IEEFA update: How California became a global leader in renewable energy

SYDNEY–California, the fifth-largest economy in the world, has become a global leader in renewable energy.

With renewables supporting 34% of the state’s total energy needs in 2018, the business community is calling for an even greater commitment to clean energy as an essential benchmark for the economic success of the state.

In August 2018, California enacted Senate Bill 100, setting a target of 100% carbon-free electricity by 2045. The bill mandates a move to 60% renewables by 2030 and requires all new houses to have solar by 2020, and commercial buildings by 2025.

This bold initiative builds on the policies of Governors Arnold Schwarzenegger (2003-2011) and Jerry Brown Jr. (2011-2019) who pushed California towards becoming a global leader in decarbonisation.

So, how did this policy shift come about?

A mandate in 2006 required utilities to purchase an increasing percentage of renewables each year beginning in 2010, or face penalties. The Renewable Portfolio Standard (RPS) has been gradually phasing out fossil fuels for electricity ever since.

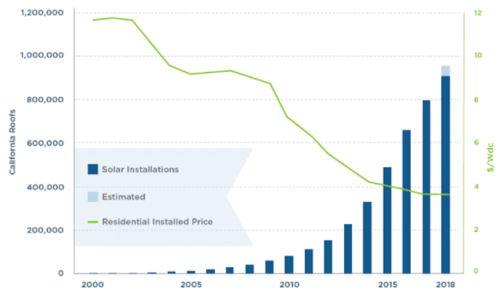

Since 2013, California has been running the Cap-and-Trade Program that has reduced the state’s carbon emissions while the percentage of renewable energy has risen, beating its renewable energy mandate of 33% by 2020 by two years, including the likely achievement of a cumulative 1 million solar rooftops in early 2019 (Figure 1), with an average system size of 6.8kW. California also, in May 2018, mandated compulsory rooftop solar on new single-family homes from 2020 onwards as a new strategy to continue to enhance energy efficiency gains across the state.

Figure 1: California Has Reached 1 Million Solar Rooftops

Source: California Energy Commission, Nov 2018

For decades, the California Air Resources Board (CARB) has led the U.S. in automotive emission standards, driving productivity up and reducing imported oil dependence to build American energy security. Having acknowledged the world-leading efforts of the CARB, we also note that California is the fourth largest oil-producing state in America, making the state’s pole position in electric vehicle sales something of an oxymoron.

In 2018, California’s Pacific Gas and Electric Company (PG&E) launched construction of the world’s two largest utility-scale battery projects to-date. They include a 300MW/1,200MWh project by Vistra Energy and a 182.5MW/730MWh project (both to be supplied by Tesla), nearly three times the size of the largest lithium battery-storage facility currently in operation in South Australia (Tesla’s Hornsdale Power Reserve at 100MW/129MWh).

California also led the world in building the first mega-scale solar projects, both for solar PV and solar thermal, reaping the benefits of having very high solar radiation levels and access to low-cost capital to drive scale and learning-by-doing. Solar is now an affordable source of electricity in the state.

Solar Star, California

Commissioned in June 2015, the 579 megawatt (MW) Solar Star project in the Antelope Valley took three years to build and at the time, was the largest operating solar project in the world. The project uses 1.7 million SunPower monocrystalline silicon modules on single-axis trackers spread over 3,200 acres and is supported by a power purchase agreement (PPA) from Southern California Edison. Solar Star produced an average 1,534 GWh of electricity annually in 2015 and 2016, giving it, at the time, a world-leading 30.2% capacity utilization rate.

California has also shown leadership in divesting from coal. As the world’s sixth largest insurance market with annual premiums of US$ 259bn, investors are taking notice.

In 2015, California’s legislature passed a bill requiring state pension funds Calpers and CalSTRS to divest their holdings in coal-mining companies.

In January 2016, then-state Insurance Commissioner Dave Jones announced a Climate Risk Carbon Initiative to evaluate the impact of a 2℃ climate change scenario on insurer investments, while calling for a voluntary divestment of all thermal coal investments as well as instituting annual disclosure requirements of carbon risk.

Both the California State Compensation Insurance Fund and the Markel Corporation are reported to have divested coal. When significant financial institutions act, others follow.

In November 2018, Commissioner Jones released the results of the “2018 Climate Risk Carbon Initiative Coal Divestment Follow-Up Survey”. The survey had covered 1,185 property-casualty and life insurance companies each with premiums totaling over US$ 100m annually. Survey results reported an increase in the number of Californian insurers that had divested or were committing to divest from thermal coal investments. Some 123 insurers have committed to divesting some or all of their coal investments, a doubling from the 66 firms who had committed to do so in 2016. In addition, 621 California insurers reported they already had zero coal exposure.

In January this year, the insurance commissioner assessed the losses from the unprecedented wildfires in November 2018 at US$ 11.4bn. As a direct result, PG&E filed for bankruptcy protection (citing an even higher US$ 30bn of assessed fire-related liabilities), providing global financial markets yet another stark reminder of the “unexpected” financial risks of climate change.

California has achieved all of this in clear recognition of the need for urgent action to address the growing financial pressures of climate change and the rise of more frequent and extreme weather events.

Senate Bill 100 provides a further instigator for global action on renewables, inviting investors to reap the benefits while driving technological and investment change in energy markets.

The Powering Past Coal Alliance highlights that even in the absence of strong climate action at the country level, cities and states, in partnership with the private sector, can drive global policy momentum.

California is driving learning-by-doing, technology development and investments to show how a clear and sustained policy effort can provide the framework for a planned transition.

With renewable energy now the low-cost source of new generation in an increasing number of markets, the lessons from California are helping drive least-cost decarbonisation globally, reducing dependence on imported fossil fuels and providing a road map for others to deliver on the global climate objectives of the Paris Agreement.

Tim Buckley ([email protected]) is Director of Energy Finance Studies, IEEFA Australasia.

Links:

IEEFA U.S.: The gathering solar wave

IEEFA update: Unmistakable trends in American wind and solar

IEEFA report: Every two weeks a bank, insurer or lender announces new coal restrictions