IEEFA: Skyrocketing EV sales in China spell a no-turning-back step change in global energy landscape

The jury is in. The global race between passenger electric vehicles and hydrogen fuel cells vs petrol vs diesel is over. EVs have won in China, the world’s biggest auto market.

EV sales in China grew 154% year-on-year to 3.3 million in 2021.

China now wants new energy vehicles (NEVs), including plug-in hybrids and hydrogen fuel cell cars, to make up 20% of sales by 2025, and aims to ban internal combustion engine (ICE) sales by 2035.

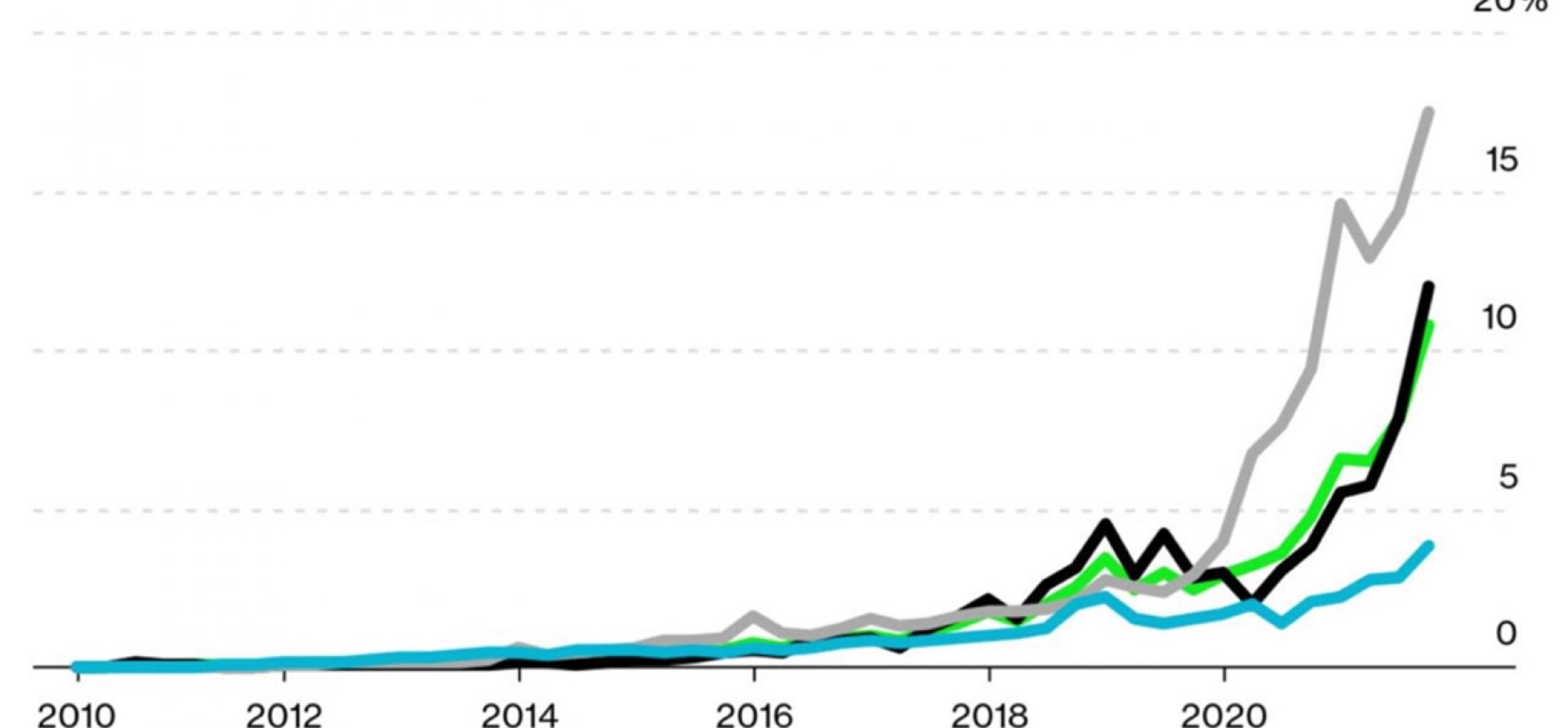

Figure 1: Above 10% – Passenger Electric Vehicle Sales in China as a Percentage of Total Sales, Quarterly

China leads the world on EVs.

The trillion dollar company Tesla has the biggest western factory in China, combining with high growth domestic manufacturers BYD and CATL (both up 500% in the past two years) to dominate the EV/battery space.

Figure 2: BYD Company Limited 2011 – 2022

Source: Yahoo Finance

China hasn’t stopped there. On 30 December 2021, the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) announced further details of China’s decarbonisation strategy. The country’s top five power utilities – the world’s largest – must attain at least 50% renewable energy capacity by 2025.

This new SASAC policy means renewable energy investment by these utilities will have to accelerate in China, already the world’s renewable energy superpower.

Late last year, the Chinese Government announced it will no longer fund new coal abroad with immediate effect.

Three days later the Bank of China announced it would implement this policy with immediate effect, marking the first formal coal exit policy from China.

China has four of the largest banks in the world so it’s a clear sign of world leadership change well underway.

Figure 3: China’s Big 5 Utilities – Renewable Energy Share of Total Installed Capacity (%)

When China moves, the rest of the world follows. Energy transition and decarbonisation are inevitable.

