No justification for the $10 billion monopoly power bill shock

Adopting real – not fake – incentive regulation for monopoly networks will reduce inflationary pressure on household budgets.

IEEFA’s recent analysis showed that over the last eight years, Australian power consumers paid nearly $10 billion or $1.2 billion a year more than necessary for ‘poles and wires’ distribution and transmission network services in their power bills.

Strong leadership from governments is required to protect consumers from continued monopoly price gouging

With consumer’s electricity bills forecast to increase over the next 6–18 months as high coal and gas prices globally impact Australia’s domestic prices, the response from the energy network regulator proves that strong leadership from governments is required to protect consumers from continued monopoly price gouging.

The Australian Energy Regulator (AER) claimed that current outcomes were consistent with incentive-based regulation.

Under incentive regulation, efficient networks may earn supernormal profits, where they outperform benchmark expenditure and performance targets.

Using the regulator’s own profitability and benchmarking data, the IEEFA report shows very little of the $10 billion supernormal profits are earned.

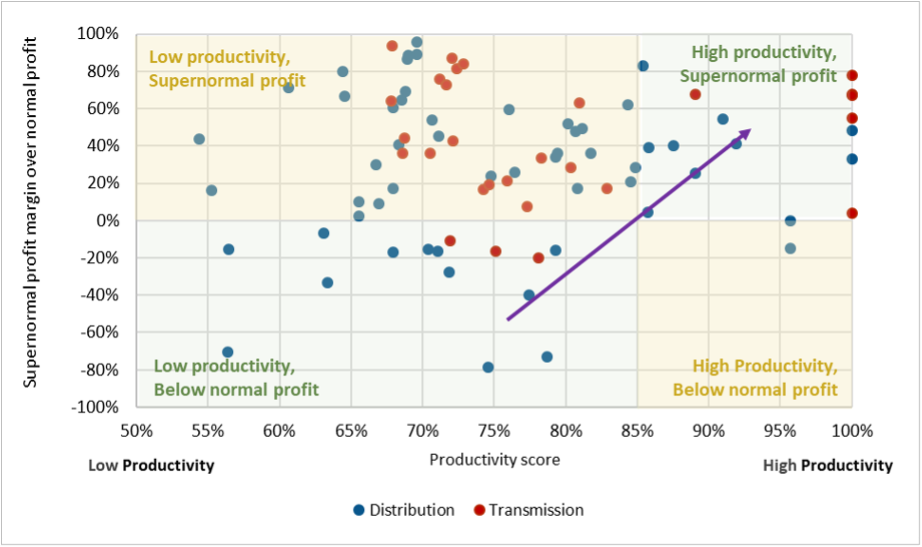

To illustrate, the figure below shows what the relationship between network productivity and profitability should be under incentive regulation (purple line). The dots show the actual relationship.

Around two-thirds of the supernormal profit outcomes are above a reasonable level and profit outcomes appear unrelated to productivity, indicating that profits are extracted rather than earned.

Supernormal Profit Margin (Percentage) Over Normal Profit vs Relative Productivity Scores, 2014-2020

