Questions abound over BP’s Brazil discovery

Key Findings

BP has attracted headlines for a major oil and gas find off the coast of Brazil.

Questions abound about the discovery and BP’s larger business strategy.

Even though the discovery is the company’s largest in 25 years, finding more oil does not necessarily mean more money.

Conducting major expansion in fossil fuel development amidst changing markets would be a risky undertaking.

Beginning in 2022, Shell attracted headlines for a large oil and gas discovery off the coast of Namibia. It was labeled as a “game changer” and “a new dawn” for the country’s oil sector. Yet earlier this year, Shell announced a total wipeout of the assets: Challenging geology, risky technology, and weak oil markets had rendered the much-hyped prospect worthless. It was a stark reminder that, in the petroleum business, finding oil does not necessarily mean making money.

This lesson should be kept in mind when considering the headlines coming out of BP’s Bumerangue prospect off the coast of Brazil. For the beleaguered supermajor, it might seem like this recent discovery (reportedly its largest in the past 25 years) offers a welcome dose of good news. Yet doubts remain—not only about the nature of the discovery, but about BP’s ability to turn it into future profits.

Offshore drilling is costly even under ideal conditions, and Bumerangue is anything but ideal. The field is 200 nautical miles offshore and in 2,372 meters of water, for a total well depth of some 5,800 meters. That’s a greater depth than most North Sea wells and near the upper end of normal operating depths in the Gulf of Mexico. Natasha Stanton, a tectonics expert at the State University of Rio de Janeiro, described the location as a complex area in “one of the most complex basins I have seen in my career.” Early tests also indicate high levels of dissolved CO2, which would boost processing costs and make the products potentially more difficult to sell in a carbon-constrained world. In addition, Brazil’s expensive offshore labor market will only further threaten margins.

If oil prices are high enough for a long enough time, the cost challenges might be surmountable. Yet futures markets expect weak oil pricing for more than a decade. And without a local partner yet (Petrobras is reportedly holding out for more testing before making any decisions), BP currently carries all of the risks. The company may have a long road ahead before it can convince investors that this project will be profitable.

Despite the project’s challenges, BP spent much of its latest earnings call celebrating the scale of its find. It appeared to be a stark and disappointing turn-around from the perspective of those who had taken the company seriously when, just a few short years ago, BP declared itself a leader in the energy transition. The company had since struggled to turn this vision into a coherent investment strategy, and markets have soured on its stock. It is now backpedaling by gutting net-zero commitments, exiting clean energy diversification plays, and leaning into oil and gas exploration. Bumerangue is the company’s 10th announced oil find this year, following discoveries in Trinidad, Egypt, the Gulf of Mexico, Libya, Namibia, Angola, and elsewhere in Brazil.

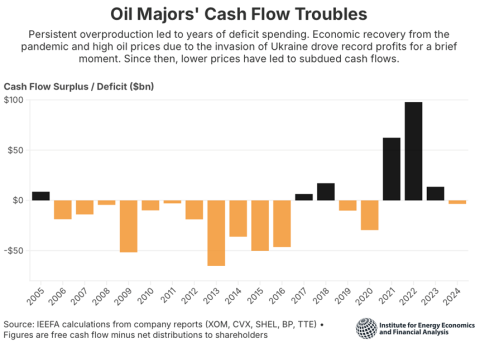

BP may be hoping its latest strategic about-face will assuage markets. Yet a strategy of fossil fuel expansion presents significant risks of its own, and it stands to misfire if global oil and gas demand slows faster than the company expects. Credit rating agencies have noted that the energy transition has become a material financial risk for fossil fuel producers, and BP’s own modeling has warned of low-carbon competition clouding oil’s growth prospects. And with some shareholders already skeptical of the firm’s capital discipline, markets may balk at the cost of newer, riskier projects. Investors remember well the sea of red ink over the past decade, when supermajors’ habit of spending more cash on dividends and share buybacks than they were generating from selling oil and gas proved ruinous to their cash flow position.

It's too soon to know whether Bumerangue will move markets. But BP’s next steps in Brazil will likely reveal much about its broader business strategy in a changing world. If the company moves forward with developing projects like Bumerangue, it will be making an aggressive and risky bet about the longer-term durability of fossil fuel demand.