U.S. coal collapse and solar off the charts

Two charts published last week illustrate this. The first contrasts the ongoing collapse in U.S. coal generation with the U.S. Government’s Energy Information Administration (EIA) forecasts, which failed to plot this train wreck even as it happened.

The U.S. in 2010 was the world’s second largest coal producer and consumer. In just one decade, production and consumption halved, meaning China is now the lead, followed by India.

Figure 4: U.S. Coal Generation – Actual and EIA Forecasts from 2010 – 2020

Source: EIA

Meanwhile, global solar additions are off the charts. Notionally independent, the International Energy Agency (IEA) has consistently failed to grasp the exponential growth of solar, despite the evidence.

Figure 5: IEA New Solar Additions Per Year – Forecast vs History

Source: RamezNaam.com

Private equity turning to renewable energy investment

Over the last year there were 86 new or improved formal coal exit policies from 190 globally significant financial institutions.

Global investment firm Blackstone recently announced one of the largest renewable energy equity investments in U.S. history, a US$3bn purchase of a minority stake in Invenergy Renewables.

Vanguard’s new coal policy commits to engage with fossil fuel firms

Vanguard’s new coal policy commits to engage with fossil fuel firms and ensure boards have a clear climate alignment with the overt threat this U$7 trillion asset manager will start voting against laggards from 2023.

Late last year, the first formal exit policy by an Indian financial institution came from the Federal Bank. It had accepted an equity injection from the International Finance Corporation, which invests in developing country banks only if they have formal climate and coal exclusion policies.

And in Europe, Germany’s new coalition government in November 2021 announced renewables would be a staggering 80% of the electricity mix by 2030 (up from the current 65%), to include 130GW of onshore wind, a doubling to 30GW of offshore wind, and a near quadrupling of solar installs to 200GW.

India can still lead world decarbonisation efforts

In India, solar costs Rs2.50/kWh – half the cost of new domestic coal-fired power and a third of the cost of new imported coal- or LNG-based power. Financiers won’t lend to fossil fuel projects that are financially unviable, even before factoring in CO2 emissions risks.

Gautam Adani is the world’s largest investor in new thermal power projects. In six years, Adani also built from scratch India’s most valuable renewable energy firm, Adani Green Energy, with a market capitalisation of US$34 billion (Rs2.5 trillion).

Six acquisitions in six months suggest Reliance aims to disrupt India’s energy market

The lure of deploying global capital at scale to deliver on India’s ambitious target of 450GW renewable energy by 2030 is likely to see Adani join corporate peers in pledging a credible net zero emissions plan, including matching the Tata group and NTPC pledges to build no new coal-fired power plants.

The billionaire to watch however is Mukesh Ambani, whose Reliance Industries has a market capitalisation of US$225 billion (Rs17 trillion) and pledges a world-leading net zero emissions by 2035. Six acquisitions in six months suggest it aims to disrupt India’s energy market, bringing much needed scale and world-leading technology.

Challenges in the energy transition

This ride won’t be smooth.

Extreme commodity price inflation was evident due to the lack of sustained investment in fossil fuels, but also due to surging demand in future facing commodities such as lithium.

New commodity scarcity (lithium, cobalt, copper, nickel, rare earths) affecting EVs, renewable energy and batteries requires a total global system redesign, at speed.

A McKinsey study flagged the market for battery cells will grow more than 20% annually to reach US$360-410bn by 2030. Last year, battery raw material prices reflected this expectation by doubling or quadrupling.

Technology change takes investment, and the global energy sector is a massive serial under-investor in research and development.

Technology change takes investment

Financial markets in the past two years have hyped green hydrogen (GH2), key to decarbonising such heavy industries as steel and fertilisers. Massive scaling up and a cost-down trajectory this coming decade will be needed to replicate the deflation path of solar.

The world’s largest operating electrolyser doubled capacity to 5 megawatts (MW) then 10MW in March 2020 (at Japan’s Fukushima). In January 2021, Canada commissioned a 20MW GH2 facility. In July 2021, Shell announced plans for a 100MW GH2 facility in Germany. This month came the announcement of a 200MW GH2 facility (Netherlands). And Contact Energy and Meridian Energy are working on a proposed 600MW GH2 facility (New Zealand).

The speed of change

In the global energy transition, the speed of change is a constant.

South Australia, for example, closed its last coal power plant in 2017 and has no hydroelectricity. Yet with investment, planning and leadership, solar and wind farms and rooftop solar on average met just over 100% of local demand daily for almost one week in December 2021.

Stranded assets remain a clear and present danger

Global financial markets are starting to price in this accelerating disruption, and to better understand the financial risks of high emissions fossil fuels – oil, coal, gas (methane) or hydrogen (other than green).

Stranded assets remain a clear and present danger.

Prepare for global financial markets to pivot from fossil fuels when global investors see the tens of trillions of new zero emissions investment opportunities.

The mobile phone killed off fixed phone lines. The internet disrupted all businesses. Renewables, batteries and EVs inevitably will vanquish high emissions industries.

By Tim Buckley, Director of Energy Finances Studies Australasia & South Asia, IEEFA

This commentary first appeared in Renew Economy.

Related articles:

IEEFA: The Goldilocks predicament: For oil and gas, there are no “just right” prices

IEEFA Australia: Comparing global commitment to renewable energy policies, programs and funding

IEEFA: IEA’s net zero emissions by 2050 maps the huge increase in global ambition