Source: IEEFA report

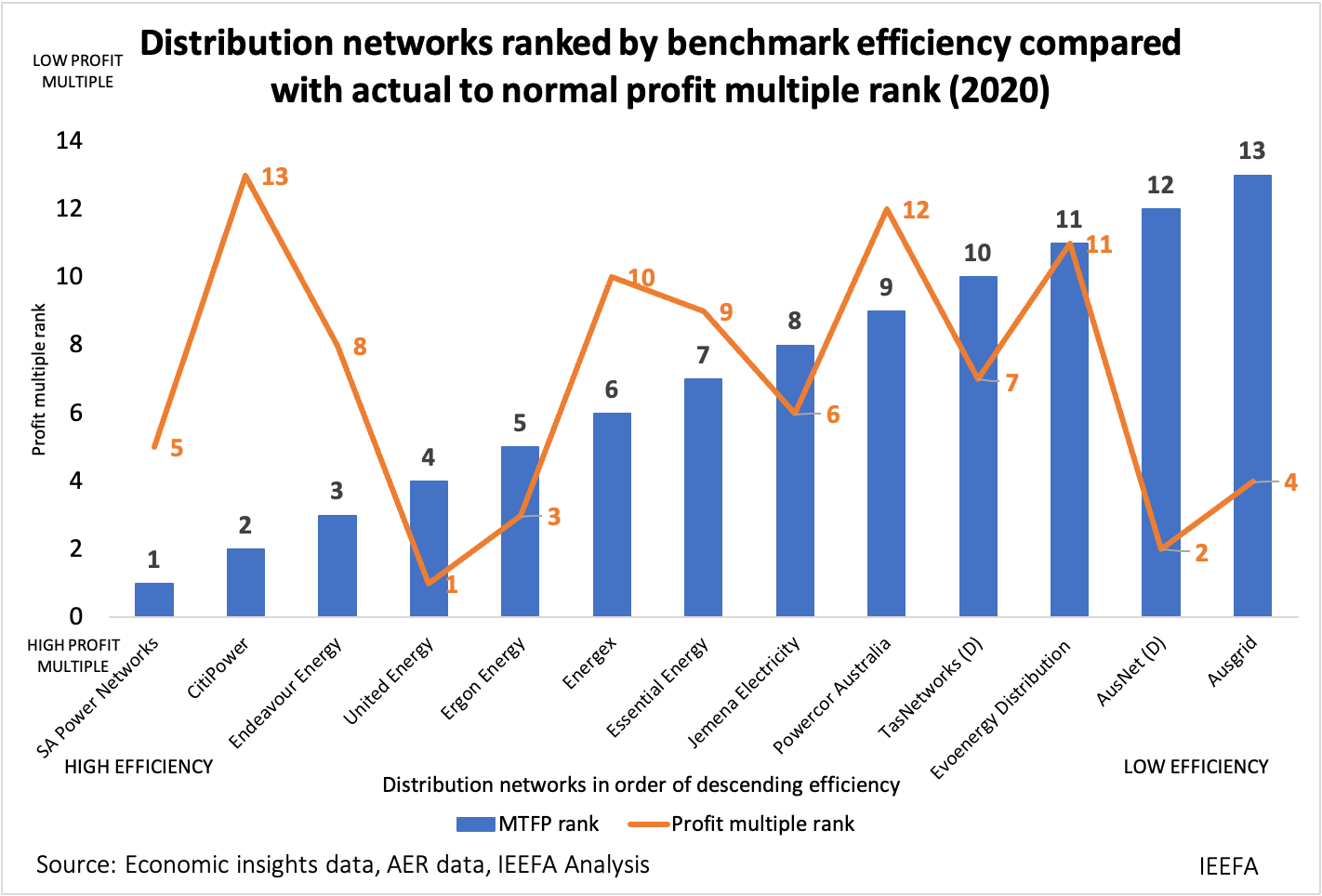

Comparing distribution network ranks under the AER’s productivity benchmarking (blue bars) with profit multiples (orange line) also highlights that current outcomes are inconsistent with effective incentive regulation.

For example, for 2020, the latest year for which productivity data is available, the network with the second-highest efficiency rank (CitiPower) is ranked last on profitability (has the lowest profit multiple) while the network ranked last on efficiency (Ausgrid) is ranked 4th on profitability.

Over the seven years for which there are productivity data, the efficiency and profitability rankings move around a little but the pattern remains the same. More efficient networks tend not to get the highest profits (e.g. CitiPower), while less efficient networks tend not to be penalised (e.g. Ausgrid).

Economic Insights’ 2021 benchmarking reports for both distribution and transmission network services prepared for the AER shows that sector-wide efficiency remains well below the level of efficiency of the current regulatory system introduced in 2006 and has barely improved since 2014.

IEEFA’s report argues for effective incentive regulation where more efficient networks are more profitable and less efficient networks less profitable.

It also accepts that information advantages or “rents” could result in earned supernormal profits up to 30% above normal profits.

The Electricity Networks Association (ENA) response was also dismissive of IEEFA’s findings.

For example, ENA claimed without any evidence that efficiency gains from supernormal profits are returned to consumers. Their response also included the irrelevant claim that network profits have declined since 2014.

The IEEFA report itself shows that network profits have declined due to falling interest rates.

Supernormal profits have remained remarkably consistent

Supernormal profits have, however, remained remarkably consistent. Actual profits as a multiple of normal profits have remained above 1.5.

The ENA also pointed to a report on the consumer benefits of incentive schemes. Nothing in that report appears to contradict IEEFA’s findings.

Under incentive regulation, prices must be set relative to cost, not relative to the consumer value of network services. The consumer value of network services remains very high, albeit around $10 billion lower than it should be.

Australian governments have so far not responded to the clear evidence that 14 of the 18 regulated networks are not operating under effective incentive regulation.

One potential reason is that State governments in Queensland, New South Wales (NSW) and Tasmania get a very large share of the $10 billion in supernormal profits. However, the damage to the State economies from inefficient network prices (the excess burden of network price taxation) is very likely to outweigh any benefit from these hidden State taxes compared with alternative revenue sources with lower excess burdens.

For Victoria, South Australia and NSW, a large chunk of their share of the $10 billion is going offshore. This further increases the economic costs of supernormal profits to Australia.

Pressure on household budgets from rising energy costs continue to increase

Pressure on household budgets from rising energy costs continue to increase. They also flow into the rest of the economy including consumer prices and from there into higher borrowing and housing costs.

Network prices are likely to increase in the coming years due to rising interest rates, inflation and capital expenditure required for network upgrades, making it even more important to contain supernormal profits where these are inconsistent with incentive regulation.

Nothing will change without strong government leadership. There is no time to waste.