5 Reasons Coal Companies Should Pay Export Royalties on Federal Leases Now

The U.S. coal industry is going through a period of shrinkage that even some of its most stalwart leaders acknowledge.

Yet the National Mining Association, in a presentation to the Office of Natural Resources Revenues last month seemed in deep denial about this reality. The industry is fast losing market share in the United States and will likely see further market erosion. The global thermal export market, once considered the solution to declining U.S. coal-company revenues, is weakening as it becomes clearer that Chinese and Indian demand for coal probably won’t continue to grow at record levels.

Meantime, industry watchers, like Platts, have noted an “export or die” mentality persisting across much of the industry. This view ignores the possibility of more balanced solutions as to how the U.S. coal industry (and perhaps the global coal industry) might adjust to the new energy economy.

But make no mistake: Change will come, and it may end up being imposed by policy choices and harsh consequences wrought by bankruptcies and distressed sales of coal companies.

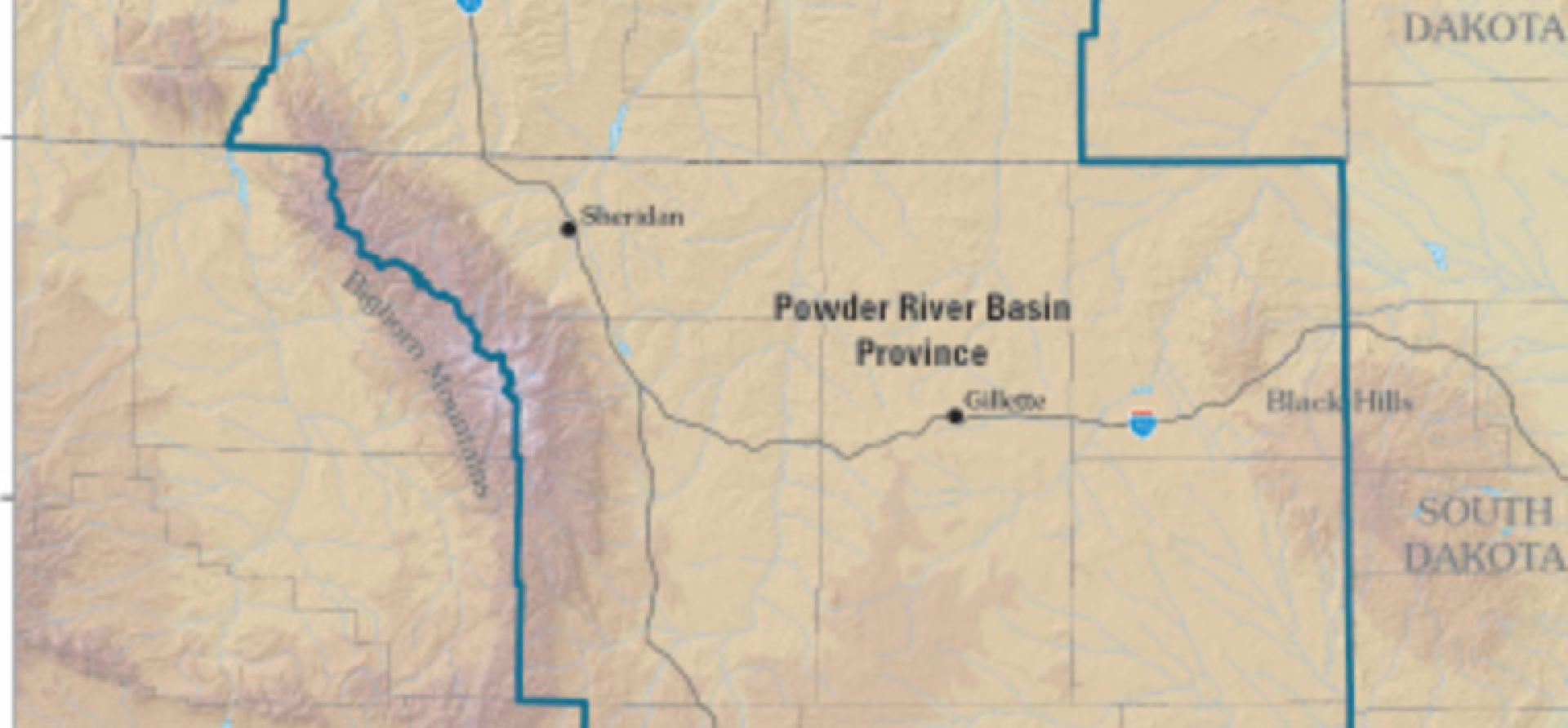

One step toward a coal industry better rooted in reality would be to close a government loophole that lets coal companies avoid paying royalties on coal mined on federal lands and then sold for export. The U.S. government owns large coal reserves in the Powder River Basin, generally located in Wyoming and Montana, which are leased to private coal companies. By law, the U.S. government is supposed to get a 12.5 percent royalty payment on all coal sold off federal coal reserves. The export loophole lets the companies get around that.

The good news is that the loophole, as we speak, is being reviewed in Washington.

Beyond the basic fairness issues it raises, here are five good business or national-security reasons the loophole should be closed:

- Removal of the royalty exemption would reestablish a fundamental risk-and-reward relationship between coal producers and U.S. taxpayers. Coal exports will still be mined from the Powder River Basin even with the market difficulties the coal industry faces, and as long as that’s the case, federal taxpayers and host states are due their share of compensation on what they own.

- The coal industry is failing spectacularly, and the loophole only props up a business model that cannot compete with low natural gas prices, rising market penetration of renewables and increased public support for alternatives to coal.

- The exemption subsidizes the development of economies that compete with the United States, as Powder River Basin coal producers seek to accelerate sales to China, Taiwan, Japan, South Korea, Vietnam, Thailand and India.

- With the depletion of Central Appalachian coal, the Powder River Basin becomes the nation’s largest and last coal reserve. It is a national resource of strategic importance, and should be treated as such rather than as a source of subsidized profit for coal companies.

- While there is no U.S. policy consensus on what to do about climate change per se, it is plain that the country is moving away from coal usage, a policy trend that is inconsistent with providing public subsidies to coal exporters.

Doing away with the royalty waiver would be fiscally rational and in the best interest of national energy security, and it would acknowledge the real-world financial condition of the coal industry.

Tom Sanzillo is IEEFA’s director of finance.