PREPA Is Paying a High Price, and for Consultants Who Didn’t Get the Job Done

[This is one in a series of commentaries on mismanagement at the Puerto Rico Electric Power Authority: Today, details on fees to consultants and advisors; Wednesday, how the recent debt-restructuring deal falls short of its core goals; Thursday, neglecting renewables.]

[This is one in a series of commentaries on mismanagement at the Puerto Rico Electric Power Authority: Today, details on fees to consultants and advisors; Wednesday, how the recent debt-restructuring deal falls short of its core goals; Thursday, neglecting renewables.]

As we explained in a post here yesterday, the debt structuring approved recently for the Puerto Rico Electric Power Authority’s will not benefit PREPA’s ratepayers.

But it’s a big win for some people: the bond consultants and legal advisors who are recovering exorbitant fees from the deal that restructured $6.8 billion of the authority’s $9 billion debt.

PREPA appears to lack the expertise in public finance required to participate in bond negotiations, so it has relied heavily on outside consultants. For this deal it hired AlixPartners, a New York-based consulting firm along with a host of legal advisors and public finance experts to manage the restructuring process.

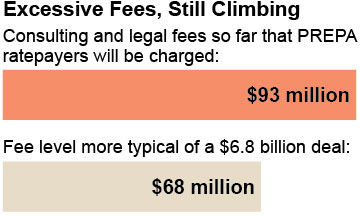

In its April petition to the Puerto Rico Energy Commission for recovery of charges associated with the debt restructuring, PREPA listed upfront consultant fees of $44.7 million. This submission, inexplicably, did not even include the fees for AlixPartners which is the lead consultant and whose charges have been publicly stated to amount to up to $37 million.

In June, the Puerto Rico Energy Commission noted that some of the fees were substantially over budget, mentioning, for example, how an original fee estimate for the Millstein law firm had totaled $2.48 million but had risen to $9 million. An initial fee estimate for the Sidley firm totaled $2.5 million, but had increased to $8.5 million. These two vendors alone drove up the price of the fees by 27 percent over initial estimates (to $56 million and counting). The $37 million for AlixPartners drives the total to $93 million, more than double the initial total stated in the original fee application.

It’s an egregiously large sum.

A 2013 study of bond-issuance fees by the Haas Institute found such fees typically amounting to about 1 percent of the face value of bonds issued; for larger bond issuances, the percentage was typically smaller. By this norm, consultant fees for the PREPA debt restructuring should have been about $68 million—not upwards of $93 million.

Why are the fees so high on the Puerto Rico deal? Maybe because of inefficiencies in services—redundancies, perhaps, or mismanagement. Or maybe because of conflicts of interest. The deal establishes a separate entity called the PREPA Revitalization Corporation that holds the restructured bonds and is responsible for paying back the bondholders through a dedicated charge on consumers’ electricity bills. But the corporation has no staff and is therefore heavily reliant on outside consultants. Decisions by the corporation—including decisions about how much to pay consultants—are made by the corporation’s “restructuring team,” a group that includes those same consultants. It would be an almost comical arrangement were it not for the seriousness of the matter: one of these consultants testified before the Puerto Rico Energy Commission as to the reasonableness of the consultants’ fees.

The audacity of the fee arrangement is heightened by a lack of transparency around the accounting and oversight practices that have allowed such fees to be paid, and calls into question PREPA’s very management culture and its ability to control costs in other areas— including the savings initiatives the agency touts as integral to the success of the restructuring deal. If, as seems likely to us, this debt deal fails to restore PREPA to sound financial footing, another round of restructuring is inevitable, as is another round of consultant paydays.

The Energy Commission has made a point of noting its “concern that PREPA’s customers will be exposed to fees without limit” and has said it might initiate court challenges to excessive fees. But the Revitalization Act passed by the Puerto Rico Legislature earlier this year that allows for restructuring to proceed stripped the commission of any authority to prevent PREPA from recovering unreasonable fees.

Cathy Kunkel is an IEEFA energy analyst. Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS

Puerto Rico’s Proposed Electricity Turnaround Banks Largely on Hope

Debt Restructuring Deal for Commonwealth’s Electric Company Only Makes Matters Worse

IEEFA Puerto Rico: The Hidden Boogeyman in the Commonwealth’s Debt Crisis