Key Findings

The idea that only a very limited number of steel products can be produced by recycling scrap steel in electric arc furnaces (EAF) is increasingly outdated.

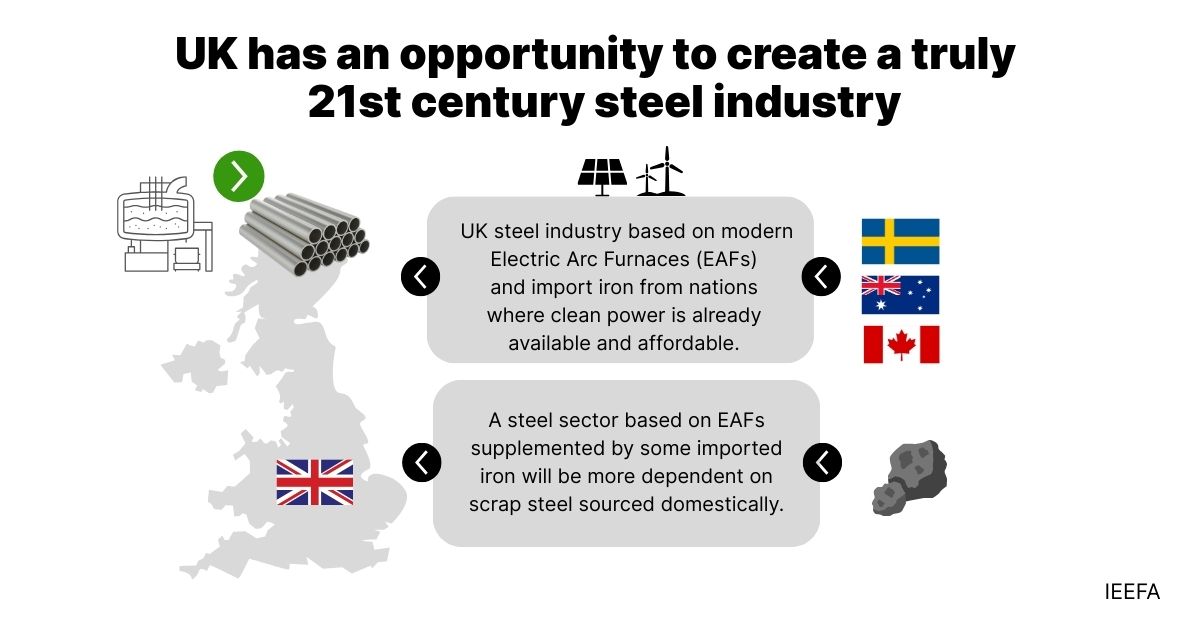

Instead of producing iron domestically, the UK can base its steel industry on modern EAFs and import iron where needed from nations where clean power is already available and affordable.

The UK’s steel industry is already dependent on imports of raw materials. A steel sector based on EAFs supplemented by some imported iron will be more dependent on scrap steel sourced domestically.

The crisis at British Steel’s Scunthorpe steel works has required dramatic intervention from the UK government to keep the blast furnaces going.

However, the crisis is also an opportunity.

There has been much hand-wringing about the prospect of the UK becoming the only G7 country without the ability to make primary steel – steel made from iron ore – and relying solely on electric arc furnaces (EAF). But played the right way, the UK can embrace technology transition away from coal-consuming and highly polluting blast furnaces and lay the ground for a modern, low-emissions steel industry fit to compete in a decarbonising world.

It has been suggested that the UK can’t decarbonise its steel industry without building direct reduced iron (DRI) plants that can make iron from iron ore using gas or green hydrogen rather than coal. The suggestion is that the iron produced in these plants is required to make steel types that can’t be made by recycling scrap.

However, the idea that only a very limited number of steel products can be produced by recycling scrap steel in EAFs is increasingly outdated.

Earlier this month, Japan’s JFE Steel announced it will build a US$2.2 billion, large-scale EAF at its West Japan Works. This EAF will use the latest technology, allowing JFE “to become the world’s first mass supplier of high-quality, high-function steel materials, such as electromagnetic steel sheets and high-tensile steel sheets, which cannot be produced with existing large-scale electric arc furnaces”, according to the company.

In the US where most steel is made in EAFs, Nucor has been making high-quality, flat-rolled sheet steel using EAFs since 1989. Nucor can use EAFs to make advanced high strength steels and ultra-high strength steels required by carmakers.

It’s true the quality of steel made in an EAF is dependent on the quality of the scrap metal feedstock. In some cases, some “virgin iron” made from iron ore may be needed to supplement scrap. The question is where does that iron come from?

Sweden may seem to provide the ideal model of a modern steel industry. In the north of the country, Stegra is building a DRI- and EAF-based steel plant that will make steel from scratch. It will run on green hydrogen, producing minimal carbon emissions.

However, this is only feasible because northern Sweden has access to affordable clean energy (in the form of hydro power) to produce green hydrogen, as well as local, high-grade iron ore.

Where power generation involves fossil fuels and is more expensive, this becomes problematic. German steel major Thyssenkrupp is an early mover among established steelmakers in the technology shift from blast furnaces to DRI. But the high cost of producing green hydrogen in Germany drew a warning from the company that its new DRI plant can’t viably run as a low-carbon plant unless the cost of green hydrogen comes down. Thyssenkrupp’s hydrogen tender is now on hold.

And this is the despite the EU having a meaningful carbon price and carbon border adjustments on the way.

Thyssenkrupp’s DRI plant will likely have to run on gas for longer. Gas-based DRI is significantly lower carbon than blast furnaces, but with more than 1 tonne of carbon dioxide emitted per tonne of steel produced, it can hardly be termed “green”.

Fortunately, the UK has an alternative. Instead of producing iron via DRI domestically, it can base its steel industry on modern EAFs and import iron where needed from places where clean power is already available and affordable.

Stegra intends to produce more green iron than it needs for its steel plant in Sweden. UK-listed mining giant Rio Tinto has agreed to purchase and on-sell any excess iron (known as hot briquetted iron – HBI). This is the beginning of a global trade in green iron.

The UK could import green iron from the likes of Sweden, Canada and Brazil, which all have high-grade iron ore and available hydro power resources to produce green hydrogen. Australia also has an opportunity become a green iron export pioneer thanks to its plentiful wind and solar resources.

Some commentators are concerned about the risk of the UK becoming reliant on iron imports in place of primary ironmaking capacity. Such concerns look overdone.

The UK steel industry is not self-sufficient. It depends on imports of both iron ore and metallurgical coal to make primary steel in blast furnaces. A modern UK steel industry based on EAFs would replace these imports with domestically available scrap steel supplemented by lower levels of iron imports from nations such as Sweden, Canada and Australia.

Rearmament in Europe doesn’t change the resource security equation. Even in the 1930s, the UK imported a lot of iron ore from Sweden for arms manufacturing in the run-up to World War II.

“Never waste a good crisis” is a quote often misattributed to Winston Churchill. In fact, it was a chief of staff to US President Barack Obama who stated, “You never want a serious crisis to go to waste. And what I mean by that is, it’s an opportunity to do things you think you could not do before.”

It must be hoped that the UK government’s forthcoming steel strategy is informed by this, and paves the way for a steel sector fit for the rest of the 21st century.