Pakistan’s dependence on imported LNG exacerbates energy insecurity and financial instability

Inefficient use of existing gas supply warrants a rethink of energy sector priorities

Key Takeaways:

Increasing reliance on LNG has exacerbated energy insecurity and financial struggles for the government, household and business, and economic sectors in Pakistan.

Immediate policy priorities on LNG regulatory incentives, tariff structures, and energy efficiency programmes should come before increasing costly LNG supply.

A favorable investment environment and sustainable growth of alternative energy technologies are critical for long-term planning, particularly in non-power sectors.

16 June (IEEFA Asia): Faced with rapidly declining domestic reserves of natural gas, Pakistan is relying more heavily on imported liquefied natural gas (LNG) as a replacement fuel. But rather than simply replacing one form of gas for another, the shift to imported LNG undermines the country’s energy security and financial stability, IEEFA’s latest report on Pakistan finds.

IEEFA estimates that Pakistan’s LNG imports could rise to more than US$32 billion by FY2030, up from nearly US$2.6 billion in FY2021, according to report co-authors and energy finance analysts Haneea Isaad and Samuel Reynolds.

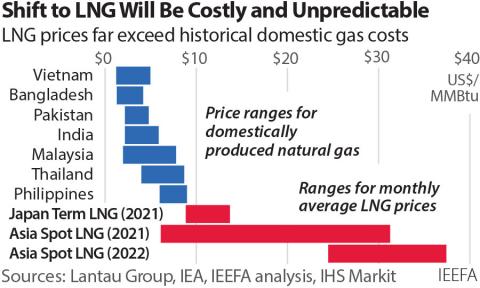

“LNG sourced from global markets has become 5 to 10 times more expensive than domestically produced gas in Pakistan,” says Isaad.

LNG has also been unreliable. LNG suppliers under long-term contracts with Pakistan have defaulted on at least 11 cargoes since January 2021, contributing to fuel and power shortages. Extreme LNG price volatility continues to stymie energy sector planning and expose the government to massive subsidy burdens.

“Pakistan’s vulnerability to commodity market shocks has only been increasing in the wake of the Ukraine crisis,” says Reynolds. “Coupled with the global economic recovery from the COVID-19 pandemic, price-sensitive countries such as Pakistan may be unable to compete with wealthier buyers in Europe and Northeast Asia.”

In this report, Isaad and Reynolds examine key risks for LNG imports and provide recommendations to mitigate the financially unsustainable growth of LNG import demand in Pakistan.

Deeper financial hole with rising LNG dependence

Pakistan imported 7.4 million tons of LNG in 2020, and the government expects LNG demand to grow rapidly over the next decade. There are currently at least four major LNG import terminal projects at various stages of development.

However, the high cost of LNG has shed new light on many of the pre-existing issues with the country’s gas system. These problems include final tariffs that are not reflective of gas costs, inefficient cross-subsidization of gas tariffs, and high volumes of unaccounted for gas (UFG) that are lost in transportation through the network.

“As more LNG is injected to this faulty network, financial issues in Pakistan’s gas sector are likely to worsen significantly,” says Reynolds. “Circular debt, chronic cashflow shortages that have historically plagued Pakistan’s power sector, is now rampant in the gas sector.”

Greater reliance on imported LNG would only reinforce credit risks for investors in the country’s LNG-to-power value chain. Planned pipeline projects and terminals may also take time to materialize as geopolitical conflicts and unviable economics exacerbate stranded asset risks for LNG infrastructure.

Macroeconomic repercussions

Natural gas is used widely throughout key sectors of Pakistan’s economy, so LNG price spikes and supply insecurity can have major negative macroeconomic spillover effects.

In the power sector, LNG fuel shortages have forced 3,500MW of power capacity offline since December 2021 and have contributed to nationwide load shedding of 10-18 hours per day in recent weeks.

In January, fuel shortages caused textile mills in Punjab were forced to close for over two weeks. As a result, exports worth US$250 million—or 20% of the entire sector’s annual revenue—were lost.

“In Pakistan’s textile sector, power generation costs can amount to roughly 30-40% of the production costs,” says Isaad. “Since the textile industry depends on gas-based power generation, rising LNG prices can grossly reduce profit margins.”

The fertilizer sector also has an entrenched dependence on natural as a fuel and feedstock, but the sector pays among the lowest gas prices despite high costs. Fertilizer accounts for 16% of national gas consumption, but only 3% of revenues of state-owned gas transmission companies.

Blueprint for long-term energy security

Instead of rapidly ramping up LNG imports, Pakistan’s near-term focus can be on using existing LNG supply more efficiently by changing regulatory incentives, rationalizing tariff structures, and implementing energy efficiency programs, among other measures.

“The focus should be on the demand side of the equation, and less so on expanding supply,” says Reynolds. “The promotion of energy efficiency equipment and more cost-reflective tariff structures can incentivize more efficient use of gas to reduce import needs.”

“More coherent strategies for LNG procurement and tenders, along with maximizing the utilization of existing LNG terminals can also help improve energy security without major new infrastructure additions,” says Isaad.

Meanwhile, the acceleration of new utility-scale and behind-the-meter renewable energy and battery storage projects can help limit demand for LNG in the power sector, the country’s largest gas consumer. Although there are plans to hold renewable energy auctions, these have been repeatedly delayed, and no new wind or solar projects have been brought online since 2020.

In the long-term, Pakistan can harness its potential as an agricultural economy by complementing its natural gas usage with biogas for power generation and domestic usage. Biogas is not new to Pakistan, but the lack of incentivizing policy has prevented a widespread uptake of this fuel.

“Alternative energy technologies, particularly those in non-power sectors, may take time to research and develop, but it is critical to lay the groundwork now for a favorable investment environment and sustainable growth in the future,” says Isaad.

Read the report: Rising LNG dependence in Pakistan is a recipe for high costs, financial instability, and energy insecurity

Read the fact sheet: LNG in Pakistan is Not Cheap, Reliable, or Clean: Debunking Common Myths about LNG in Pakistan

Read this press release as a PDF, and in Urdu: آئی ای ای ایف اے:(IEEFA) درآمدی مائع قدرتی گیس (ایل این جی) پاکستان میں توانائی کے عدم تحفظ اور مالیاتی عدم استحکام کو بڑھا رہی ہے

Author contact:

Haneea Isaad ([email protected])

Sam Reynolds ([email protected])

Media contact: Alex Yu ([email protected]) Ph: +86 178 217 06229 / +852 9614 1051

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)