Norway

Latest Norway Research

See more >

The carbon capture crux: Lessons learned

September 01, 2022

Bruce Robertson, Milad Mousavian

Report

IEEFA Update: How India’s clean energy drive is supercharged by Reliance’s grand ambitions

November 30, 2021

Kashish Shah

Insights

IEEFA: More clean energy investment will insulate against rising coal, oil and gas prices

November 04, 2021

Johanna Bowyer

Insights

IEEFA U.S.: Prices are up—but the oil industry’s return is more complicated

July 15, 2021

Tom Sanzillo, Clark Williams-Derry

Insights

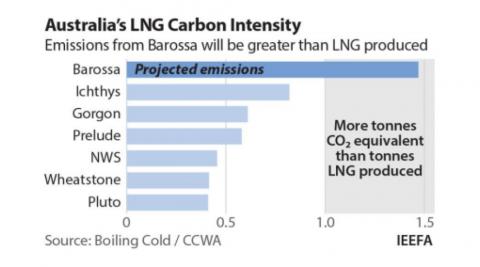

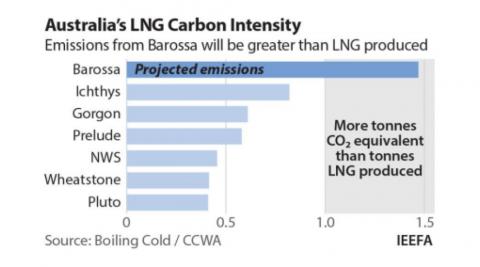

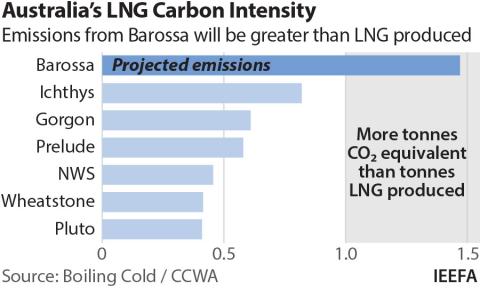

Should Santos' proposed Barossa gas 'backfill' for the Darwin LNG facility proceed to development?

March 01, 2021

John Robert

Report

IEEFA Africa: Is Angola a cautionary tale for Guyana’s oil wealth hopes?

February 10, 2021

Tom Sanzillo, Gerard Kreeft

Insights

IEEFA: After a terrible 2020, the oil industry’s story has turned political

January 08, 2021

Clark Williams-Derry, Tom Sanzillo

Insights

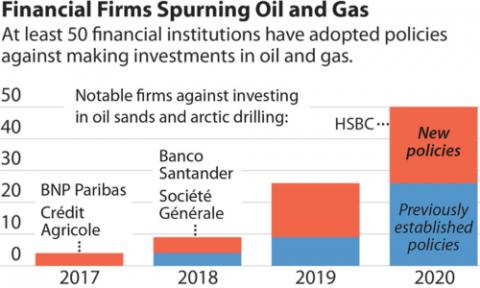

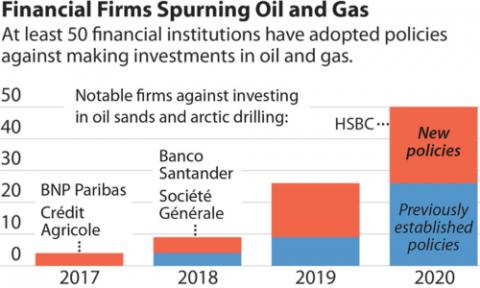

Global financial corporations get cracking on major oil/gas lending exits

October 01, 2020

Tim Buckley, Saurabh Trivedi

Report

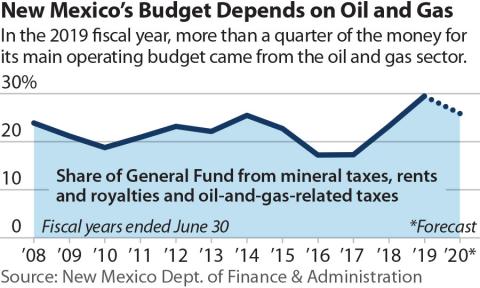

New Mexico’s risky reliance on oil revenue must change

October 01, 2020

Tom Sanzillo, Suzanne Mattei

Report

Norden is Leading the World on Fossil Fuel Divestment

February 01, 2020

Tim Buckley

Report

IEEFA update: The terrible, horrible, no good, very bad year for oil and gas

January 21, 2020

Kathy Hipple

Insights

IEEFA update: Capital flight from thermal coal is accelerating

January 20, 2020

Tim Buckley

Insights

Latest Norway Reports

See more >

The carbon capture crux: Lessons learned

September 01, 2022

Bruce Robertson, Milad Mousavian

Report

Should Santos' proposed Barossa gas 'backfill' for the Darwin LNG facility proceed to development?

March 01, 2021

John Robert

Report

New Mexico’s risky reliance on oil revenue must change

October 01, 2020

Tom Sanzillo, Suzanne Mattei

Report

Global financial corporations get cracking on major oil/gas lending exits

October 01, 2020

Tim Buckley, Saurabh Trivedi

Report

Norden is Leading the World on Fossil Fuel Divestment

February 01, 2020

Tim Buckley

Report

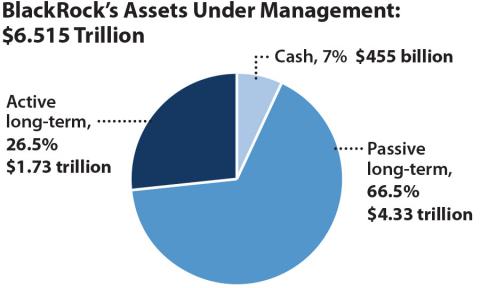

Inaction is Blackrock’s biggest risk during the energy transition

August 01, 2019

Tim Buckley, Tom Sanzillo, Kashish Shah...

Report

Financial risks cloud development of Argentina’s Vaca Muerta oil and gas reserve

March 01, 2019

Tom Sanzillo, Kathy Hipple

Report

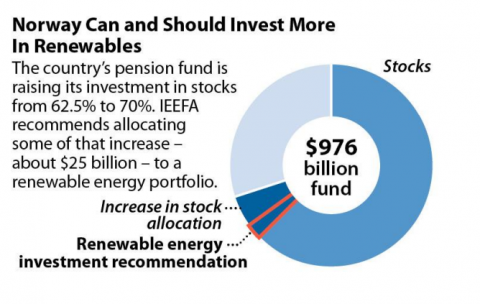

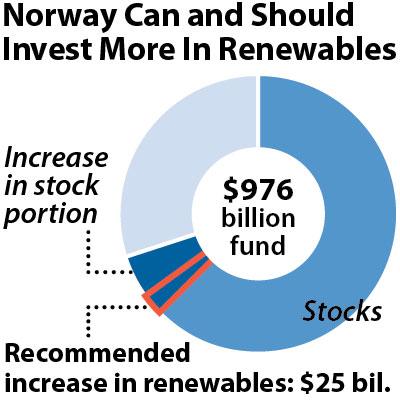

How renewable energy holdings can contribute to the growth of Norway’s pension fund in a time of oil industry uncertainty

August 01, 2017

Tom Sanzillo

Report

Latest Norway Press Releases

See more >

IEEFA: Santos’ Barossa gas field emissions create major risks for shareholders

March 31, 2021

Press Release

IEEFA U.S.: Plummeting oil and gas prices leave New Mexico’s budget short by hundreds of millions of dollars

October 20, 2020

Press Release

BlackRock’s fossil fuel investments wipe US$90 billion in massive investor value destruction

August 01, 2019

Press Release

Norway’s GPFG sovereign fund to invest up to $14bn in unlisted renewables

April 05, 2019

Press Release

IEEFA report: Argentina’s Vaca Muerta Patagonia fracking plan is financially risky, fiscally perilous

March 22, 2019

Press Release

Informe IEEFA: El plan argentino de fracking en Vaca Muerta de Patagonia es financieramente riesgoso, fiscalmente peligroso

March 21, 2019

Press Release

IEEFA Report: Renewable Energy Opportunity Now for Norway’s $976 Billion Pension Fund as Global Institutional Capital Migrates Out of Fossil Fuels

August 30, 2017

Press Release

IEEFA Report: Norway Sovereign Wealth Fund Stands to Gain by Investing Now in Renewable Energy Infrastructure

February 22, 2017

Press Release

Divestiture Movement, Deepening Distress of Coal Industry, Emerging Battles Over Solar, Overbuilding of Shale Gas Pipelines Highlight IEEFA Energy Finance 2016 Conference in New York City

February 29, 2016

Press Release

Norway’s Latest Move to Divest From Coal Holdings Stands to Affect Scores of Energy Companies in Asia, Europe and the U.S.

June 05, 2015

Press Release

IEEFA Lauds Norwegian Lawmakers for Moving $900 Billion Pension Fund Toward Divesting Further From Risky Coal Assets

May 27, 2015

Press Release

Global Coverage of IEEFA Research on Norway Divestment

May 18, 2015

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.