Ignoring risks doesn't make them disappear - IEEFA comments in response to 2024 LNG Export Study

The 2024 LNG Export Study’s refusal to assess and include probabilities in its modeled results undermines the credibility of its analysis as to how differing LNG export capacity levels affect domestic natural gas prices.

The creators of the 2024 LNG Export Study, and government agencies that follow the study’s guidance, exhibit organizational behaviors like those that led to the Space Shuttle Challenger disaster on Jan. 28, 1986: Their decision-making processes disregard proper risk assessment.

In the case of the shuttle, the probability of failure was ignored, with no heed paid to data that potential O-ring issues rose as temperatures dropped. A lingering sting exists knowing that many top minds in our country could have prevented this tragedy if they had listened to what available data was telling them. This was a case of organizational behavior and its culture overpowering risk management and stifling communication.

The foreword of the Summary 2024 LNG Export Study includes a caveat stating that “for the portions of this study that have modeled results, the study does not attach probabilities to any of the scenarios examined.” The statement indicates that decisions regarding how LNG exports influence future domestic natural gas prices—a dominant consideration of this and past economic studies—are guided by a process and methodology for modeling that is designed to ignore the probabilities of its estimates.

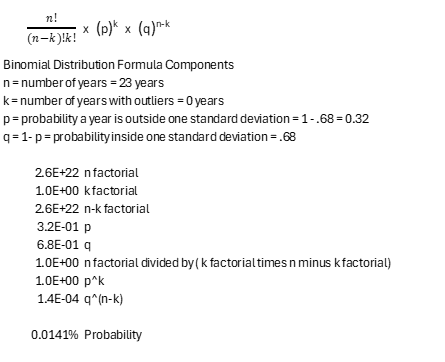

Were probabilities incorporated, it would become evident that modeled relationships and future estimated conditions based thereon have virtually no chance of occurring as a holistic outcome. For example, the probability of the 2024 LNG Export Study price estimates for Henry Hub Natural Gas prices in years 2030, 2035, 2040, 2045, and 2050 occurring is 0.014 percent, given a normal distribution of its returns. A detailed computation is provided as an appendix.

Instead of modeling a future that will never happen, DOE/FECM should consider running a natural gas markets stress test from three different perspectives: price, supply, and demand. Asking what price, what supply, or what demand for natural gas will cause an energy crisis in the United States that is detrimental to its economy could lead to a better understanding of the impact from future LNG export levels and public interest determinations. Risk-informed methodologies are sorely needed. The study is supposed to aid in gauging the likelihood of potential outcomes influenced by LNG export capacity levels changing. It is an impossible task when risk is ignored.

Appendix

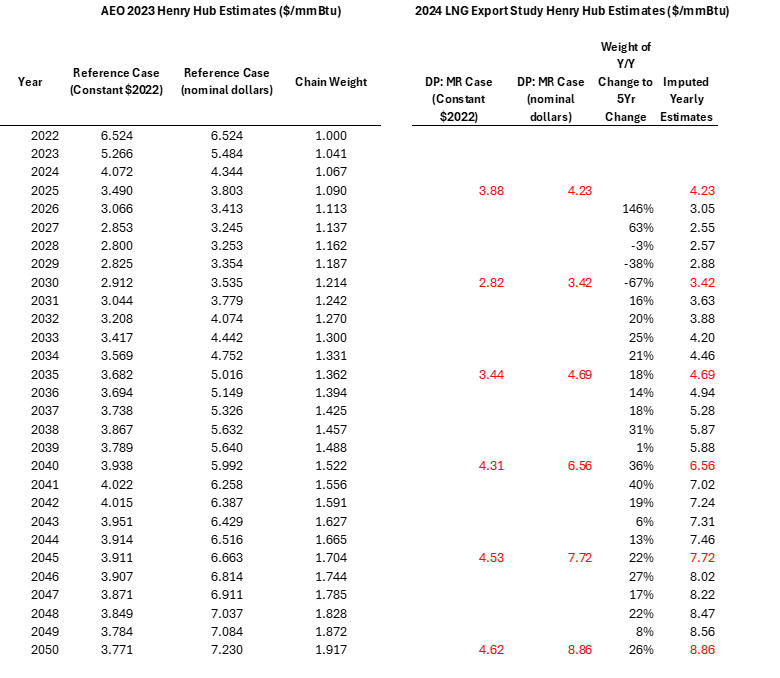

Henry Hub Natural Gas price is the benchmark for evaluating domestic natural gas prices. Going back to 1998, we see a wide dispersion in annual average price returns, which is illustrated in the following graph. Statistically, outlier returns, observations falling outside +/-1 standard deviation would be expected to occur 32 percent of the time, for any given year-over-year comparison.

