Is India’s 2030 gas consumption target feasible?

Key Findings

India's plan to add 500MMSCMD of gas consumption by 2030 means that it might have to rely heavily on imports. The country will also need to undertake massive infrastructure development.

LNG import capacity to meet this requirement could fall short by 240MMSCMD even after the proposed infrastructure expansion.

Price sensitivity of gas consumption and competition from evolving cleaner energy alternatives hamper infrastructure expansion and trigger stranded asset risk.

India aims to increase the share of natural gas in its energy mix. Keeping this in mind, the government has set a target of 500 Million Metric Standard Cubic Metres per Day (MMSCMD) of gas consumption by 2030. This requires a dramatic increase of over 170% within a short period from 185MMSCMD in the fiscal year (FY) 2023-24.

Achieving the proposed consumption levels requires increased domestic gas production, enhanced liquefied natural gas (LNG) imports and massive infrastructure additions. Yet, we need to ask whether these additions will be enough to meet the consumption increase. Also, is gas the right fuel for the country or should it leapfrog to cleaner technologies such as hydrogen, biofuels and renewable electricity?

Limited production could lead to increased import reliance

Natural gas availability could be a major challenge for enhancing consumption. India’s domestic natural gas production in FY2023-24 was around 99.5MMSCMD while LNG imports were 85.6MMSCMD.

Domestic production hovered around 50% of consumption. While nearly 30MMSCMD of domestic natural gas has come on stream over the past three years, and 15MMSCMD is expected to come on stream in 2024-25, these fields have their own challenges. Most new fields are deepwater or high pressure-high temperature (HP HT) fields, with difficult reservoir conditions. Their technical and technological difficulties, including the safety of man and machinery, result in commissioning delays impacting production targets. For instance, ONGC’s KG-DWN-98/2 project was delayed and its expected peak fell to 10MMSCMD from earlier estimates of 15.57MMSCMD.

Natural gas production will likely peak at 113MMSCMD in 2026 and decline to around 90MMSCMD by 2030. Therefore, even if all proposed fields come online, domestic gas production in India can be around 90-100MMSCMD in 2030, requiring an LNG import of 400MMSCMD to meet the 500MMSCMD consumption target.

Infrastructure remains a challenge

But is there a proposition to bolster fuel import capacity? India’s LNG import capacity is around 171MMSCMD, of which 10MMSCMD is yet to be commissioned. An additional capacity of 72MMSCMD is expected to be developed, but there are no clear timelines. Even if all the proposed capacities start by 2030, the total import capacity will only be around 240MMSCMD.

The government has proposed stringent regulations for this planned capacity addition. Going by the current under-utilisation of LNG terminals, operated at about 30% utilisation, the Petroleum and Natural Gas Regulatory Board has proposed guidelines to regulate the construction and expansion of terminals, with one approval criterion being “avoiding infructuous investment”.

There are ambitious targets for city gas distribution for 2030, with 17,500 compressed natural gas (CNG) stations and 120 million piped natural gas (PNG) connections planned. As of April 2024, there were 6,861 CNG stations and around 13 million PNG connections. This large gap from the 2030 target could impact gas consumption as industry, and potentially the transport sector, is likely to drive the demand. However, the increasing availability of electric vehicles, electric heat pumps for industry and hydrogen could eat into gas’ share. Innovative technologies like fast-charging stations, bi-directional charging capabilities and new policies could also expedite the transition to newer fuels.

Moreover, enhancing infrastructure does not imply a guaranteed increase in consumption. Instead, it could result in stranded assets. IEEFA’s Global LNG Outlook 2024-2028 noted that: “The number of city gas distribution network connections (measured by CNG stations and PNG connections) increased by 38% in 2022 and 2023, but gas consumption increased just 0.1% over the same period.” This implies that infrastructure expansion is based on exaggerated demand and not actual demand.

Potential decline in end users for gas

India’s gas consumption is price sensitive. Volatile gas prices spark erratic demand, which can result in stranded assets if massive investments are made on the back of low prices or potential demand. Gas consumers quickly switch fuels when prices are high. The move back to gas is sluggish, even with favourable prices. In 2022, when spot prices reached new highs, LNG imports fell 17%, but the recovery in 2023, when rates eased, was only 9%.

