IEEFA Update: A Sense of Desperation in Global Coal-Expansion Campaigns

Coal apologists the world over like to cite spurious “facts” to support their argument for new investments in coal projects. A commonly heard theme: We need more coal because it’s cheap.

In Australia, the government’s chief scientist’s call for a national “clean energy target” has set off a wave of highly dubious claims about coal from its most ardent supporters.

The truth of the matter is that new coal-fired power stations are an increasingly expensive way to build generation capacity, a fact reiterated recently here in Australia by Catherine Tanna, managing Director of the power utility EnergyAustralia.

Globally speaking, Kobad Bhavangri of Bloomberg New Energy Finance cites reputational, regulatory and return risks as key reasons for why new coal-fired power is more expensive today than it has been historically.

Only in “an imaginary world” is coal cheap, Bhavangri notes.

So the Minerals Council of Australia’s latest attempt to demonstrate how cheap new coal-fired generation is compared to renewables doesn’t stand up to much scrutiny. That group’s figures include a predicted cost of US$1.8bn per 1,000MW for new ultra-supercritical coal power, an assertion that the Australian Financial Review notes bear “no relation to reality.”

For a more honest idea of how much new coal in Australia actually costs, you can take a look at South Africa, which has a similar cost-of-construction profile. South Africa’s state-owned electricity utility Eskom is currently building two huge ultra-supercritical coal power plants, the Medupi and Kusile projects. Medupi and Kusile have a capacity of 4.8GW each; their size is matched by huge cost and time overruns.

Medupi, currently expected to be completed in 2020, may have a cost to completion of over US$14 billion. Kusile won’t be finished until at least 2022 with a cost to completion of perhaps almost US$17 billion. That comes to a total cost of about US$3.3bn per 1,000MW, 83 percent higher than the Minerals Council of Australia estimate.

AS COUNTRIES LIKE CHINA, JAPAN AND SOUTH KOREA MOVE AWAY FROM EXPENSIVE COAL PROJECTS AND TOWARD RENEWABLES, they are seeking to push their coal expertise onto developing countries instead.

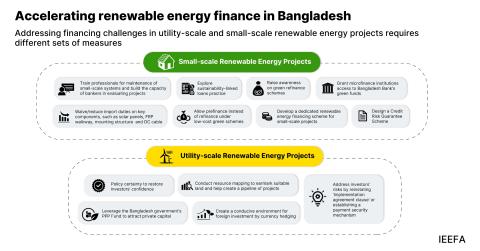

These deals are held together, however, only by implicit finance subsidies that hides the true cost. The Japan International Cooperation Agency (JICA) has recently given its largest ever subsidized loan—500 billion yen (US$4.5 billion) to Bangladesh to cover the cost of an ultra-supercritical coal-fired power plant and coal port at Matarbari in the south of that country. At 1.2GW, the power plant would be the largest in Bangladesh. Of the 500 billion yen, 300 billion will fund the power station at a cost of US$2.3bn per 1,000MW. Given that the plant will be using imported coal and can’t operate without the coal port, the true cost is even higher.

In addition, JICA has provided technical and planning support to Bangladesh—indeed JICA wrote the Bangladesh national Power System Master Plan. Not surprisingly, the plan calls for a future power system that ignores renewables and is dominated by expensive imported coal and LNG-fired technology, which Japan just happens to be able to provide.

Because new coal-fired power developments has gotten so expensive, and so risky, interest among financial institutional in investing in new coal projects has waned, and much of the investment that goes into coal-fired power stands to be limited to existing power plants whose owners seek to extend their lifespans.

Even this tack will prove expensive when (and if) carbon taxes become the norm.

Already heavily-indebted coal plant operators in India are seeking central government financial assistance to help retro-fit their plants in response to a government crackdown on air pollution. The total cost of the required technical updates there has been estimated at a staggering US$38 billion

One avenue of bailout that Indian power companies are pursuing is to persuade the government to allow increases in coal-fired power tariffs.

Such tactics really only further undermine the notion that coal-fired power is cheap, especially given how power tariffs from solar PV plants fell below the cost of existing coal-fired power plants this year.

Whether you’re talking about new coal-fired power stations or life-extensions on existing plants, the idea that coal isn’t costly doesn’t stack up anymore. Campaigns to the contrary—and in the face of the plummeting cost of renewables—come off now as increasingly ridiculous and desperate.

Simon Nicholas is an IEEFA energy finance analyst.

RELATED POSTS:

IEEFA Brief: Coal Industry’s Solution to Energy Poverty Is Not Economically or Socially Feasible

IEEFA Australia: Hume Coal Proposal Will Be Left Behind as Energy Markets Move On

IEEFA Update: The Coal ‘Comeback’ of 2017