Paris Agreement Fuels Global Ambitions Toward Greener Economies

As the world wakes up today to new ambitions around lowering the industrial world’s effects on climate, the emission-control deal signed over the weekend in Paris serves ultimately to underscore the immense impact such policy can have on investment decisions.

The accord is a sensible step forward, and one that’s been a long time coming. It’s a clear acknowledgement that the global economy is moving away from fossil fuels.

The Paris pact comes with one caveat, however as noted this morning by the Wall Street Journal: “The deal relies on countries making painful choices in how they produce and consume energy.”

There is much work to be done still around educating investors on the perils of sinking money into coal, for instance. IEEFA for the past several years has published research around the growing stranded-asset risk investors run when they take a stake in fossil fuel companies, especially those that pursue greenfield development projects.

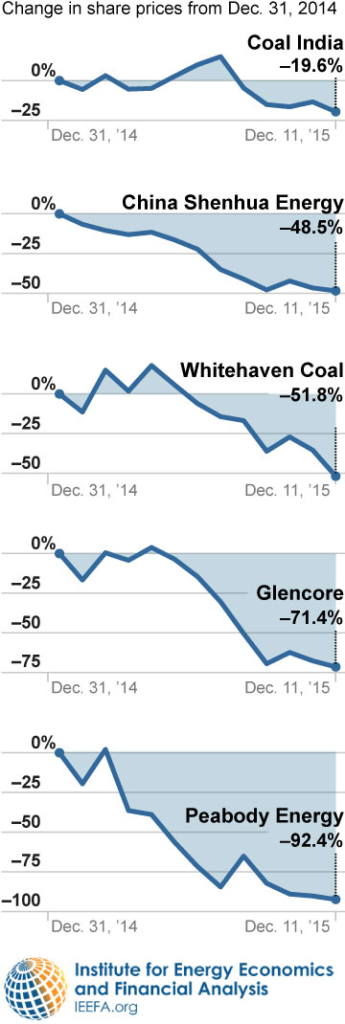

The financial market implications of stranded coal mines, stranded coal-fired power plants and stranded coal-related rail and port infrastructure assets are hugely increased by the Paris understanding. The immediate proof of that is in the month leading up to and during the summit, which marked significant losses in the value of oil and coal stocks as markets increasingly factored in the prospect of a successful agreement being reached.

The financial market implications of stranded coal mines, stranded coal-fired power plants and stranded coal-related rail and port infrastructure assets are hugely increased by the Paris understanding. The immediate proof of that is in the month leading up to and during the summit, which marked significant losses in the value of oil and coal stocks as markets increasingly factored in the prospect of a successful agreement being reached.

In a U.S. equity market that has been flat over the last month, Peabody Energy shares are down 36 percent, having fallen 11 percent over past week alone, down 92 percent in the past year. Arch Coal is down 38 percent over the past month and 25 percent in the past week. Consol Energy Inc. is down 6 percent in a month and 79 percent over the past year. China Shenhua Energy, respectively, is down 6 percent and 15 percent.

Global mining majors have likewise taken a hit, not just from the Paris Agreement but because they have overestimated demand from China, assuming than Chinese economic growth would continue at an unsustainable 7-8 percent rate going forward and betting that a structural shift to fewer commodities and less energy-intensive service-sector growth would not materialize. Investor wealth destruction has been severe.

AngloAmerican shares are down 22 percent in the past week, down 36 percent in a month and 73 in the past year. Glencore Plc shares are down 4 percent, down 8 percent and 70 percent over the same timeframes. BHP shares are down 1 percent, 15 percent and 35 percent. Rio Tinto, having progressively exited many coal assets over the past two years, has done better by comparison but is still down 3 percent, 11 percent and 20 percent over the past week, month and year.

Australian coal stocks have been similarly battered.

The risk unfolding across the fossil-fuel sector exposes not just businesses, investors, and shareholders but in some cases significant segments of entire national economies through refusal to accept the inevitable rise of technology and innovation in energy markets.

The ever-lower cost of renewable energy, combined with strides in energy storage, stand to create an enormous wealth-transfer effect that will move capital out of fossil fuel companies.

Tom Sanzillo is IEEFA’s director of finance; Tim Buckley is IEEFA’s director of energy finance studies, Australasia.