Oversight board rejection of Puerto Rico debt bill misrepresents purpose

Oversight board refuses to act on debt but won’t let Puerto Rico take action

The Financial Oversight and Management Board’s rejection of H.B. 1383, a Puerto Rico bill that would have restructured the island’s $9 billion debt, misrepresents the purpose and impact of the bill.

This year’s process was the most contentious and least productive of any year

The oversight board known as the FOMB argued in a letter that the bill, recently passed by the Puerto Rico Assembly and vetoed by the governor, would have taken away its exclusive authority to renegotiate debt and supervise critical infrastructure projects under the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA).

But the act would not be necessary if the board and its advisors found structurally sound fiscal solutions to problems faced by the Puerto Rico Electric Power Authority (PREPA). The board has presided over PREPA since its 2016 creation. This year’s process was the most contentious and least productive of any year. The board’s record of failure includes two rejected debt proposals that cost PREPA’s ratepayers hundreds of millions in fees for advisors. Each rejected debt proposal required executive leadership by the commonwealth to finally point out the futility of raising rates beyond an economically sustainable rate.

An FOMB letter rejecting the measure also reminds governor and legislative leaders the board is authorized to approve debt, not the Puerto Rico Legislature or Puerto Rico Energy Bureau (PREB). But when the board is long gone and problems arise, it will be up to the governor, legislature and bureau that will need to solve them. It is extremely shortsighted to think that excluding locally elected and legally constituted regulatory bodies from long-term debt decisions is sound debt policy.

A recent review of the nest of conflicts of interest at the FOMB makes clear that the advice coming from the board is corrupted. Steven Rhodes, a member of the nation’s bankruptcy bar, demonstrates in extraordinary detail that McKinsey, FOMB’s financial advisor, holds indirect interests in Puerto Rico’s bonds. The letter to the U.S. bankruptcy trustee requests that it consider the fee arrangement being considered for McKinsey. The letter contains a list of 137 third-party managers used by McKinsey as it pursued its investments in Puerto Rico’s bonds. Many of the third-party managers on the list have been part of prior PREPA restructuring agreements as creditors.

With an alignment of interest between McKinsey and certain PREPA bondholders, it is highly questionable that PREPA and its ratepayers are receiving unbiased advice regarding the current year budget or fiscal plan. It also remains to be seen whether the current round of negotiations of PREPA debt will produce a third agreement that favors bondholders over PREPA ratepayers. The letter also identifies a number of vendors that received contracts from PREPA at the same time McKinsey held investments in those companies.

The governor’s veto comes from advisors with a nest of conflicts. The McKinsey relationship with bondholders corrupts the credibility of the advice it is giving to the board. The consulting giant must be removed from its advisory role to the FOMB and PREPA immediately.

H.B. 1383, far from being an impairment of FOMB rights under PROMESA, is a corrective action that brings focus to fundamental issues ignored in prior budgets, fiscal plans and restructuring agreements.

Each provision of the bill that FOMB finds objectionable responds to specific instances where the board, PREPA, private grid operator LUMA Energy and their respective army of advisors failed to resolve underlying issues. The measure had the temerity to seek permanent solutions for Puerto Rico; this seems intolerable to the FOMB.

