Key Findings

Gas use in eastern Australia has been declining over the past 10 years, particularly for electricity generation, and this trend is likely to continue.

About 80% of eastern Australia’s gas supply is used for exports, backed by proven and probable (2P) reserves, reducing the need for new gas supplies.

There has been a focus on gas demand reduction measures through all electric homes, particularly in Victoria.

Queensland’s gas output has plateaued, meaning any new supplies would be more expensive to pipe to Victoria, driving energy costs up further.

The Australian Energy Market Operator has (AEMO) flagged a potential gas supply shortfall due to the drought in Tasmania and the cold snap in southern Australia. The warning follows the gas industry’s call for more supply after a near halving of supplies from Victoria’s largest gas producer this financial year and low wind-power output. It is a familiar refrain from the gas industry.

AEMO warned shortages could occur on peak demand days until the end of September as storage levels in eastern Australia are drained, which in turn contributes to tight gas market conditions during the peak winter heating demand season. AEMO recently called for new gas supplies to address supply gap risks.

However, IEEFA analysis shows that new gas supplies are not needed in the long term as more can be done on demand side measures to further reduce domestic gas consumption. Further, about 80% of eastern Australia’s gas production is exported via the three LNG plants at Gladstone in Queensland, but the contractual demand for these three ventures is underpinned by existing proven and probable gas reserves.

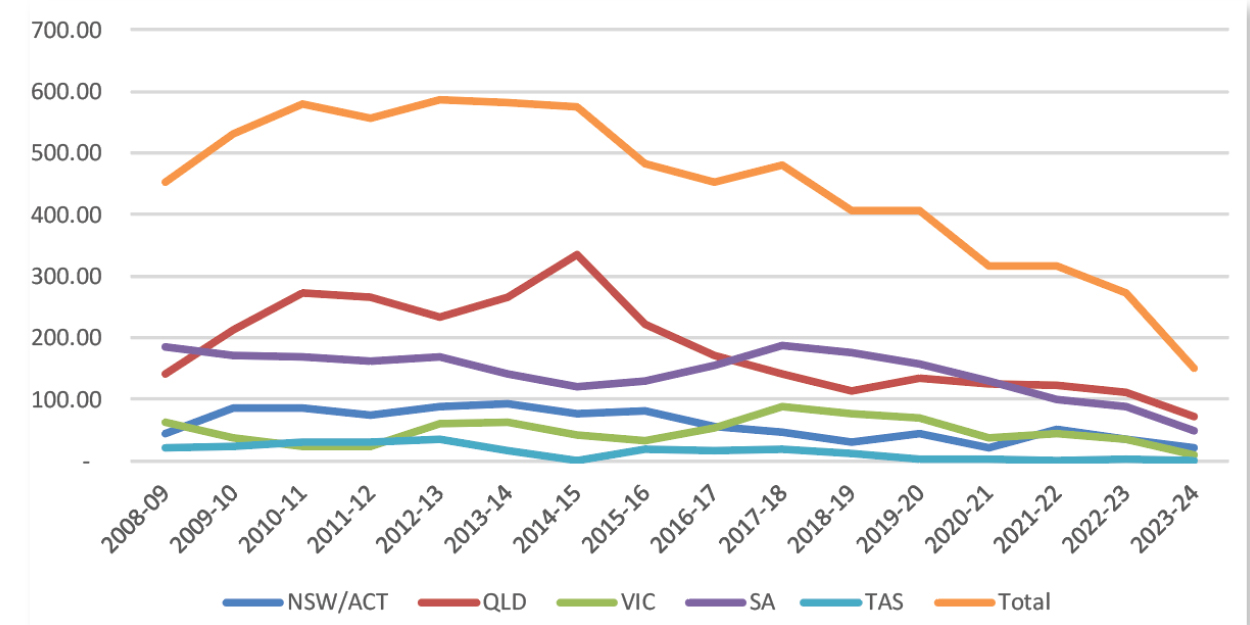

The remaining 20% reflects domestic demand, which has been declining over the past 10 years (Figure 1).

Gas losing power in electricity generation

Figure 1: Eastern Australia gas-fired power demand

Download the full briefing note to read more.