IEA’s net zero emissions by 2050 maps the huge increase in global ambition

The International Energy Agency’s (IEA) Net Zero by 2050 energy sector roadmap out today says the world should add “no new oil and gas fields approved for development in our pathway, and no new coal mines or mine extensions are required”.

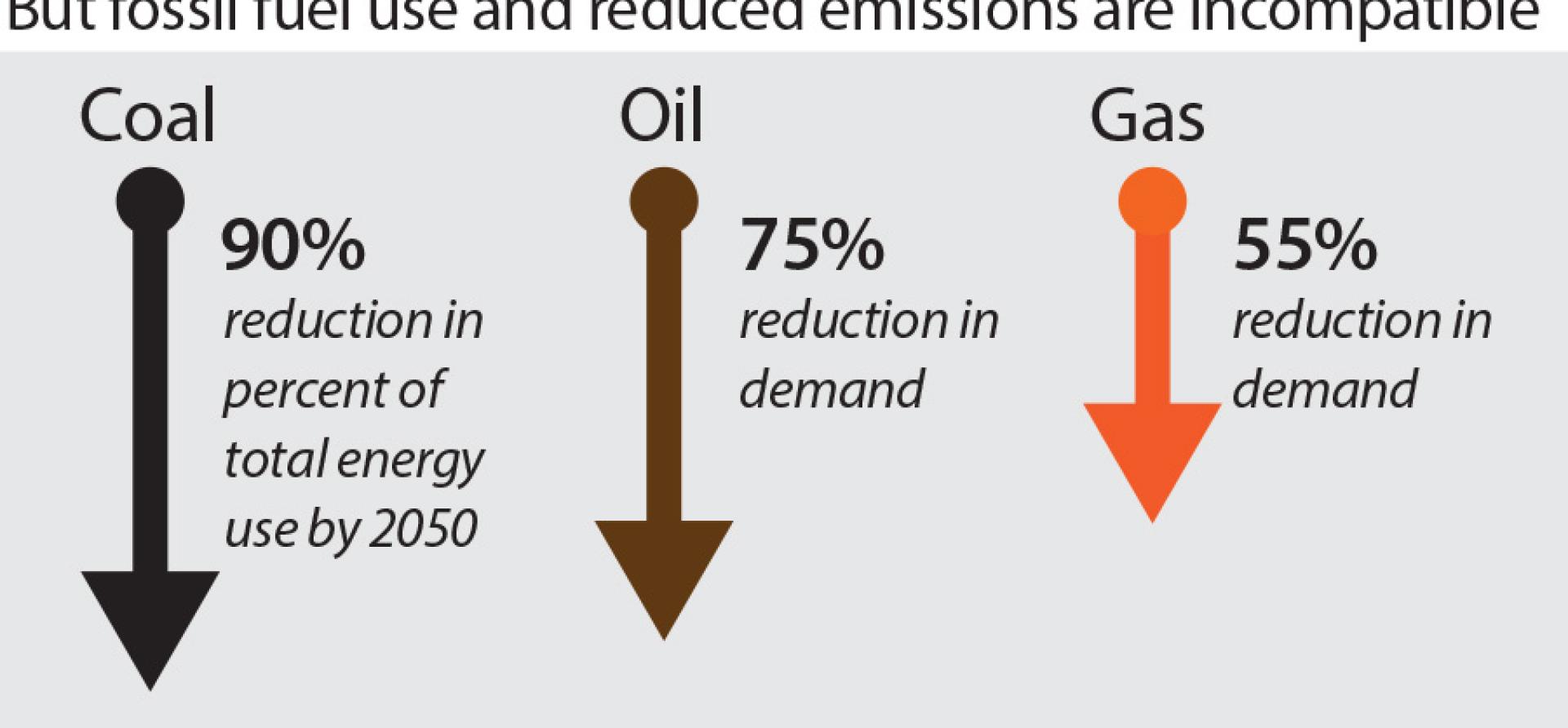

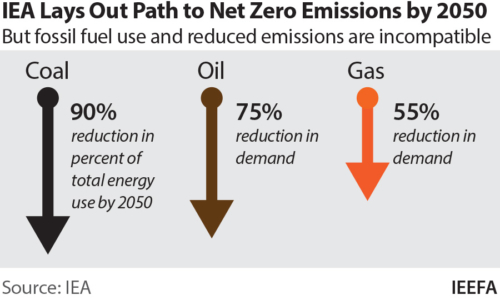

Simply put, more fossil fuels are entirely inconsistent with reduced emissions.

Existing unabated coal use declines by 90% to just 1% of total energy use globally by 2050. Fossil gas demand declines by 55% whilst oil use declines by 75% by 2050.

There is no ‘gaslit recovery’ in a net zero emissions world.

The IEA’s roadmap highlights the huge role that energy efficiency, renewable energy, electrification of everything, electric vehicles (EVs) and reduced methane emissions will have to play.

The IEA also highlights the ratcheting up of global ambitions, both by leading governments, financial institutions and corporates.

Critically, collective pledges to-date only put the world on a 2.1°C trajectory, rather than the Paris target of 1.5°C or below.

There is zero scope for new fossil fuel developments

The next phase is to accelerate interim policy actions by 2030 to drive a step-change, a complete transformation of how we produce and consume energy.

There is zero scope for new fossil fuel developments if the world is to get onto the right trajectory.

Staggering changes are upon us.

The climate science is clear and getting clearer. And the remaining global carbon budget for the growing dominance of 1.5°C pledges is less than 60% of that required for a 2.0°C world.