Source: U.S. Energy Information Administration

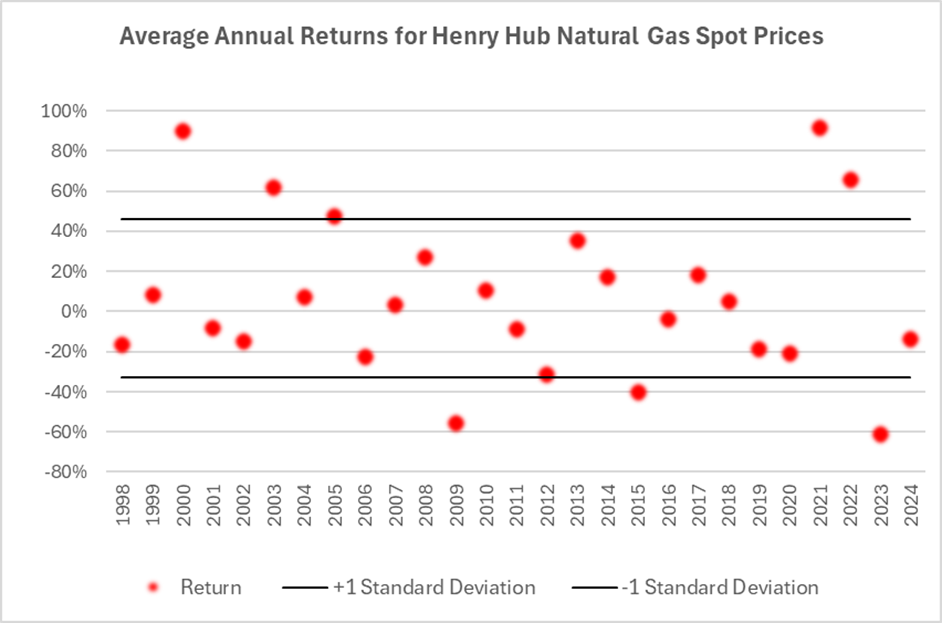

The next graph is the reference case for the 2024 LNG Export Study, which is the Defined Policy: Model Resolved case for Henry Hub Natural Gas in nominal dollar prices (not constant dollar 2022). The modeled estimates were converted from constant 2022 dollars to nominal using the chain-weighted conversion factors found in Annual Energy Outlook 2023 (AEO 2023). Only five-year increments were provided in the study. To impute the years in between these estimates, the yearly weightings of five-year changes in AEO 2023 were applied to 2024 LNG Export Study estimates. The blue dots are imputed while the orange dots are actual estimates from the 2024 LNG Export Study. The following graph shows the dispersion of long-term natural gas price estimates from the 2024 LNG Export Study are much narrower than historical results.

Source: DOE/FECM 2024 LNG Export Study with writer’s computations

Assuming a normal distribution of natural gas price returns, the binomial distribution formula can be used to examine the probability that no outliers occur, like what is seen between years 2028 to 2050 in the 2024 LNG Export Study estimates for Henry Hub natural gas prices. These years are highlighted due to their extremely unlikely probability of occurrence in realistic market conditions.