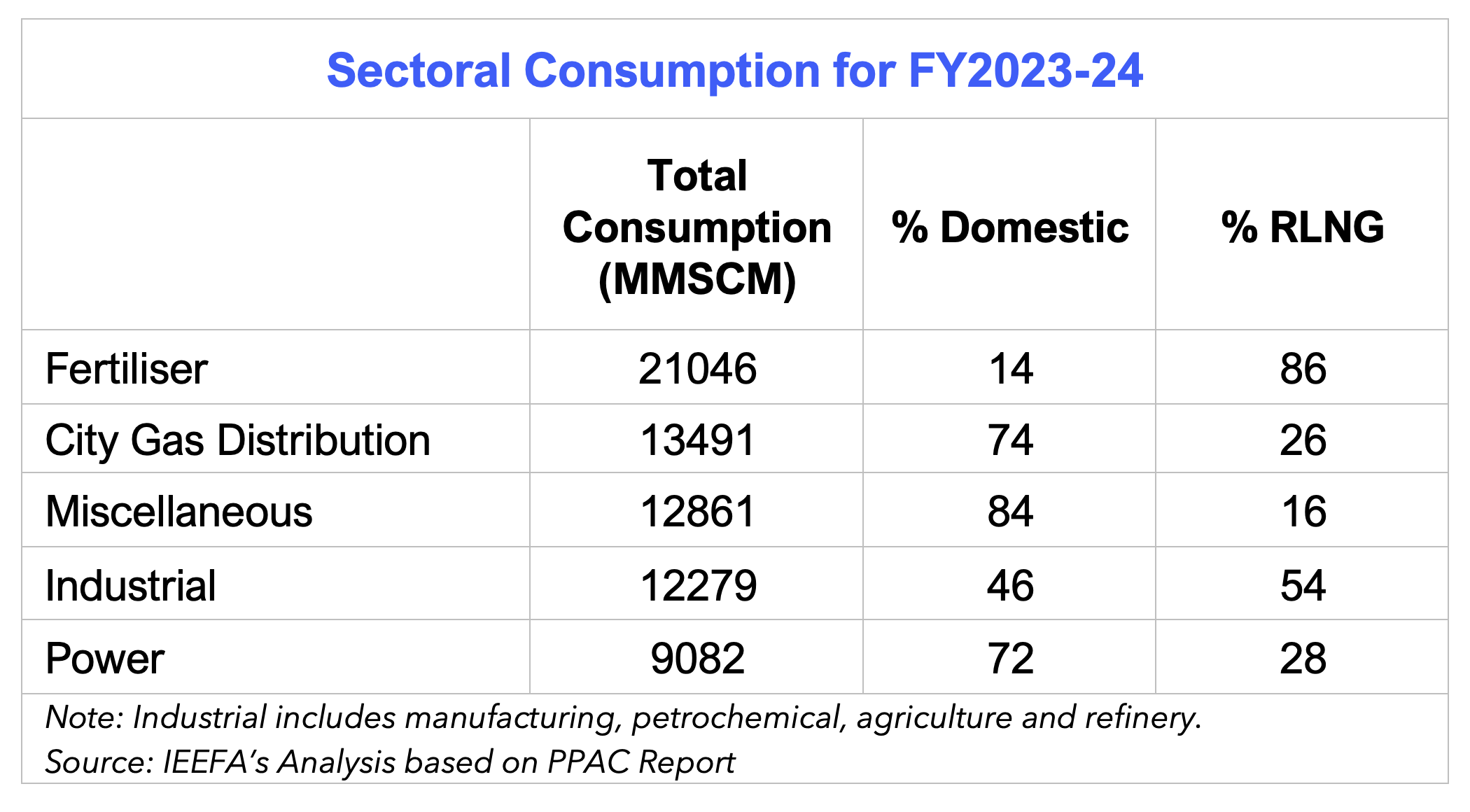

The various gas-consuming sectors include fertilisers, power, city gas distribution and industry (refinery, petrochemicals and others).

The fertiliser industry consumes the most gas, owing to the high fiscal subsidies it receives. For sectors where consumers bear the brunt of high prices, consumption is either low or driven by cheaper domestic gas.

The US Energy Information Administration has noted that the production of basic chemicals, including ammonia, for fertilisers and refining will increase gas consumption through 2050. However, India’s focus on green hydrogen and organic fertiliser puts a question mark on this forecast.

Power consumption has been on a high for the last two years. The gas share in power production increased to 3.1% in May 2024 from 1.6% in May 2023. On average, gas contributes 2% to power generation. But, as competitive alternatives are available, expensive gas-based power is not expected to be a big gas sector consumption driver. IEEFA’s recent analysis on using gas to meet peak demand notes that the increased deployment of renewable energy assets, improving economies of scale for battery storage and the rise of round-the-clock tenders point to the diminishing role of gas in the medium term.

So, while infrastructure expansion is not in tandem with proposed consumption, consumption avenues also compete with cleaner, cost-effective options. This could limit the role of gas in the medium- to long-term in India’s energy mix.

This article was first published on Mongabay.