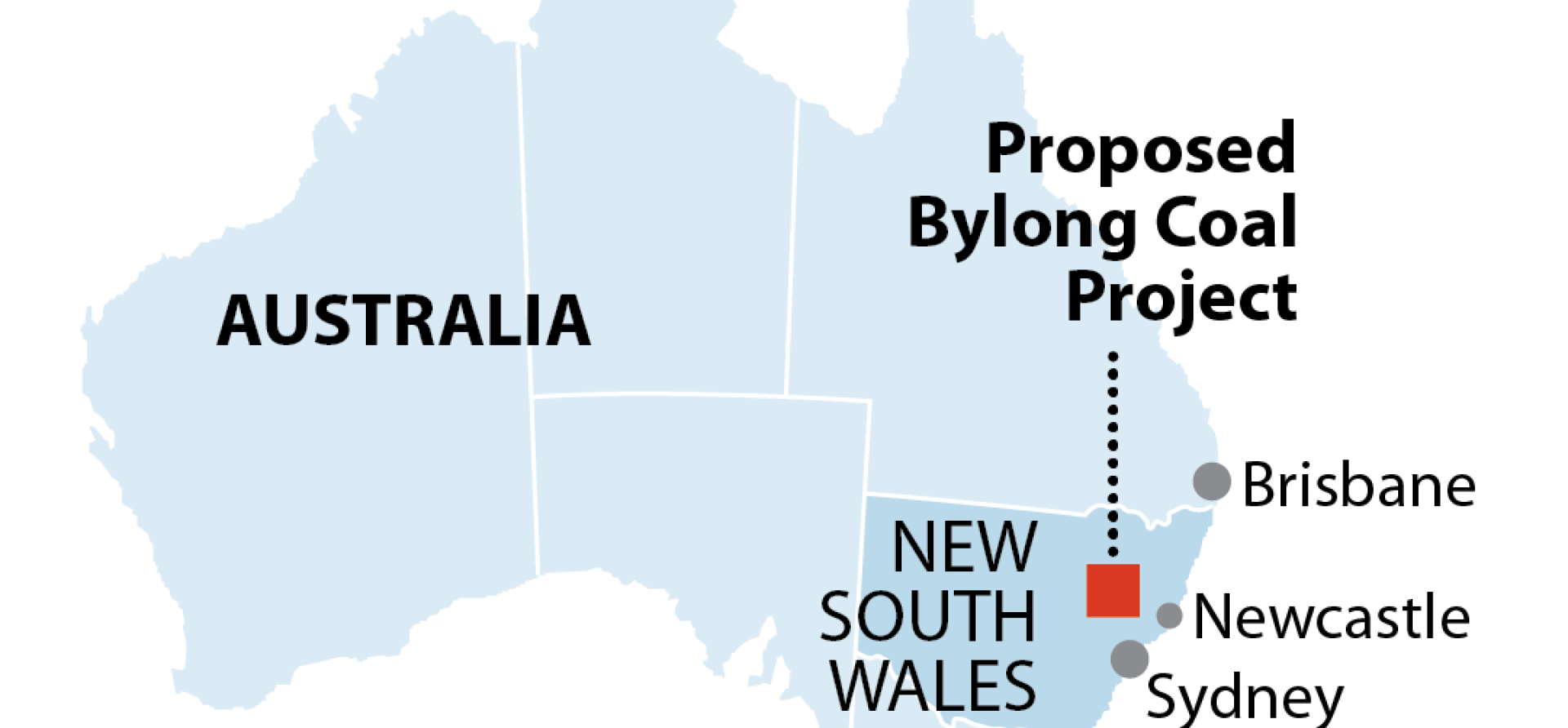

IEEFA update: South Korea’s KEPCO writes off A$680m Bylong Coal Project in Australia

The NSW Minerals Council is increasingly out of step with big miners despite an apparent win after lobbying the NSW Government in the wake of the Bylong coal mine refusal.

The Minerals Council campaigned to remove Scope 3 emissions – emissions burnt overseas from exported Australian coal – from planning assessment considerations after the NSW Independent Planning Commission rejected the Bylong proposal, in part because of greenhouse gas emissions.

