IEEFA Puerto Rico Report: Debt Restructuring Deal for Commonwealth’s Electric Company Only Makes Matters Worse

[This is the first of five commentaries: Next week, detail on likely increases in electricity rates; fees to consultants and advisors; how the deal falls short of its core goals; short shrift to renewables.]

[This is the first of five commentaries: Next week, detail on likely increases in electricity rates; fees to consultants and advisors; how the deal falls short of its core goals; short shrift to renewables.]

Earlier this year, Puerto Rico enacted the Electric Power Authority Revitalization Act to allow for the restructuring of the Puerto Rico Power Authority’s $9 billion debt and to reform the agency’s operations and rate structure. The law also effectively reduces regulatory oversight of the agency by the Puerto Rico Energy Commission, which was created two years ago to watch over PREPA.

While the resulting deal is aimed ostensibly at preparing PREPA for a healthier financial future, it fails abysmally to do so. We explain in a report we published today why it will most likely have the opposite effect and how the process of restructuring is being mismanaged.

By way of background, PREPA’s problems have come about as the unnecessary result of poor fiscal practices, unwise acceptance of increasingly risky bond deals, ill-advised political interference in decision-making, an outdated agency framework, and an onerous rate design.

IEEFA sees five core flaws in the restructuring:

- Transparency is lacking and the restructuring is weighted too heavily in favor of bondholders and consultants. A weak law, secretive bond negotiations, and inconsistent and opaque reporting on the refinancing are working collectively to impair the ability of the Energy Commission to ensure that electricity rates in Puerto Rico are just and reasonable. Additionally, PREPA lacks the financial expertise to participate in bond negotiations on its own behalf, meaning that much of the restructuring has been done by outside bond consultants.

- The deal won’t meet its goal of restoring PREPA to fiscal stability. The arrangement is supposed to lower debt and debt service costs and allow PREPA to re-enter the bond market as a healthy, solvent, creditworthy institution. While PREPA claims it is reducing debt levels by 15 percent, that assertion distorts the truth. At the outset of the deal, it reduces PREPA’s indebtedness by 11%. But over the life of the deal, due to additional borrowings and activities, PREPA’s indebtedness will fall by only about 1%. While the underlying operations budget that supports the debt deal relies on a number of new savings initiatives at PREPA, the outcome of these initiatives is in question because the purported savings are poorly documented and PREPA’s track record is one of frequently missed budget targets. Further, fees being charged by financial consultants and lawyers are excessive, harming PREPA ratepayers and damaging the integrity of the deal.

- The debt deal does not include a viable plan for getting PREPA back into the bond market. The absence of a re-entry strategy—which is crucial if PREPA is to achieve fiscal health—will place additional stress on PREPA either to produce new revenue from ratepayers or to abandon new investments.

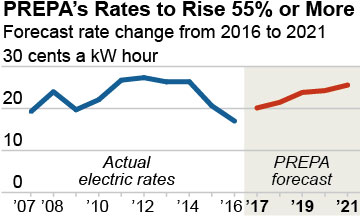

- The deal will impose increasingly unaffordable electricity rates on Puerto Rico’s struggling economy. While PREPA itself estimates that electric rates will increase by 55% over the next five years, reaching 25.6 cents/kWh in 2021, rates will most likely increase more than that for a number of reasons. First, PREPA’s forecasted operational savings are not likely to materialize. Second, electricity sales in Puerto Rico will continue to fall as the economy contracts. Third, PREPA ratepayers are on the hook for far more bond consultant and lawyer fees than they should be paying. Fourth, PREPA may be entirely unable to access the bond markets, putting it in the position of having to raise rates to pay its bills.

- The deal is hindering Puerto Rico’s transition to renewable energy. PREPA’s finances are in dire condition at a time in which the utility is also in violation of federal air quality regulations and is under a mandate to make substantial capital investments in modernizing its electric system. PREPA, principally dependent on oil-based power generation, is planning now to turn almost entirely to natural gas by way of a new $2.4 billion investment that gives renewable energy exceptionally short shrift and that undermines energy security by relying on one source of fuel. Despite a legislative mandate to diversify Puerto Rico’s energy mix by increasing investment in renewables, PREPA’s plans include no timeline or financing for developing specific renewables projects. The centerpiece of PREPA’s investment strategy is a proposed offshore liquefied natural gas (LNG) import terminal and related infrastructure. This commitment will merely convert the island’s power system from over-reliance on imported oil to over-reliance on imported natural gas. The cost of this program, combined with the high levels of legacy debt imbedded in unsustainable rates, will crowd out any potential future investment in renewable energy.

Electricity rates are already too high in Puerto Rico, an island that has one-third the median income of the handful of U.S. states that have similarly high electric rates. Rates in most states are about half what they are in Puerto Rico.

For PREPA to achieve true financial stability, bondholders must accept a more significant reduction in principal, and the agency must adopt sound, auditable financial practices.

Tom Sanzillo is IEEFA’s director of finance. Cathy Kunkel is an IEEFA energy analyst.

RELATED POSTS:

IEEFA Puerto Rico: The Hidden Boogeyman in the Commonwealth’s Debt Crisis

Misguided Plan to Rebuild Puerto Rico’s Electric System Is Fraught With Risk and Cost