IEEFA Exxon: A Company in Need of More Accountability at the Top

ExxonMobil has been reducing its cash returns to investors over the past few years, a trend we highlighted in our report last week, “Red Flags on Exxon Mobil,” but has still paid out far more to investors than standard financial metrics would support.

ExxonMobil has been reducing its cash returns to investors over the past few years, a trend we highlighted in our report last week, “Red Flags on Exxon Mobil,” but has still paid out far more to investors than standard financial metrics would support.

Indeed, all indicators, including the company’s recent announcement that it will likely de-book reserves and take asset impairments, point to ExxonMobil becoming a smaller company. This prospect is hard for many investors to get their heads around given the company’s history as a market leader. But it’s real nonetheless.

While the subtitle of our report, “A Note to Institutional Investors,” sends a message to a particular set, we think the report serves also as a warning to ExxonMobil’s board of directors.

ExxonMobil will go through a management transition in 2017, when the current CEO, Rex Tillerson, retires. The question it will raise—and is raising in the minds of investors now—is whether there is true accountability at the top of ExxonMobil?

Investors normally pay very little attention to CEO changeovers at big companies, since the new leader usually comes out of the company’s culture. The previous CEO of ExxonMobil, Lee Raymond, left in 2005 with revenues in the $370 billion range and a legacy of growth. Tillerson, by comparison, is leaving a shrinking company behind and will probably be grateful for $250 billion in revenue his last year (even lower than last year’s $268 million, the worst during his tenure).

The company says it prides itself on achieving the highest performance possible from senior management. The board officially requires adherence to seven performance standards: safety, shareholder distribution, free cash flow, return on capital employed, strategic business and total share returns.

As Tillerman departs, it will be interesting to see how the board manages the transition and whether it will appoint a replacement with a viable vision of the future. It will be interesting, too, to see how rich Tillerman’s retirement package will be (management has told lower-level employees at its Australia Bass Strait facility that they must accept pay cuts and shift reductions).

Our research—and the research of others—suggest ExxonMobil’s directors ought to be able to glean something about where the company is/should be going based on metrics around shareholder distribution and free cash flow and the harsh truth that the company is suffering.

Here’s a cheat sheet on metrics of note that might be helpful in informing the decision over who should run the company after its decline under Tillerman.

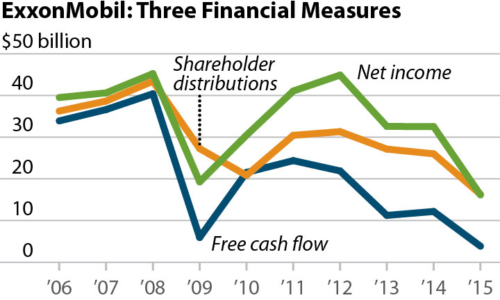

- Shareholder distribution

Since 2006, ExxonMobil has paid its shareholders an aggregate of $302.7 billion. While the average payout during these 10 years was $30 billion, actual annual distributions to shareholders declined significantly, from a peak in 2008 of $43.4 billion to a low of $16.29 billion in 2015.

These shareholder payments have consisted of $205 billion in share buybacks and $97.7 billion in dividends. ExxonMobil has announced it will end its longstanding policy to return cash to shareholders principally through the mechanism of stock buybacks, reducing that payment to zero in 2016.

The company is maintaining its policy of regular dividend increases. - Free cash flow

ExxonMobil’s free cash flow has deteriorated over the past decade. From 2006-2008, free cash flow averaged $37 billion annually. Since then it has averaged $14 billion annually. Free cash flow hit a decade low of $3.85 billion in 2015. Moody’s cites this decline as one reason for downgrading the company in February 2016. - Return on capital employed

Goldman Sachs has noted that return on capital investment is weak and has been for decades. - Total share returns

ExxonMobil’s stock performance lagged the S &P 500 over the 10-, 5- and 3-year measures. And it has lagged the S&P 500 for 10 quarters straight since January 2014, during a period characterized by falling revenues, rising costs, declining net income, decreasing cash reserves, rising indebtedness and diminished capital investment.

It’s up to the board of directors—in this time of transition—to address the underperformance of top management.

If nothing changes at the top, nothing will change.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

IEEFA Exxon: The Problems Are More Than Cyclical