The NSW Minerals Council is increasingly out of step with big miners

The lobbying appeared to have worked after Planning Minister Rob Stokes accepted a set of sweeping changes to the IPC that the NSW Minerals Council, unsurprisingly, said it “cautiously welcomes.”

Mr Stokes has also put forward a new bill which stops planning authorities from approving new mining projects with a condition related to the emissions of exported Australian coal. They will still consider greenhouse gas emissions when determining and assessing the project.

Adding new thermal coal mining capacity to a market set for long-term, structural decline makes no financial or economic sense

At the same time South Korea’s KEPCO, which proposed a new Bylong coal mine from 2010, has written off the $680 million it invested after the IPC refusal.

The Institute for Energy Economics and Financial Analysis has previously made it clear that the Bylong Coal proposal should not go ahead because adding new thermal coal mining capacity to a market set for long term, structural decline made no financial or economic sense.

But while the Minerals Council appears to have had a win with the NSW Government, its stance is increasingly misaligned with the outlook of global mining companies.

In July 2019, BHP – owner of the Mount Arthur coal mine at Muswellbrook – announced that it would set a public goal for Scope 3 emissions reduction and work with customers to achieve it. This represented a significant departure from previous attitudes towards emissions where Australian miners considered their responsibility for emissions ended when their mineral products left the country.

BHP WILL DECIDE BY APRIL 30 WHETHER IT WILL LEAVE THE NSW MINERALS COUNCIL after becoming concerned that the council’s public stance on emissions reduction is out of step with its own.

Following BHP, Brazilian mining giant Vale has also stated it would set a target to reduce Scope 3 emissions while aligning its operations with the Paris Agreement on Climate Change and aiming for net-zero emissions by 2050.

Anglo-American chief executive Mark Cutifani told a major mining investment conference in Cape Town this month: “Climate change is one of the defining challenges of our time”, as he made clear that mining companies will have to react to climate concerns.

A gathering wave of investors is ruling out funding thermal coal mines

Anglo American won’t need to worry about reducing the Scope 3 emissions of its thermal coal mines for long. It has made clear it will be out of thermal coal mining in the near future.

At the same Cape Town event, Rio Tinto acknowledged the mining sector will have to submit to pressure and reduce carbon emissions. Rio’s Bold Baatar stated the resources sector had reached a ‘make or break’ moment and the success of mining companies would depend on how well they integrate sustainability concerns into their business models.

Rio Tinto completed its global exit from the thermal coal sector in 2018 with the disposal of its NSW operations. Despite this, Rio faces a shareholder resolution that would require it to set Scope 3 emissions goals following the steps taken by BHP and Vale.

THE MAJOR MINERS AREN’T REACTING TO GLOBAL CLIMATE CONCERNS OUT OF THE GOODNESS OF THEIR HEARTS. A gathering wave of investors is ruling out funding thermal coal mines and power plants as the fossil fuel investment outlook continues to weaken and financiers feel the heat of public opinion on climate change.

As a result, finance for coal mines is increasingly hard to come by and expensive, a key theme of the February 2020 mining investment conference in Cape Town.

Global consultancy firm McKinsey & Co recently warned mining companies they risk a backlash from society and investors if they do not take climate concerns seriously and significantly reduce emissions, including Scope 3.

South32’s thermal coal exit is well underway

The world’s major mining companies are starting to reset their environmental, social and governance outlook in an effort to make them better fit 21st century public opinion as concerns over environmental sustainability and climate change turn off the finance tap. And this is just the beginning of an ongoing process.

Global mining companies will seek new ways to reduce Scope 3 emissions. If they don’t, investors will eventually force them to.

With thermal coal a key Scope 3 culprit and better, cheaper renewable energy undermining its economics, major miners are pushing the exit button. Rio Tinto has already quit coal completely, South32’s thermal coal exit is well underway, while BHP and Anglo American are planning theirs.

In this context, the NSW Minerals Council’s lobbying on Scope 3 emissions mean it is moving in the opposite direction to global leaders of the mining industry. Minerals Council attempts to hold back the tide look increasingly out of touch with reality.

This op ed first appeared in the Newcastle Herald.

Simon Nicholas is an Energy Finance Analyst with IEEFA

Related articles: