IEEFA response to Capacity Mechanism Project Initiation Paper

Download Full Version

Key Findings

There is a high risk that the proposed capacity mechanism will overcompensate fossil fuel generators and under compensate low emissions generators.

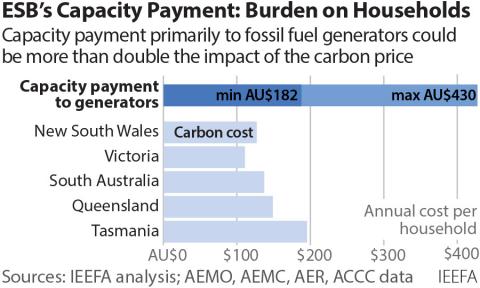

The Energy Security Board’s capacity mechanism proposal has the potential to impose a substantial additional cost on electricity consumers.

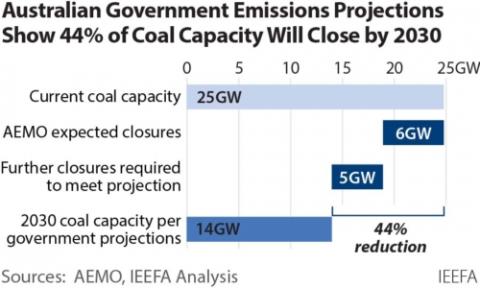

The financial viability of several coal generators in the National Electricity Market is under threat and as such, with the risk of abrupt unexpected closure, it is vital to manage coal exit uncertainty.

The proposed capacity market is not likely to solve the challenges facing the NEM

Overview

IEEFA is concerned that the proposed capacity mechanism will make it more difficult and more costly to achieve emissions reductions required to align with the Paris Agreement, to which Australia is a signatory.

The Energy Security Board (ESB) proposes to pay generators based on capacity available in “at-risk periods.” The ESB’s definition of “at-risk periods” is focused on periods of time when wind and solar generation is low (contrary to the ESB’s stated principle of technology neutrality), so therefore wind and solar generators are likely to receive minimal capacity credits. Thus, there is a high risk that the mechanism will overcompensate fossil fuel generators and undercompensate low emissions generators.

There is a high risk that the mechanism will overcompensate fossil fuel generators and undercompensate low emissions generators.

International experience shows that in general, capacity markets favour resources with lower fixed costs and higher operating costs, as they can offer capacity at the lowest cost and thus are more likely to receive capacity credit revenue. These models typically favour coal and gas generators, and disadvantage renewables and other low emission energy resources. They also tend to favour existing generators (with largely depreciated assets) over new entrants.

With increased levels of wind and solar in Australia’s National Electricity Market (NEM), and the falling cost of batteries, it is more important than ever that price signals faced by power generators are highly flexible to reflect changes in the supply-demand balance over short time periods. This is the very reason that regulatory authorities and Energy Ministers accepted the need to move to paying generators based on prices over 5 minute intervals instead of 30 minutes, which began last year.

It is more important than ever that price signals faced by power generators are highly flexible to reflect changes in the supply-demand balance.

The ESB’s proposed capacity payment reflects a move in the opposite direction - towards a central planner (or retailer) attempting to guess at least a year in advance (and possibly greater) how much power supply will be needed, over what time periods, and from what types of power plants. This could worsen reliability because it is likely to encourage the wrong types of power plants to remain operating (the expensive aged ones) while deterring the entry of newer, more reliable and more flexible power plants that are better suited to a grid with increasingly high levels of wind and solar.

IEEFA has been following the capacity mechanism discussion and analysing various aspects of the proposal through the duration of the ESB Post 2025 Market Design work. Our analysis has come to the following conclusions:

- The financial viability of several coal generators in the NEM is under threat. As such, there is a risk of abrupt, unexpected closure.

- Almost 6,500 megawatts (MW) of new known dispatchable capacity is due to be added to the NEM between 2017 and 2027.

- The proposed capacity market is not likely to solve the challenges facing the NEM.

- The ESB’s capacity mechanism proposal has the potential to impose a substantial additional cost on electricity consumers.

- The ESB’s capacity market benefit calculation does not provide a full picture of the costs and benefits of the capacity mechanism.

- There are many other more targeted options to deal with the challenges facing the NEM while reducing emissions

IEEFA recommends that all options be delivered to the ministers in December 2022, including a cost benefit analysis for each option and a critique of how each option would address the challenges facing the NEM and reduce emissions.