The new IEA modelling assumes:

- Clean energy investment trebles to US$5 trillion p.a. by 2030, accelerating global economic growth in the process;

- Energy efficiency needs to deliver a 4% annual improvement globally by 2030;

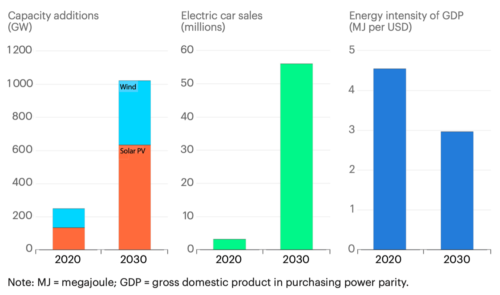

- Global installs of variable renewable energy (VRE) need to quadruple from 2020 levels to 1,020 gigawatts (GW) annually through to 2030;

- EVs need to rise from 5% of global new car sales to 60% by 2030, with new internal combustion engine (ICE) car sales ceasing entirely by 2035;

- Global battery production for EVs needs to increase fortyfold to 6,600GWh annually;

- Global investment in grid transmission and distribution needs to treble to US$820bn annually; and

- Methane emissions globally from fossil fuel supplies must reduce by 75% by 2030, assisted by independent satellite tracking and incumbent players’ belated efforts as transparency increases.

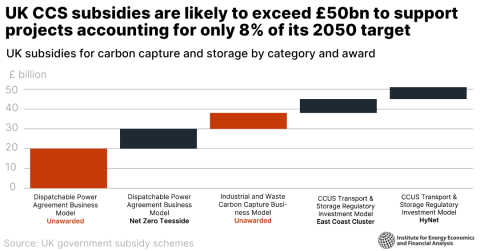

Critically, the IEA has stopped buying the fossil fuel industry smokescreens of offsets and unfeasible technologies like carbon capture and storage (CCS) when talking about the global energy sector’s efforts over this coming decade, suggesting it will play only an immaterial role (the IEA still references this figleaf post 2030).

We applaud this move to consider only commercially proven and likely technologies.

The IEA continues to highlight that the perverse incentives of massive fossil fuel subsidies need to be phased out, while the benefits of a price signal on carbon is a key opportunity.

Beyond 2030, the IEA notes that technology breakthroughs might allow advanced batteries, hydrogen (particularly via heavy industry demand precincts), bioenergy, CCS and/or direct air capture and storage to each play a role, if research, development and deployment (RD&D) is invested in at scale.

The IEA models that RD&D investment needs to treble to US$90bn annually vs current levels. For advanced batteries, this pathway to commercialisation is being funded by capital markets. For others like CCS and hydrogen, serious investment rather than talk is required.

Key Clean Technologies Ramp up by 2030 in the Net Zero Pathway

Source: IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, 18 May 2021

Given the actions required by 2030 will be predominantly driven by technologies known and in operation today, the IEA models that 55% of cumulative emissions reductions will come from initiatives linked to consumer choices, assisted by enabling policy frameworks e.g. moving to EVs, retrofitting housing with energy efficiency technologies and installing heat-pumps to clean cooking.

The role of zero carbon-ready building codes to drive decarbonisation of the built environment will also be key.

IEA modelling shows the power of electrification in driving decarbonisation

The IEA models that the shift to zero emissions-industry solutions will drive 16 million new jobs in the energy sector, a 40% expansion in the workforce globally. New jobs in zero emission industries offset the 5 million existing jobs lost during the energy transition three to one.

The key political message in IEEFA’s view is that there are risks and opportunities, but countries need to embrace opportunities for new investment, employment and net exports (i.e. boosted by reduced imports of coal, gas, oil, diesel and ammonia).

The IEA modelling shows the power of electrification in driving decarbonisation, with electricity forecast to account for half of all energy needs by 2050 globally.

Two-thirds of total energy use globally is forecast to come from renewable energy by 2050 – wind, solar, hydro, bioenergy and geothermal.

Solar is forecast to increase twenty-fold.

Consistent with the flight of global capital already evident, the IEA models that no new final investment decisions should be made to build unabated coal power plants, effective immediately.

Given there are precisely zero CCS coal-fired power plants in the U.S., Japan, Korea or Australia operational today, and none under construction, this means the IEA modelling is finally consistent with the IEEFA position that thermal coal use globally is in a slow, steady terminal decline.

The IEA modelling is finally consistent with the IEEFA position

The IEA models that the accelerated closure of all subcritical coal-fired power plants must be completed by 2030 – consistent with the Japanese government’s July 2020 commitment to shut 100 of their 140 coal plants, but replicated by every country globally.

This energy transition will need to happen a decade faster in the developed world, in recognition of the core Paris Agreement “Common But Differentiated Responsibility” clause.

The great news is global finance is moving, and this tipping point will drive exponential change, led by the unexpected likes of BlackRock, JPMorgan Chase, Korea Development Bank and the Japan Bank of International Cooperation – four of the largest private and public financiers of fossil fuels in the world, until 2021.

IEEFA has tracked a 40% acceleration year-on-year year-to-date 2021 in new or improved formal coal exit policies by globally significant financial institutions (GSFI), with the past two weeks seeing new announcements by Mizuho Financial Group Inc, Sumitomo Mitsui Financial Group Inc, Manulife, Prudential Plc, Asia Development Bank, Macquarie Group and Maybank, plus the Reserve Bank of India joining the Network for Greening the Financial System (NGFS).

The domination of greater Asia here is telling, and key.

As BlackRock says, there is now a global tsunami of capital flowing to support the science of climate change, and the required infrastructure solutions.

IEA’s roadmap shows the global energy landscape is set to change profoundly, and at an unprecedented pace, as world leaders – governments, GSFI and corporates move to align with net zero emissions by 2050 and a 1.5°C limit.

We live in exciting times. Get ready for exponential change in the global energy landscape!

Related articles: