Key Findings

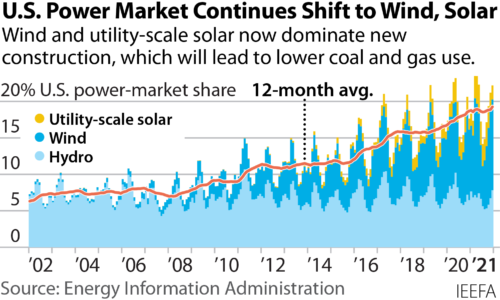

Wind, solar and hydro’s share of the U.S. electric power market may reach 33 percent or more by the end of 2026.

Construction has already begun on the first two commercial-scale offshore wind farms in the U.S.

Several of the largest, traditionally coal-based utilities in the country such as Georgia Power, Duke Energy and the Tennessee Valley Authority have announced plans for a coal phaseout by 2035.

Executive Summary

Surging global energy prices have been a central theme over the past year, as rebounding economic activity vied with new waves of COVID infections, and the shock of Russia’s invasion of Ukraine has roiled oil and gas markets in particular. But the soaring cost of fossil fuels and unexpected disruptions in energy security are now supercharging what was already a torrid pace of growth in solar, wind and battery storage projects.

IEEFA predicted last year that wind, solar and hydro’s share of the U.S. electric power market would approach 30 percent by the end of 2026. IEEFA now believes the forecast reflected the low end of possible growth, given the significant acceleration in expected solar and wind (particularly offshore) capacity installations through 2026. We now expect that clean energy’s share of the electric generation market could hit 33 percent or more. Together with existing nuclear generation, this would push the U.S. share of carbon-free electricity to well over 50 percent—a massive transition from just five years ago.

Some of the most notable recent developments include:

- Construction has begun on the first two commercial-scale offshore wind farms in the U.S., which has lagged far behind development efforts in Europe. A recent federal lease auction brought in a record $4.4 billion for development areas off the New Jersey/New York coasts, and underscored investor enthusiasm for the resource’s economic potential over the coming decade. Offshore wind will have an increasing impact on power markets up and down the East Coast.

- A significant shift among several of the largest, traditionally coal-based utilities to completely move away from the fuel. Georgia Power, Duke Energy, and the Tennessee Valley Authority have all recently embraced plans for a 2035 coal plant phaseout.

- An end to the decade-long run of annual increases of gas-fired electric generation. IEEFA projected last year that the increase in gas-fired capacity had plateaued; we now think that total annual gas-fired electricity generation has peaked as well. IEEFA believes that gas-fired generation in the U.S. peaked in 2020, and we expect it to decline this year and into the future as rapid growth in solar and wind output displaces both coal and gas generation. The challenges for gas have been exacerbated by the recent runup in prices and growing concerns about methane emissions from gas production and distribution, which significantly reduce the fuel’s supposed environmental benefits.

- Corporate renewable energy demand is climbing quickly as American businesses embrace net-zero goals, pushed by consumer demand, higher electricity prices and the rise in fossil fuel costs. This could drive the construction of as much as 94 gigawatts of renewable energy capacity by 2030.

- Real-world experience and research increasingly show that high levels of green energy with battery storage can be integrated into the U.S. power grid while maintaining system reliability. A recent report from the National Renewable Energy Laboratory concluded that with sufficient storage, renewable generation (including solar, wind, hydropower, geothermal and biofuel resources) could meet as much as 94% of demand on an annual basis with “no unserved energy and low reserve violations, indicating no concerns about hourly load balancing through the end year of 2050.”[1]

The compelling economics and proven reliability of renewable energy and storage have changed perceptions in utility and corporate boardrooms across the U.S., driving a buildout of wind and solar generation portfolios and prompting businesses and consumers to push for greater access to green energy. With fossil fuel price volatility and energy security currently among the top concerns of executives and policymakers, IEEFA finds the energy transition is tipping even more strongly toward renewables and battery storage, and expects this trend will continue to drive fossil fuels out of the power market.

[1] National Renewable Energy Laboratory. Grid Operational Impacts of Widespread Storage Deployment. National Renewable Energy Laboratory. 2022.