IEEFA Ohio: FirstEnergy’s Bailout Plan Is Paying Off (for FirstEnergy)

The Public Utility Commission of Ohio this week gave FirstEnergy a much smaller bailout than the company wanted.

The Public Utility Commission of Ohio this week gave FirstEnergy a much smaller bailout than the company wanted.

But it’s still a bailout.

We expect opponents—including consumer and environmental organizations, industrial electricity customers and other power producers in Ohio—to appeal the PUCO decision to the Ohio Supreme Court. These groups will probably ask the Federal Energy Regulatory Commission to give it a hard look too.

Champagne corks are no doubt popping nonetheless at FirstEnergy. The bailout, after all, is part and parcel of a FirstEnergy survival strategy we detailed in an October 2014 report (“A Major Utility Seeks a Subsidized Turnaround”) on how FirstEnergy has been struggling financially since its 2011 merger with Allegheny Energy. In that deal, FirstEnergy paid a premium to acquire a heavily coal-dependent electric company just when the market for coal-fired power began to go south. It was a bad move, and it’s one of the big reasons FirstEnergy today is so financially weak.

Over the past three years, FirstEnergy’s revenues have not been sufficient to cover the company’s expenses and its dividend payments to shareholders. Indeed, the corporation has paid out more in dividends than it has actually earned in profits—following a model that is obviously not sustainable.

So the company is chasing ratepayer bailouts.

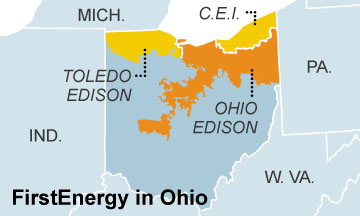

Keep in mind that even though the lifeline approved this week by the PUCO is less than what FirstEnergy asked for, the numbers are huge. Ratepayers of Ohio Edison, Toledo Edison and the Illuminating Company will pay FirstEnergy about $200 million per year for three years, with a possible two-year extension, pushing the total to as much as $1 billion.

And FirstEnergy can use the money for pretty much whatever it wants. It will be collected through customer charges labeled as a “distribution modernization rider” on bills, even though FirstEnergy is not required to use the money to upgrade its distribution system. The order creatively includes in the definition of “grid modernization” such things as “reducing outstanding pension obligations, reducing debt, or taking other steps to reduce the long-term costs of accessing capital.”

In other words, the money is to shore up FirstEnergy’s weak finances. It rewards bad decision-making and supports the company’s larger bailout strategy.

The next chapter is coming soon, as the campaign shifts to West Virginia, where FirstEnergy is widely expected to attempt a “sale” of its deregulated coal-fired Pleasants Power Station to its regulated subsidiary Mon Power. Such a move, if approved, would lock FirstEnergy’s West Virginia customers into subsidizing operating costs and profits at Pleasants for the remainder of its useful life.

If it can get bailouts in Ohio, FirstEnergy must be thinking, it can get them in West Virginia too.

Cathy Kunkel is an IEEFA data analyst.

RELATED POSTS:

IEEFA Report: A Cynical Re-Regulation Strategy in West Virginia

FirstEnergy Throws a Hail Mary Pass in Its Campaign to Keep Aging Power Plants Alive