Rising LNG dependence in Pakistan is a recipe for high costs, financial instability, and energy insecurity

Download Full Report

View Press Release

Key Findings

Reliance on LNG has exacerbated energy insecurity in Pakistan.

LNG delivered to Pakistan has recently been up to eight times more expensive than domestically-produced gas. LNG procured through emergency tenders have also been significantly more expensive than undelivered contract volumes.

LNG prices in spot markets are expected to remain elevated until the middle of this decade, while Pakistan’s LNG import bill could increase rapidly over the next decade.

LNG is rapidly exacerbating circular debt in the gas sector. Injecting more expensive LNG to the gas network will significantly increase the value of financial losses due to unaccounted for gas (UFG).

Executive Summary

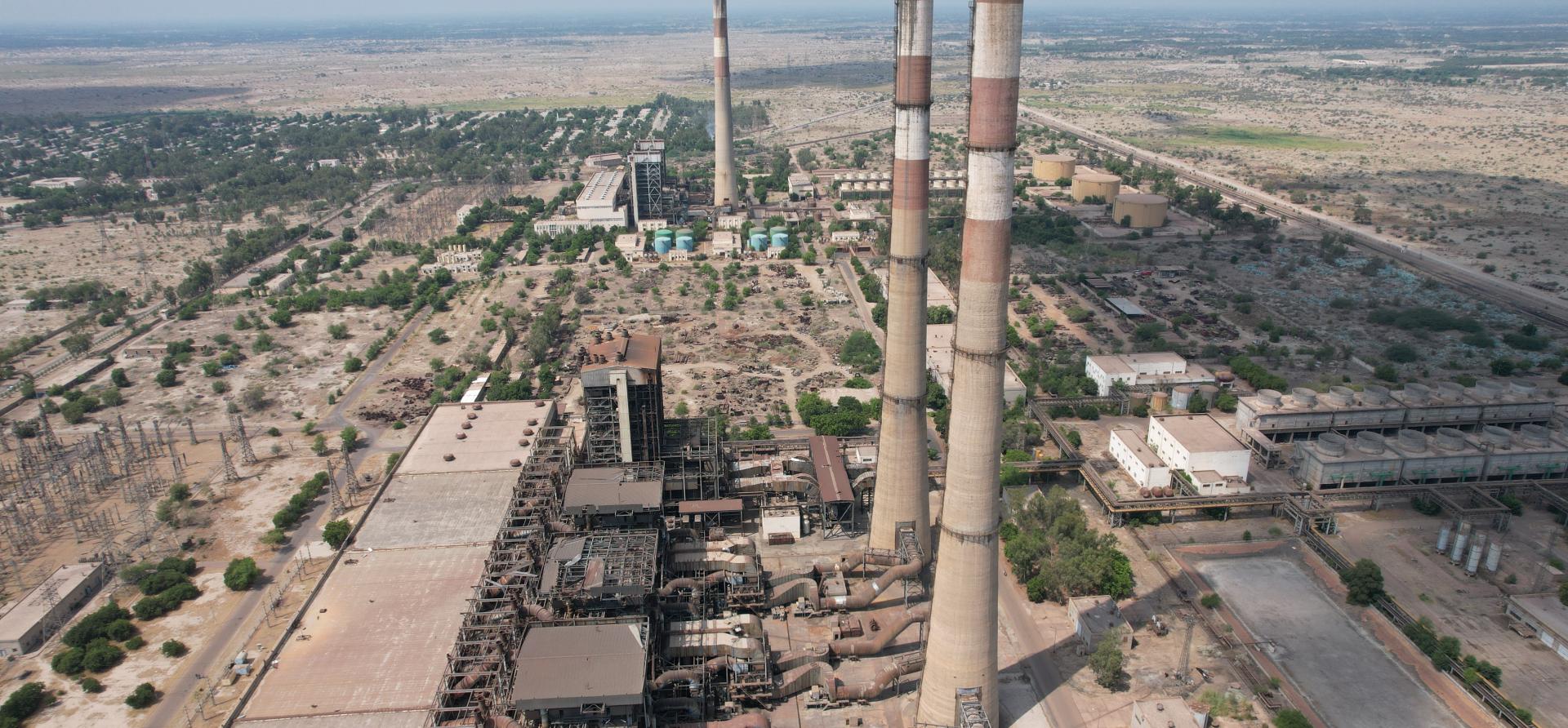

Pakistan’s increasing dependence on imported liquefied natural gas (LNG) is exacerbating energy insecurity and financial struggles in the country’s energy sector.

Natural gas has historically played a large role in Pakistan’s economy, but as domestic production declines, policymakers are increasingly looking to replace lost production with LNG imports. As a result, Pakistan meets many of the criteria for optimistic LNG demand growth scenarios, including rising demand, a diversified gas end-user base composed of various economic sectors, and a dense and growing network of transmission and distribution pipelines.

However, plans for an expanded role of LNG in the country’s primary energy supply have turned into an economic and energy security disaster.

LNG suppliers have repeatedly failed to deliver contractually obligated volumes, which, in some cases, has left the country without fuel or power. Power and fuel shortages have directly impacted the economic productivity of domestic firms.

Moreover, LNG sourced from global markets has recently been 5-10 times more expensive than domestically produced gas. Extreme volatility of LNG prices over the past two years has undermined energy sector planning and exposed the government to ongoing budgetary risks.

Often hailed as a “bridge fuel” to cleaner, cheaper energy sources, LNG has instead caused Pakistan to rely more heavily on dirtier, more polluting fuels when natural gas prices spike, such as cement factories buying coal from Afghanistan as prices surge.

LNG prices are expected to remain high and volatile for the next several years. The high cost of gas has shed new light on many of the pre-existing issues with the country’s gas system. These problems include final tariffs that are not reflective of gas costs, inefficient cross-subsidization of gas tariffs, and high volumes of unaccounted for gas (UFG) that are lost in transportation through the network.

As more LNG is injected into Pakistan’s gas system, these issues are likely to worsen significantly. Circular debt—chronic cash flow shortages caused by accumulation of delinquent accounts payable between buyers and sellers which have historically plagued Pakistan’s power sector—is now rampant in the gas sector.

The high financial burden of LNG, whose spiking commodity cost is exacerbated by required payments in U.S. dollars, is likely to have ripple effects throughout the economy: the government budget, household energy bills, investor confidence in the energy sector, and the productivity of key economic sectors like textiles and fertilizers.

These actions are discussed in greater detail in the body of the report:

- Optimize LNG procurement strategies to manage volatility and non-delivery risks.

- Reform tender processes for LNG.

- Reform gas distribution company revenue regulations through performance-based mechanisms.

- Focus on energy demand, not supply, by rapidly scaling up energy efficiency programs and rationalizing tariffs.

- Maximize utilization of existing LNG terminals before constructing new ones.

- Reduce gas demand in the power sector first by accelerating new utility-scale and behind-the-meter renewable energy and battery storage generation projects.

- Begin to develop capabilities to transition non-power sectors from gas/LNG reliance, through alternative energy sources such as biogas and hydrogen.

Read this report in Urdu:

پاکستان میں قدرتی مائع گیس پر بڑھتا انحصار : مالی عدم استحکام ، توانائی کا عدم تحفظ اور مہنگائی

Read the fact sheet: LNG in Pakistan is Not Cheap, Reliable, or Clean: Debunking Common Myths about LNG in Pakistan

Read the press release: Pakistan’s dependence on imported LNG exacerbates energy insecurity and financial instability