Letter to the Legislative Assembly regarding Restructuring Agreement for PREPA

Download Full Version

Key Findings

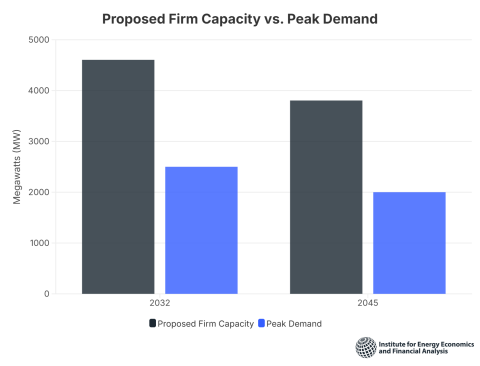

Recently, Filsinger Energy Partners, PREPA’s financial advisor, and PREPA increased the estimated rate for FY 2024 to 27 cents/kWh, 35% more than the legislative goal. The Legislature should not approve an unnecessary debt deal with an unaffordable price for Puerto Rico’s consumers and small businesses.

The RSA will impede Puerto Rico’s plans to invest in Puerto Rico and rebuild the grid.

Recently, the Financial Oversight and Management Board (FOMB) stated that PREPA was insolvent in 2011. Two debt issuances occurred after 2011, suggesting a substantial likelihood that the market was misled. A recent lawsuit brought by two bond insurers challenges the legality of an additional $3.7 billion in PREPA debt issued between 2002 and 2007.

Executive Summary

The Legislative Assembly of Puerto Rico will be asked to help write and approve a bill that will enable the Puerto Rico Electric Power Authority (PREPA) to close on its Restructuring Agreement (RSA). The RSA, if approved, will have grave consequences, including immediate and long-term electric power rate increases and dire consequences on the Puerto Rico economy.

We want to bring to your attention fundamental information that has been omitted or excluded in the discussion of this RSA that dramatically alters the viability of this RSA as a means to enable PREPA to access financial markets and rebuild the electric power grid.

An alternative path to debt restructuring is available and the Legislature could step up as an active leader in this discussion. The PROMESA law requires that the Puerto Rico Legislature act as a democratic check and balance when, as in this instance, the oversight board uses a faulty and deficient process to lead PREPA and the Commonwealth into a financial disaster.

It is not too late to make an alternative debt plan for PREPA—one that is affordable to the public, fair to investors, sustainable for the economy, allows the electricity grid to be effectively rebuilt, and calls to account many of those who must share responsibility for loading PREPA with debt.

Press release: Money owed to PREPA bondholders should be written off to meet long-term goals

Please view full report PDF for references and sources.