IEEFA Norway: Why the World’s Biggest Sovereign Wealth Fund Should Invest in Global Renewable Energy Infrastructure

We published a report this morning that highlights how Norway is at a historic crossroads in how it manages some of its vast national wealth bound up in the Government Pension Fund Global (GPFG).

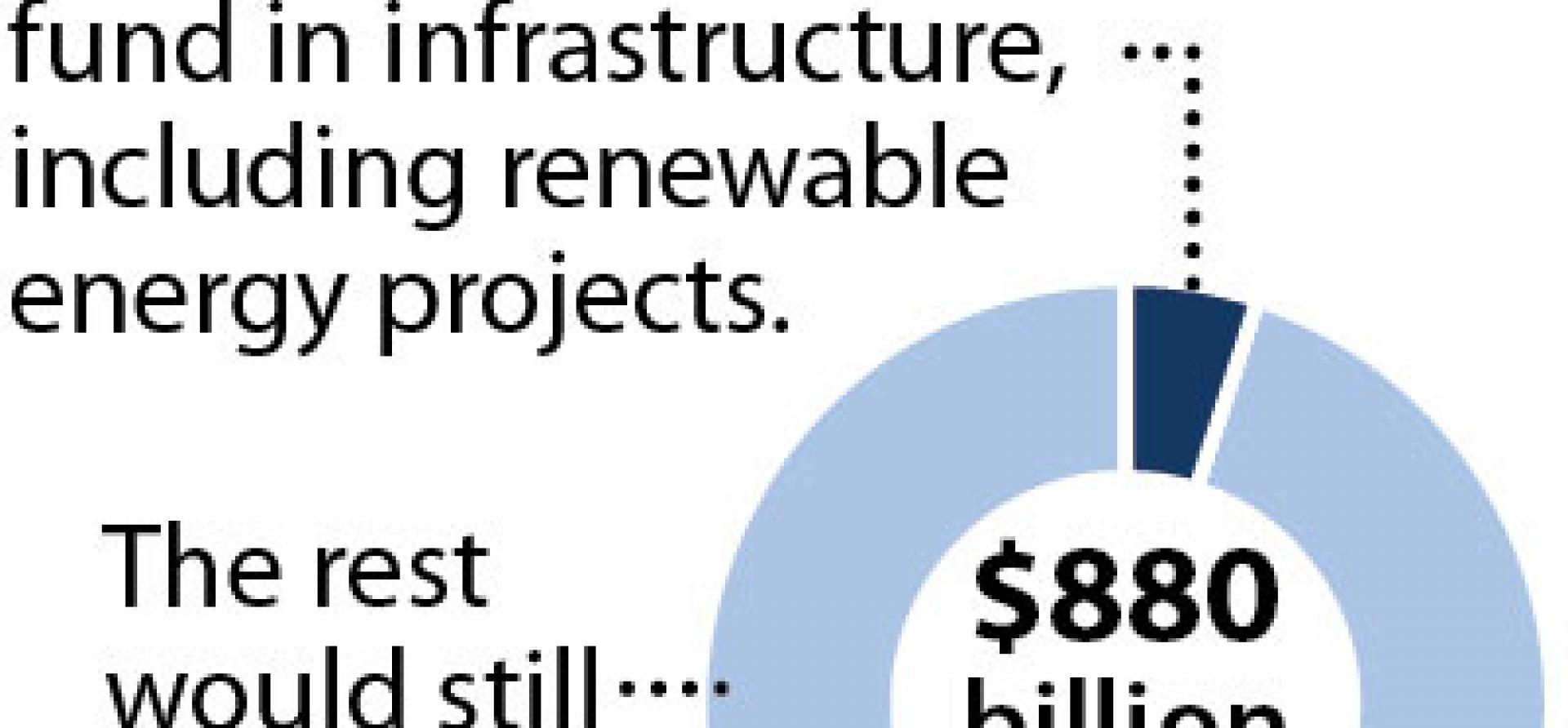

Indeed, GPFG is facing an unusually opportune moment this summer, as Parliament considers whether to enact a mandate that would have the fund put up to 5 percent of its $900 billion in wealth into unlisted infrastructure holdings.