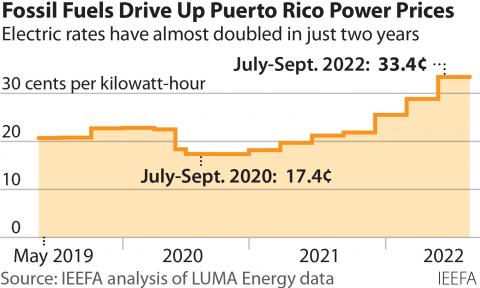

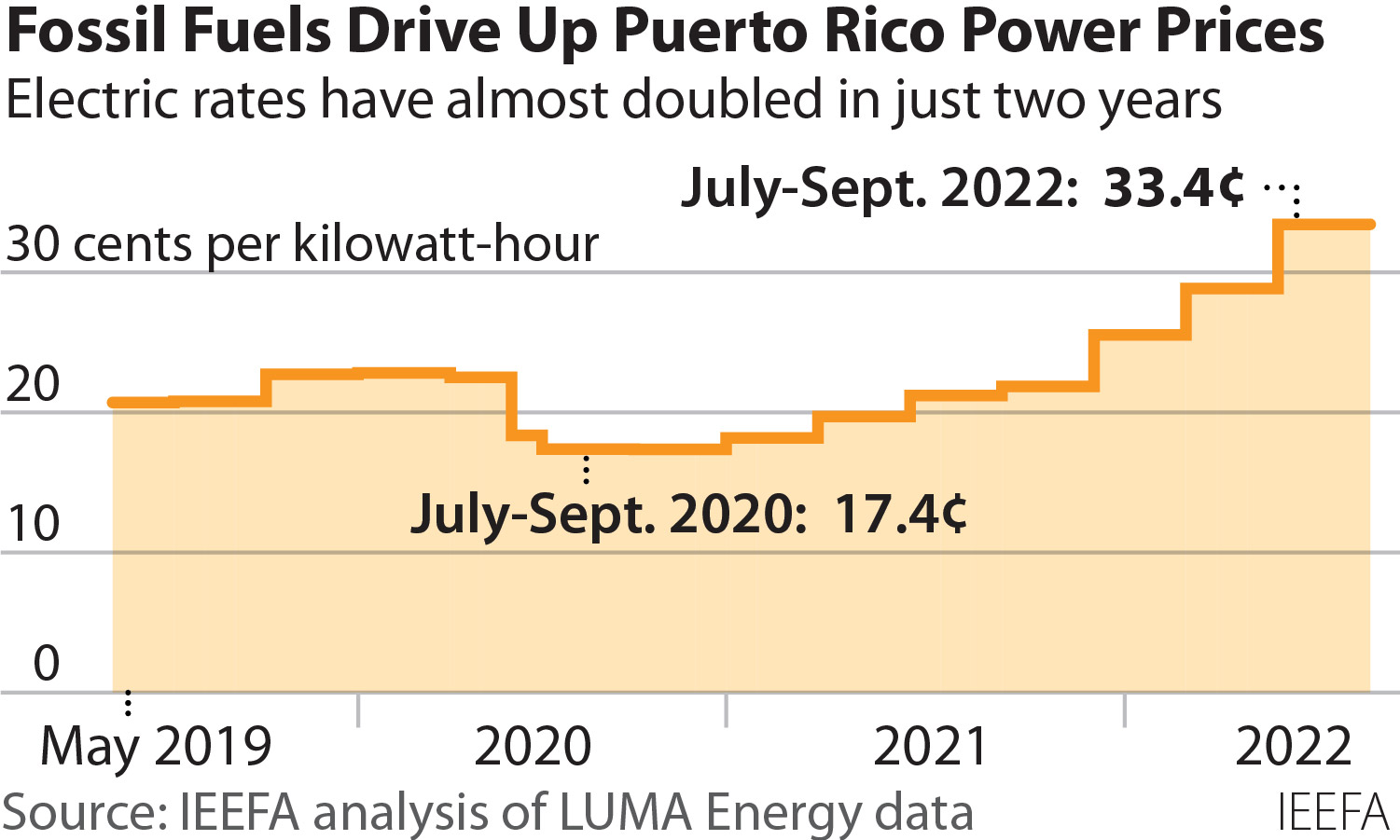

The Puerto Rico Legislature set as a goal of 20 cents per kilowatt hour (kWh) in 2019. In 2016, PREB reviewed PREPA’s finances for the first time. The hearings included testimony from consumers and businesses. They provided detailed data on the role of electricity rates in household budgets and the impact of rates on Puerto Rico’s businesses, large and small. As an expert witness at the time in support of Puerto Rico’s business interests, IEEFA concluded that affordable rates were in the range of 16 cents/kwh.

Much has occurred since then, including multiple hurricanes. According to the 2022 fiscal plan recently approved by the FOMB, PREPA’s rates are now far in excess of those rates paid by other consumers in comparable service areas. The FOMB approved plan states: “… the ‘share of wallet’ of electricity costs for the average Puerto Rico household, is far above the average for U.S. and comparable island markets even without the recent surge in fuel prices.”

