Eskom’s international customers are turning towards solar

- Further solar projects announced to reduce reliance on Eskom and hydro

- Botswana, Namibia and Zimbabwe now considering very large solar programs

After South African power utility Eskom announced its interim financial results last week, which included a forecast that the company would make a R20bn (US$1.4bn) loss for the full year, there was a warning that the utility’s perilous state was not just an issue for its home nation.

The utility’s perilous state is not just an issue for its home nation.

Whilst in Johannesburg, African Development Bank (AfDB) President Akinwumi Adesina noted that a solution to Eskom’s financial malaise will have to be found because other nations import power from the debt-laden power generator.

Cost and schedule blow-outs at two unfinished coal-fired power plants have left Eskom unable to generate enough cash to service its US$31bn debt.

Although international power sales made up only 6% of Eskom’s total sales for the 2018-19 financial year, its cross-border customers have far smaller power systems than South Africa and are often reliant on such imports.

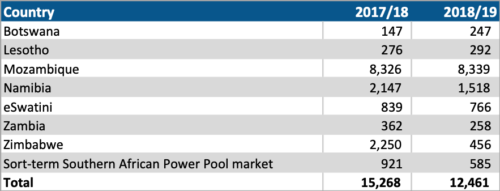

STILL, ESKOM’S INTERNATIONAL POWER SALES DECLINED FOR THE FIRST TIME IN YEARS during the last financial year, down 18% on the prior period (see Table 1).

Eskom is likely to see this figure decline further over the years to come as its international customers take advantage of the decreasing cost of solar technology and their strong solar radiation resources to become less dependent on a financially hamstrung power utility in another country.

Table 1: Eskom’s International Power Sales (GWh)

Zambia was the first of Eskom’s international customers to get the ball rolling on utility-scale solar with the initial Sub-Saharan project under the World Bank’s Scaling Solar program. The 54 megawatt (MW) solar project was completed in March 2019 and was shortly followed by the completion of another 34MW Scaling Solar project by global renewable energy leader Enel.

With its reliance on hydro power being exposed by drought, Zambia has been pushing further into solar power and the nation’s Industrial and Development Corporation, which overseas state-owned enterprises, has directed the national power company to increase reliance on renewable energy.

Botswana and Namibia make good locations for major solar developments

A 2019 tender for another 100MW of solar in fact achieved 120MW of projects awarded and set a new Sub-Saharan record low price for solar power at under US$40/MWh.

In October 2019, Japanese renewable energy company Univergy announced a US$200m investment in to solar projects that will add another 200MW of solar to the Zambian grid in 2020. And only last month, the AfDB itself announced finance for a 100MW small-scale solar scheme alongside the Green Climate Fund.

Botswana had until recently been sitting at an energy crossroads with a plan to build new capacity at its Morupule B coal-fired power plant following lower-than-expected output from the existing plant that has been plagued by technical issues.

However, with project developer Marubeni having pulled out of the proposed extension, Botswana may now have turned the corner in the direction of solar. In April 2019, Botswana re-launched a 100MW solar power tender intended to reduce reliance on imports from Eskom.

Following this, in September 2019 it was reported that Botswana, along with neighbour Namibia, was considering an ambitious, staged solar power development totalling up to 5GW. The first stage would eliminate the need for power exports from Eskom with later stages converting both countries from electricity importers to exporters.

With low population densities and high solar radiation resources, Botswana and Namibia make good locations for major solar developments. Botswana also boasts the highest sovereign credit rating in Sub-Saharan Africa.

Finance for coal projects is increasingly hard to come by

Namibia itself was already targeting solar power developments to reduce imports on which it is reliant for about half its power requirements. In August 2019, Namibia announced 40MW of further solar power over two projects as part of a new plan to add 220MW of renewable energy by 2023.

The small landlocked kingdom of eSwatini (formerly Swaziland) has also identified the risk of relying on a hugely indebted South African power utility and is developing a 40MW solar project to reduce imports from Eskom.

Mozambique, the largest of Eskom’s overseas customers, is targeting increased power capacity to meet growing demand from sources including hydro, renewables and coal. This comes at a time when finance for coal projects is increasingly hard to come by and the major mining companies are pulling out, or considering pulling out, of thermal coal.

Mining giant Vale announced in November 2019 that it will shift the production focus of its Mozambique coal mines to produce less thermal coal for power generation and more coking coal for steel-making. It will also take a US$1.6bn project write-down in the process.

Meanwhile, Mozambique’s solar power development continues. The nation’s first 40MW utility-scale solar project went on line in August 2019 and the International Finance Corporation (IFC), which helped fund that project, is now developing 60MW of additional solar installations. The French Development Agency is also planning another 80MW.

A Sub-Saharan transition towards renewable energy is accelerating

In the most recent development, Zimbabwe is now talking about a major move into solar to address its over-reliance on hydro. Drought has led to inadequate power generation resulting in consistent blackouts, a situation that climate change is likely to make worse. Technical issues at the Hwange coal-fired power station have contributed to the problem.

The power shortage in Zimbabwe is reportedly now to be addressed by an ambitious-sounding 2GW solar build out supported by the United Arab Emirates according to the government.

African Development Bank Abandons Coal

The AfDB’s warning about the impact of an Eskom collapse on the region came shortly after it announced in November 2019 it would no longer finance coal-fired power projects, a move that may have sealed the fate of the proposed 1GW Lamu coal-fired power project in Kenya. In the same month Kenya was ranked in the Climatescope top five emerging markets for renewable energy development for the first time.

A Sub-Saharan transition towards renewable energy is accelerating. Solar power will allow South Africa’s neighbours to increasingly become power exporters rather than importers.

The way things are currently going with Eskom, that may come not a moment too soon for South African electricity consumers.

Simon Nicholas is an IEEFA Energy Finance Analyst.

Related articles:

IEEFA update: South African coal exports face long-term decline

IEEFA update: Marubeni pulls out of Botswana coal power project

IEEFA update: As Marubeni distances itself from coal, other industrial behemoths will follow

IEEFA Guest Commentary: The Sensible Path Forward for South Africa’s Eskom