Such a move would allow the fund to capture value and reap stable returns especially from the fast-growing global renewable energy sector.

The fund would be joining an investment trend that is gaining momentum—62 percent of sovereign of wealth funds held infrastructure investments in 2016 and an additional 7 percent were considering doing so.

Our report outlines how GPFG can proceed and describes the opportunity in renewable-energy infrastructure in detail. One of our core findings is that assets bought and sold across this space now—in wind farms and solar plants— yield returns and retain value.

A mandate by Parliament would mirror a recommendation already in place by Norges Bank.

While Norway’s Finance Ministry has been reluctant to approve such a move, citing concerns over assorted risks, Parliament has the authority to advance such a move.

Skeptics may very well argue that renewable energy comes with too much risk. And indeed, while renewable energy is no more immune to regulatory and political risks than investments that that include telecommunications and transportation holdings, these risks can be mitigated, as has been demonstrated for quite some time now by well-managed funds that have developed robust methods do just that. Our report shows how risk mitigation can be accomplished through a combination of in-house expertise, co-investment and strategic investment strategies.

Skeptics may very well argue that renewable energy comes with too much risk. And indeed, while renewable energy is no more immune to regulatory and political risks than investments that that include telecommunications and transportation holdings, these risks can be mitigated, as has been demonstrated for quite some time now by well-managed funds that have developed robust methods do just that. Our report shows how risk mitigation can be accomplished through a combination of in-house expertise, co-investment and strategic investment strategies.

Infrastructure is a long-established asset class embraced by many of the world’s leading investment funds, and renewable energy accounts for roughly 42 percent of all unlisted infrastructure transactions. It is practically becoming a separate investment vehicle unto itself.

The industry outlook is positive. Government regulators and energy ministries in most countries are finding that wind and solar developers are offering competitive prices for power generation. This lowers the cost of electricity for host-country businesses and households and makes such investments that much more appealing. More and more governments recognize also that technology-driven, market-based renewable energy solutions will help address climate change—a fact that increases their appeal further and that adds to the growing global momentum around renewables.

Growth across the global economy over the next several years is expected to create demand for $3.3 trillion in various infrastructure investments, particularly in emerging economies.

Well-managed infrastructure investments bring returns of 12 to 15 percent annually, with investments in renewable infrastructure producing steady, returns that exceed expectations. Brookfield Asset Management, among the models mentioned in our report, operates exemplary funds that return 10 to 20 percent annually.

The renewables sector is no longer the experimental space it once was, having entered a long-term growth cycle with a strong outlook driven by low costs, competitive prices, policy advances and rapid uptake. The sector is also diversifying by adding wind and solar investments to long-held hydropower portfolios.

Our report includes five recommendations on how Norway can move forward on this front:

- By creating an investment mandate requiring managers to invest 5 percent of the fund’s assets in unlisted infrastructure, including renewable energy investments.

- By expanding GPFG specialized in-house professional staff resources, with a focus on developing a team comparable in quality to those found among other top institutional investors.

- By establishing partnerships with established investment funds that have a track record in the unlisted infrastructure field, and co-investing with those funds under mutually beneficial arrangements.

- By setting aside a portion of the fund’s infrastructure investment for listed utility companies that have significant and promising portfolios in renewable energy.

- By putting a firm and prudent commitment in place to invest in infrastructure projects in emerging markets.

These five moves would allow the fund to capture value from a growing market that offers reliable returns. These investments would not be correlated to the fund’s equity and bond portfolio, which is to say they would add risk diversification. They would provide steady cash flow and they would be anti-inflationary.

The opportunity in infrastructure investment is enormous and immediate—in developed and emerging economies alike—and the risk is manageable.

Tom Sanzillo is IEEFA’s director of finance.