IEEFA update: U.K. must align energy regulation with 2050 zero-carbon goal

June 12, 2019 (LONDON) – Britain this week will become the first major economy to commit to becoming net zero-carbon by the middle of the century, but will need to introduce clearer regulation to enable such an ambitious goal after several years of complex electricity market reforms.

The parting act of outgoing Prime Minister Theresa May will be to amend the country’s climate change legislation, to achieve net zero greenhouse gas emissions by 2050, tightening an already robust aim of cutting emissions by at least 80% compared to 1990 levels.

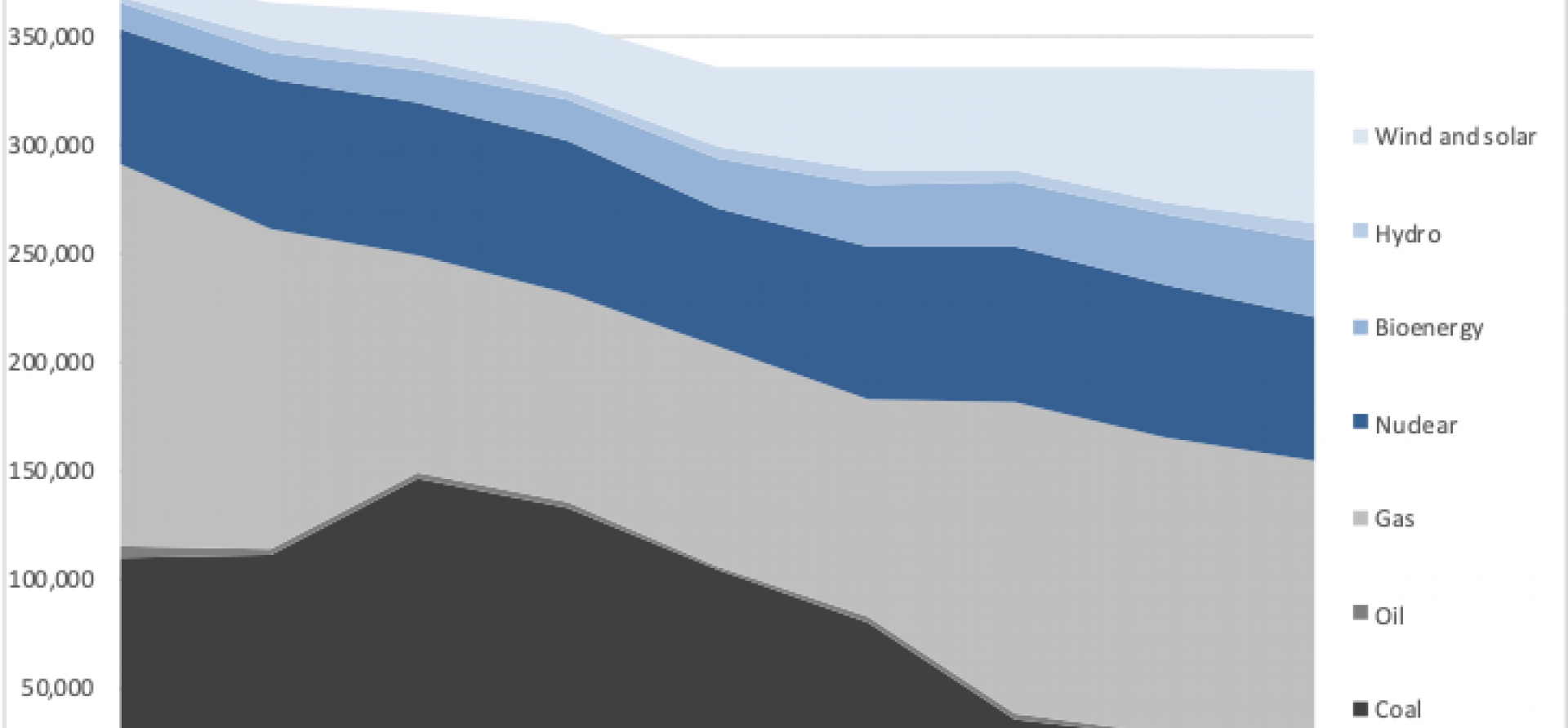

UK electricity mix, 2010-2018 (GWh)

THE UK’S NEW GOAL IS IN LINE WITH THE GLOBAL PARIS AGREEMENT ON CLIMATE reached four years ago, when countries agreed to achieve net zero greenhouse gas emissions in the second half of this century. A general consensus is that developed countries like Britain would take a lead, recognising their greater historic contributions of greenhouse gases.

Britain must now set clearer, preferably technology-neutral regulation, to give investors a clearer sight of how electricity generation and other energy technologies will earn a return.

The recent hiatus in the country’s solar power industry is a case in point, as well as wider electricity market reforms, for how disjointed policy can become.

The UK’s energy watchdog, Ofgem, remains at the centre of complex reform efforts, which have been ongoing since before 2014, when the government decided to introduce a capacity market which has mainly benefited conventional coal, gas and nuclear generation.

Capacity markets award contracts for generators to be available several years in advance of delivery, to give investors certainty over future cash flows, and policymakers certainty over available supply.

Ofgem has embarked on additional, deep-rooted reforms of network charging

The EU recently suspended the capacity market, however, after a legal objection. Meanwhile, the British government has successively rolled back and then abolished subsidies for renewable power (with the exception of offshore wind), while Ofgem has now embarked on additional, deep-rooted reforms of network charging. Those network-charging reforms are in the process of eroding incentives to install the distributed energy resources which are expected to be the backbone of the grid going forwards, including battery storage and wind and solar power.

Most recently, in March, the government phased out subsidies for rooftop solar without offering a replacement scheme, meaning that households with renewable capacity would give their zero-carbon power to the grid for free, unlike any other source of generation.

Thankfully, the government this week announced a new scheme, to be introduced by the end of the year, which will require suppliers to buy rooftop solar electricity from households at market rates. But such market power prices are only one part of a broader picture, which remains elusive. As in all European countries, it remains unclear in Britain how small-scale, distributed renewables will compete fairly with conventional coal, gas and nuclear power plants in myriad energy and non-energy electricity markets, in a post-subsidies world.

AND SIMILARLY TO OTHER COUNTRIES, BRITAIN’S TRANSPORT SECTOR GOAL TO ACCERLERATE ADOPTION OF ELECTRIC VEHICLES (EV) REMAINS FAR FROM JOINED-UP with the electricity sector, given today there are almost no examples of EV charging that respond to electricity market prices or network stress.

Successive U.K. governments and Ofgem have been global leaders in setting ambitious energy and climate change policies. Outstanding examples include the 2008 Climate Change Act, a target to phase out coal in 2025, plans to phase out sales of diesel and gasoline cars from 2040, and now, the goal to be zero-carbon by 2050.

The next step will be to offer clearer regulation which can end recent energy policy turmoil and the resulting complexity that sends mixed signals and risks losing investors who are unable to keep up with unpredictable shifts in direction.

Gerard Wynn ([email protected]) is an IEEFA energy finance consultant.

Related items

IEEFA update: UK reforms are killing solar market despite sector’s potential growth

IEEFA report: Electric vehicles (EVs) and batteries can drive growth in rooftop solar

IEEFA Europe: Progressive energy policies will make rooftop solar more affordable