IEEFA India: Investment trends in renewable energy 2019/20

The share of renewable energy capacity has been increasing in India’s power sector, delivering more than two thirds of India’s new capacity additions during the fiscal 2019/20 year.

India installed 9.39 gigawatts (GW) of new on-grid renewable energy capacity during 2019/20 plus some 1.5GW of behind-the-meter rooftop solar in calendar year 2019.

This rate of renewable energy installation to date is positive.

However, to achieve the central government’s ambitious target of 450GW of renewable energy by 2030 requires capacity installation of 36GW annually. This in turn requires further capital flow from both Indian and international investors.

To ascertain whether India can come close to meeting its ambitious targets, we explored India’s renewable energy investment trends over 2019/20.

Key Investment Deals

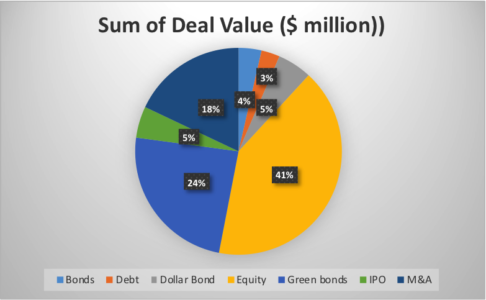

An analysis of the data shows that key investment deals in Indian renewable energy generation during 2019/20 totalled US$8.4bn.

Table 1: Top Ten Deals During 2019/20

| Company name | Deal type | Acquirer/Investor | Deal Value (US$m) |

| Greenko Energy Holdings | Equity + Green Bonds | GIC and ADIA | 2124 |

| Renew Power | Offshore Bonds + Dollar Bonds + Equity | HSBC, JP Morgan and Barclays, Goldman Sachs, ADIA and CPPIB | 1050 |

| Adani Green Energy | Green Bonds + Equity | Total | 837.99 |

| IL&FS | M&A | Orix | 669 |

| Sterling & Wilson | IPO + Equity | 27 anchor investors. Leading investors – Nomura, Schroder, ADIA. | 608 |

| O2 Power | Equity | Temasek, EQT | 500 |

| Azure Power | Green Bonds + Equity | CDPQ | 436.1 |

| Acme Clean Tech Solution | M&A | Actis | 390 |

| Amplus Energy Solutions | Equity | Petronas | 390 |

| Hero Future Energies | Equity + Debt | Masdar, AIIB | 215 |

Source: JMK Research

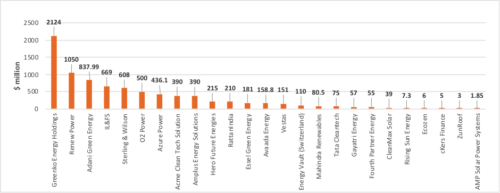

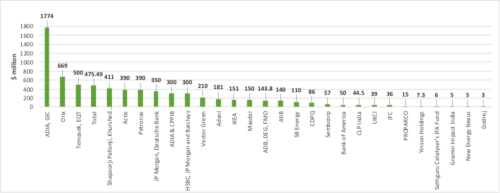

Over 63% included capital investment by five renewable energy companies – Greenko Energy Holdings, ReNew Power, Adani Green energy, Infrastructure Leasing & Financial Services (IL&FS), and Sterling and Wilson – while 46% was contributed by five investors: General Insurance Corporation (GIC) and Abu Dhabi Investment Authority (ADIA), Orix, Temasek, Total and Shapoorji Pallonji, and Khurshed Daruvala .

While Greenko Energy Holdings has been the top renewable energy developer in India during 2019/20, GIC and ADIA have been the biggest investors, with all capital invested in Greenko Energy Holdings: 46% in the form of equity (US$824m) and the remaining in green bonds (US$950m). Greenko has also raised another US$350m from JP Morgan and Deutsche Bank via green bonds.

Figure 1: Investment Acquired by Key Developers 2019/20

Figure 2: Key Investors in Renewable Energy 2019/20

Further analysis echoes this investment trend with the majority of the biggest deals packaged as equity investment or green bonds, followed by mergers and acquisition (M&A) and finally initial public offering (IPO).

Figure 3: Investment by Deal Type

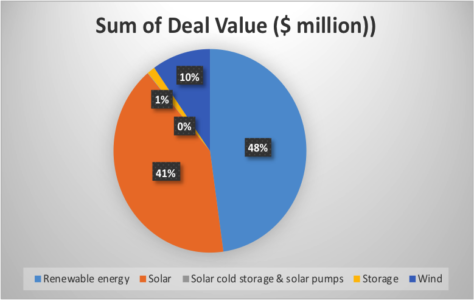

Almost half (48%) of the total investment was for generalised renewable energy, with 41% targeting the solar sector and 10% to wind. Only 1% of the total investment during 2019/20 was for storage or solar pumps.

Figure 4: Investment by Sector Type

Will national and global capital flow to the deflationary renewable energy market?

Renewable energy prices in India have now stabilised at rates 20-30% below the cost of existing thermal power, and up to half the price of new coal-fired power.

In April 2020, a bidding price of Rs.2.55/kWh for 25 years emerged in a solar bid tender by NHPC India. A new non-mine mouth or imported coal-fired power plant in India cannot compete with this as they require a starting tariff of Rs4-5/kWh with annual escalation.

And in May 2020, a bid price of Rs.2.90/kWh for the first year with 3% annual escalation emerged for supply of round-the-clock (RTC) power by Solar Energy Corporation of India Ltd (SECI). This tariff for the supply of power using 100% renewable energy with storage is a very good proposition for power distribution companies (discoms) to meet their energy demand need.

With the decreasing cost of debt and solar module prices, it is an opportune time for the government of India to accelerate the energy transition through better regulation and policy definition in the power sector.

The government needs to reduce off-taker risk by ensuring discoms both honour contracts and make payments to generators.

Further, they need to ensure discoms comply with renewable purchase obligations (RPO), that is, either buying electricity generated by specified ‘green’ sources, or in lieu of that, purchasing renewable energy certificates (RECs).

Finally, to attract more investment, the government needs to ensure policy certainty and explore innovative financial solutions in order to attract more funds.

With the global appetite changing in favour of cheaper deflationary renewable energy technologies, and with over 130 and counting globally significant banks and financial institutions committing to divest their funds from the fossil fuel sector, it is time to make India an attractive investment opportunity, and in so doing, build a strong economy with sustainable energy choices.

The recent downgrading of India’s sovereign credit rating highlights an increased risk for global investors and poses a threat for attracting more investment into the renewable energy market. The government needs to undertake reforms and strengthen the supervision, regulation and capitalization of the financial sector to boost investor confidence.

Vibhuti Garg is an energy economist with IEEFA India.

This article first appeared in ET Energy World.

Related articles:

Energy is pivotal for any country to ensure sustainability

Despite low tariffs, global capital continues to support India’s solar ambitions

Government-owned funders are leading backers of non-performing assets in the power sector

The renewable energy transition is coming to Asia

World-leading solar parks kick-start India’s dynamic clean energy transition