Sixth Guyana lawsuit filed over failure to protect public from spill risks

Key Findings

A sixth lawsuit over a major oil drilling project in Guyana has been filed, alleging a failure by the Guyanese government to protect the people and environment from future oil spills.

A lack of transparency suggests critical assurances from ExxonMobil, Hess and CNOOC to provide unlimited guarantees for spill cleanup have not been enforced.

ExxonMobil’s estimates show that an oil spill could spread beyond Guyana’s boundaries, placing fishing and tourism industries at risk.

Another lawsuit has been filed over Guyana’s failure to release the details of an ExxonMobil insurance policy covering the costs of a future oil spill cleanup caused by offshore drilling.

The lawsuit, the sixth filed over the massive drilling project, is an attempt to ensure that the consortium—ExxonMobil, Hess Corp., and the China National Offshore Oil Corp. (CNOOC)—would be responsible for the costs of an oil spill and not foist responsibility to Guyana taxpayers.

ExxonMobil has identified 11 billion barrels of proven and probable reserves of crude oil off the coast of Guyana. Today, there are currently two fields in production (Liza 1 and 2) and one more approved (Payara). The consortium seeks to drill for oil for the next two or three decades. The revenues are expected to provide a financial windfall for Guyana.

Weak contract terms provide vague protections

IEEFA has reported that the contract governing the exploration and development is one-sided, with several provisions benefiting the consortium to the detriment of Guyana. The latest litigation exposes one of the loopholes. Weak contract terms provide vague protections. And the failure by environmental authorities to enforce even vague protections means Guyana is just one substantial oil spill away from turning its expected windfall into another global disaster.

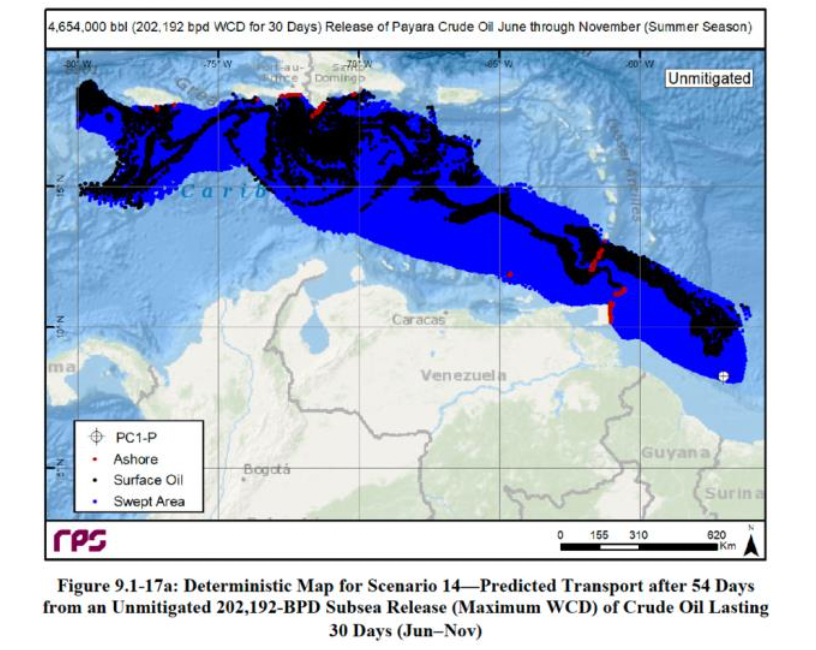

This issue goes beyond Guyana’s borders. Oil slicks do not respect geographical boundaries. An environmental impact assessment for the Payara project shows potential damage not only to Guyana, but also to Trinidad, Tobago, Barbados, Grenada, Bonaire, Aruba, Curaçao, Colombia, the Dominican Republic and Venezuela. Oil on the beaches is not good for tourism and fishing, two industries that sustain regional economies.

The lawsuit outlines the terms and conditions expected of insurance coverage, and sanctions if its provisions are not carried out. The questions raised by the litigation include:

- Has the Guyana Environmental Protection Agency obtained the insurance policy from Esso?

- Has the EPA ensured that ExxonMobil would be required to cover the total costs of restoration, cleanup and damage from a spill or well blowout?

