages of a centrally governed financial institution

International climate financiers, including MDBs/DFIs, typically prefer providing financial solutions through central government-controlled entities rather than private companies or state governments. Such institutions, mandated to invest in climate-friendly assets, can offer concessional-rate capital and risk mitigation solutions, such as partial risk guarantees, to the facility. Moreover, private financiers may be more inclined to invest in the financing facility if public financiers take a riskier position in their capital structure, as financing SRTUs may involve higher risk. Therefore, a central government-owned or managed financial institution would be preferable to mobilise various forms of capital, particularly foreign public finance, including climate finance.

Risk mitigation strategies for the facility

One of the major risks that the proposed facility would also face is operating lease payment by SRTUs. Hence, there is a need for a PSM. A central government entity, similar to the current plan of the government, can offer the PSM. Alternatively, individual states can offer a PSM for their SRTUs. A state-managed PSM may be a more judicious allocation of risk, can encourage timely lease payments by the SRTUs to the facility and potentially reduce the PSM’s size compared to a centrally managed one. Furthermore, states have incentives to support e-bus projects as they want to make cities less carbon-intensive and polluting. Therefore, states will likely provide PSMs that address delay or default in lease payments.

Lease agreement conditions and climate commitments

The lease agreement between the e-bus financing facility and SRTUs should include specific conditions. For instance, a five-year phased retirement timeline of existing carbon-intensive diesel or compressed natural gas (CNG) run buses can ensure a smooth transition and minimise disruptions to transportation services. To prevent these carbon-intensive retired buses from re-entering the secondary market, there can be provisions to ensure proper disposal through recycling or scrapping in compliance with environmental standards. Such strong climate change commitments, in addition to ambitious e-bus deployment targets by SRTUs, will be important to attract international climate finance.

Challenges can be solved

A dedicated e-bus financing facility can address the financial challenges the SRTUs face while avoiding perturbing OEMs’ core business. By mobilising concessional loans, grants, and funding from various sources leveraging central government ownership, the facility can play a crucial role in financing the adoption of electric buses and accelerating the transition to sustainable public transportation in India.

An abridged version of this article was first published by Deccan Herald.