Current rates are economically uncompetitive

The letter also ignores the reality that a considerable portion of the current rate covers prior bad management practices, including flawed financial advice. The current fiscal plan promises a new round of savings, but it takes no note of the last six years of promises to implement savings that have mostly not been achieved. The FOMB ignores the reality (and prior PREB decisions) that the current system cannot differentiate between how much of the rate dollar is due to the costs of mismanagement and how much of it due to valid cost increases. It is not at all wrong to try and curb out-of-control costs with a rate cap when that is the only tool available.

In short, current rates are economically uncompetitive. The short-sighted attack on affordable rates contained in the FOMB letter ensures its plan of adjustment will impair Puerto Rico’s economic recovery.

The essence of a plan to exit bankruptcy should leave PREPA intact

Similarly, the board assails H.B. 1383 for establishing a maximum 25% recovery rate for PREPA’s bondholders. In a typical bond recovery, Puerto Rico might be expected to support a 65% to 85% recovery rate, according to Moody’s Investors Service. But Puerto Rico is not typical; its citizens have a median income half that of Mississippi, the poorest state on the mainland. Citigroup’s filings in a restructuring proceeding have made it clear that no plan of adjustment should be approved if the rate of electricity price increases exceeds the rate of economic growth. As mentioned above, two debt proposals with excessive recovery rates have been rejected. It appears as if the FOMB is prepared to offer a third, equally flawed plan.

PREPA’s bondholders and its army of advisors are in a far better position to absorb losses than PREPA. The essence of a plan to exit bankruptcy should leave PREPA intact. The FOMB tacit support for unsustainable debt recovery levels ensures it won’t happen.

The FOMB complaints that H.B. 1383 does not reform the pension system are equally erroneous. The pension plan is an operational expense. Like many other operational expenses, prior mismanagement has left the pension system underfunded. Rather than see the realignment of PREPA’s financial structure as an opportunity to settle accounts in a comprehensive manner, the FOMB takes the unfathomable approach of driving the pension system into further actuarial imbalance.

H.B. 1383 is perfectly consistent with PROMESA and the current fiscal plan. The fiscal plan consists of a series of choices. For example, if PREPA and LUMA deliver on a legally established Integrated Resource Plan and press for a significant increase in renewable energy, fuel costs will be lower. The fiscal plan is clear. Either PREPA or LUMA has decided to stall on the implementation of renewable energy. The situation is so bad that PREB is appointing a third party to ensure this urgently needed reform is implemented.

Similarly, the fiscal plan shows that the cost of electricity is so high, the system so badly managed, and the outages so common that Puerto Rico’s residents have taken it upon themselves to install solar panels on their homes and businesses at an unprecedented rate. The costs are borne completely by Puerto Rico residents and businesses. The FOMB response is to propose disincentives to curtail this self-help measure that residents are taking to protect themselves against a system that fails to meet customer needs.

The FOMB also complains that H.B. 1383 restricts the use of privatization as a tool to ensure sound implementation of PREPA’s grid transformation. To date, the two major privatization contracts won by New Fortress Energy and LUMA Energy have provided substantial reason to question the validity of the privatization plans.

New Fortress was granted an unfair advantage in the awarding of the contract. The U.S. Federal Energy Regulatory Commission (FERC) recently found that the company moved forward with its project to build a liquefied natural gas facility in San Juan without complying with federal regulations. In addition, there is no evidence that New Fortress has produced the promised savings to PREPA’s fuel budget that were part of the basis for the award. The LUMA Energy contract was also awarded improperly. Although they were brought on to improve service, there are continued lapses.

The FOMB consistently argues that H.B. 1383 would impair its authority under PROMESA. The board has failed to use that authority to offer permanent solutions to PREPA’s problems. The FOMB letter fails to even consider that there were valid reasons for Puerto Rico to pass the legislation. The letter is not an exercise of its authority—but rather, an abuse of it.