- Do the terms and conditions that are in the insurance coverage comport with the permit, contract and statutes?

- Do the company or companies involved have the resources necessary to cover the costs of a significant spill?

- What corporate entities are responsible for the costs?

- How much of the costs are covered by the actual permit agreements?

The lawsuit also demands that the EPA cancel the permit if Esso does not provide the insurance, guarantees and indemnities required.

The plaintiff, Frederick Collins, an insurance professional with more than 20 years of experience, said that a recent radio interview with the former EPA director indicates insurance compliance provisions are being violated.The former directors said the agency had not obtained guarantees that ExxonMobil would cover the full costs of a cleanup. The plaintiff said Guyana authorities have refused to provide copies of the existing insurance policies that would show the unlimited liability guarantee provided in the permit.

Concerns are amplified by ExxonMobil’s recent disclosure of an oil spill at the Liza 2 site.

The concerns are amplified by ExxonMobil’s recent disclosure of an oil spill at the Liza 2 site. The conditions surrounding the discharge and the details of the cleanup were not known when the Collins case was filed. The former EPA director said in the same interview that ExxonMobil is currently pumping on Liza One at a rate of 150,000 barrels per day, 50 percent more than the permitted rate.

The overproduction, if corroborated, has implications for safety and health risks at the site, as well as increasing the chances of a major failure such as a well blowout or spill. Esso has already acknowledged using a faulty gas compressor that has resulted in gas flaring beyond permitted levels.

The concerns raised about the potential for an oil spill are not academic. The 2010 Deepwater Horizon disaster in the Gulf of Mexico should remind Guyana officials of the need to act with dispatch to protect the public. The BP spill devastated marine life and livelihoods. Although most local economies affected by the BP spill were able to rebound with the benefit of diverse economic bases, a country like Barbados—with 22 percent of its economy linked to tourism—faces particularly high economic risks. Neighboring countries should pay close attention to the lawsuit.

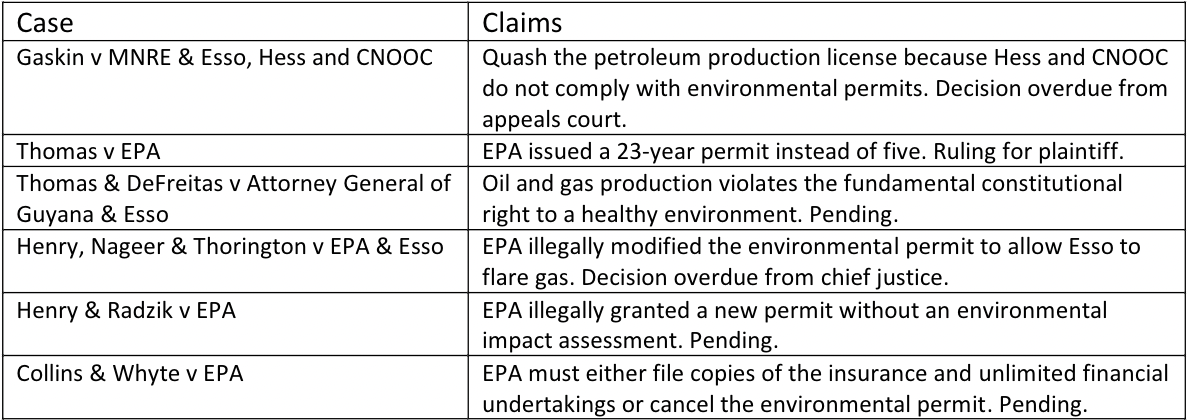

Four of the lawsuits filed relate to the Guyana government’s failure to properly manage the permit process and enforcement of permit provisions. In one case, the courts found that Guyana officials broke the law by improperly granting ExxonMobil a 23-year permit when permits are legally restricted to five years. The effort by Guyana officials to cut corners and hasten production was overturned by the court.

A recent World Bank review of efforts to reform the program and bring administrative capacity in line with oil development operations found that Guyana’s management ability is slipping. The World Bank findings and the six lawsuits point to a weak policy and highly questionable management. The questions raised by the latest litigation and the lawsuits that have preceded it do not bode well for the people of Guyana.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.