IEEFA update: The Energy (Dis)Information Administration

The Energy Information Administration will release its annual energy outlook soon, along with its standard cautionary disclaimer as to how it is more a guess than a prediction of what will happen.

Oh that it were a better-educated guess.

Many policymakers, particularly those in Congress and state legislative bodies that don’t have either the time or expertise to digest the uncertainties around the outlook, treat it as a forecast—and a federally endorsed one at that. Given its stature in that regard, it seems the EIA outlook would hew closer than it does to fact than fiction, but here the agency has fallen woefully short—as the EIA itself largely acknowledged in a recent analysis of its outlooks from 1994-2017.

In that analysis, the EIA concedes it overestimated future coal consumption more than 75% of the time—clearly an indication that the agency has a modeling problem that consistently undermines its credibility. More troubling, the agency’s ability to get it right hasn’t improved over time; in fact, it has gotten worse.

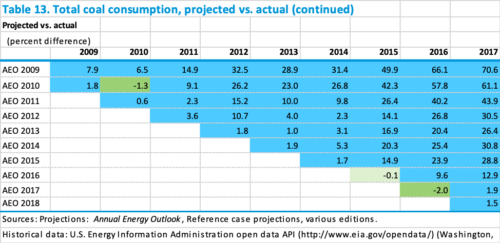

The table below, taken from the EIA’s website, graphs the agency’s annual outlooks from 2009-2018; a blue box indicates that an outlook overestimated actual coal consumption for the given year—blue, in other words, means “wrong.”

For example, the 2009 outlook projected that 2017 coal consumption would be 70% higher than it actually was. The forecast had total coal consumption in 2017 at 1,223 million tons; actual consumption that year was 717 million tons—a whopping difference of 506 million tons.

That margin of error matters—a policymaker in 2009 looking at EIA’s outlook might dismiss renewable energy research and development, concluding that domestic coal supplies would meet national electricity needs.

And, indeed, that was what EIA projected—that coal would remain the leading generator of U.S. electricity. Specifically, the agency wrote: “Coal continues to provide the largest share of energy for U.S. electricity generation in the AEO2009 reference case, with only a modest decrease from 49 percent in 2007 to 47 percent in 2030.”

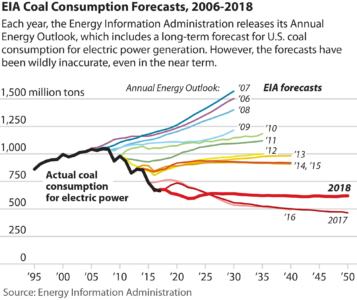

Another way to view the same data is presented in the chart below:

THE AGENCY ALSO WAS STILL EXPECTING NEW BUILDS IN COAL GENERATION, projecting 46 gigawatts of new coal-fired capacity through 2030. That, in retrospect, was so fantastical and out-of-touch that today it appears to have been a blind shot in the dark.

The EIA last year estimated that coal provided just 27% of the nation’s electricity needs, down from 30% in 2017 and the 49.6% share coal averaged from 2001-2008. With coal plant retirements piling up in recent years and more to come, a trend coupled with continued strong new construction of natural gas-fired and renewable generation capacity, that percentage will, at best, remain flat, and will more likely continue to drop, rendering the agency’s 47% estimate for 2030 laughably off the mark.

The analysis laid out in the chart above starts in 2009 because that is when the transition reshaping the electric power industry began. The recession of 2007-09 essentially brought electricity demand growth, already slowing in the early 2000s, to a halt, resulting in a flat-lining that has persisted for the past decade; the natural gas fracking revolution began to take hold in 2008-2009, providing ample, low-cost supplies for developers looking for a cleaner alternative to coal; and the seeds of the surge in renewable energy development were planted, leading to the huge capacity growth in solar and wind power generation over the past several years.

The EIA perhaps deserves a pass for its early forecast errors, given the speed of the transition that has occurred. But jump closer to the present, when the impacts of the transition were clear across the industry. EIA’s modeling still appears mysteriously stuck in the past, however. In its 2014 outlook, for example, the agency projected that coal consumption in 2017 would be 31% higher than it turned out to be. And the agency’s 2015 outlook overestimated 2017 consumption by 29%.

How this degree of error is possible is hard to comprehend. After all, the 2015 outlook was released on April 15 of that year, when the initial wave of coal plant retirements and coal-to-natural-gas conversions to comply with new federal mercury-emissions rules was roiling the industry. The EIA itself estimated that the rule would lead to the retirement of 31GW of capacity and the conversion to gas of an additional 4GW. Still, it projected that coal production would climb from 985 million tons in 2013 to 1,118 million tons in 2030—an average annual increase of 0.7%. Much of the agency’s optimism that year was predicated on an assumed rise in the remaining coal fleet’s average capacity factor, which the EIA projected would climb from 60% in 2013 to 67% in 2016.

But instead of increasing, the average capacity factor of the nation’s coal-fired power plants fell to 53.3% in 2016, even as older, less efficient plants were retired, according to EIA data.

FINALLY, THERE IS THE MOST RECENT, AND MAYBE MOST GLARING EXAMPLE, of EIA’s inability or unwillingness to accurately estimate future coal consumption trends. In its 2018 outlook, the agency projected that following the most recent round of coal plant retirements—through the early 2020s— total coal capacity would level off at about 190GW by 2030 and that there would not be another plant retirement through 2050. Second, EIA estimated that coal production, after falling through the early 2020s would stabilize and average 750 million tons annually through 2050.

These two projections are predicated on a couple of highly questionable assumptions. On the retirement projection, EIA’s analysis ignores the existing coal fleet’s already advanced age. According to the agency’s own data, 88% percent of U.S. coal plants were built before 1990. More telling, on a capacity-weighted basis, the average age was 39 in 2017. Assuming that these plants will all be operating in 2050 borders on the ridiculous.

EIA also estimated last year that as the U.S. coal fleet ages, its average capacity factor will inexplicably climb to 70%—a level not seen since the mid-2000s, when the plants were younger and the electric power system operated in a much less coal-dependent fashion than it does today.

Given the agency’s track record, policymakers and analysts would probably do well to consider filing the EIA’s upcoming 2019 outlook under “F,” but for fiction rather than fact.

Dennis Wamsted ([email protected]) is an IEEFA editor.

RELATED ITEMS:

IEEFA U.S.: A sea change in American offshore wind

IEEFA U.S: Tribal investment in struggling coal-fired Four Corners plant will lose millions

IEEFA Georgia: The diminishing importance of coal-fired power generation