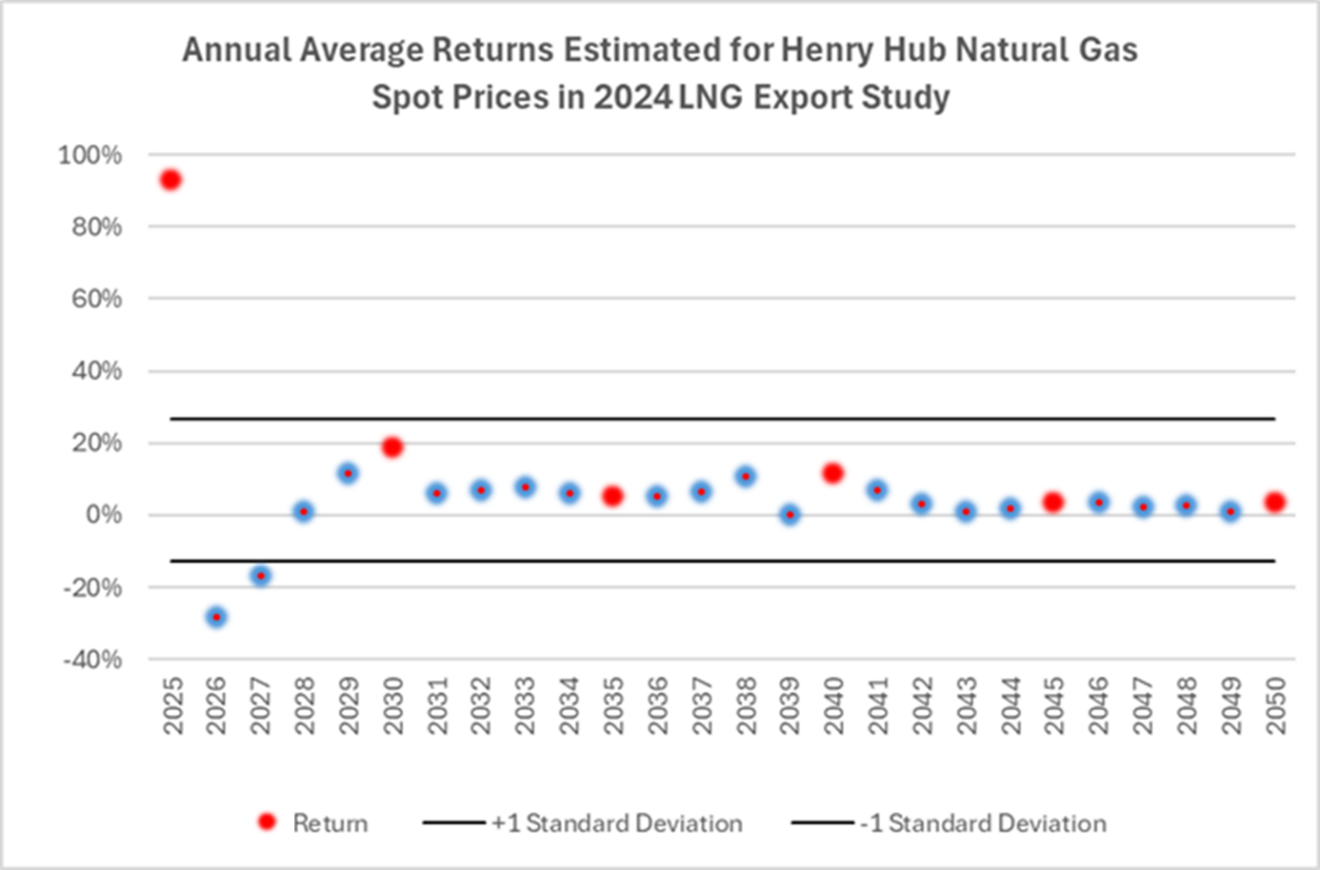

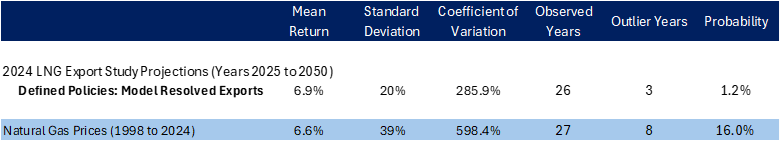

The following table compares the historical probability of outliers with the estimated probability of future returns exhibited in the 2024 LNG Export Study for Henry Hub natural gas prices.

Source: EIA, DOE/FECM 2024 LNG Export Study