IEEFA India: The rise of ESG investing and sustainability reporting

COVID-19 has provided a wake-up call for investors, opening their eyes to the potential for physical risks such as global pandemics and climate change to cause much more economic damage than financial crises.

The pandemic has accelerated the adoption of environmental, social and governance (ESG) investing, which aims to include a company’s environmental footprint, the way it manages relations with its stakeholders and its corporate governance mechanisms in the investment decision-making process.

ESG was already gaining traction among the biggest investors in the world. The United Nations Principles for Responsible Investing (UNPRI) was founded in 2006 and now has more than 3,500 signatories including the biggest institutional investors with US$120 trillion in assets under management. These signatories have committed to integrating ESG factors into investment decision-making.

Investors are realising that numbers alone don’t tell the whole story about a company and that profitability and sustainability go hand in hand. In a survey of global institutional investors by Ernst & Young, nine out of 10 gave greater importance to companies’ ESG performance post the pandemic and 86% said that corporate decarbonisation is key to their investment.

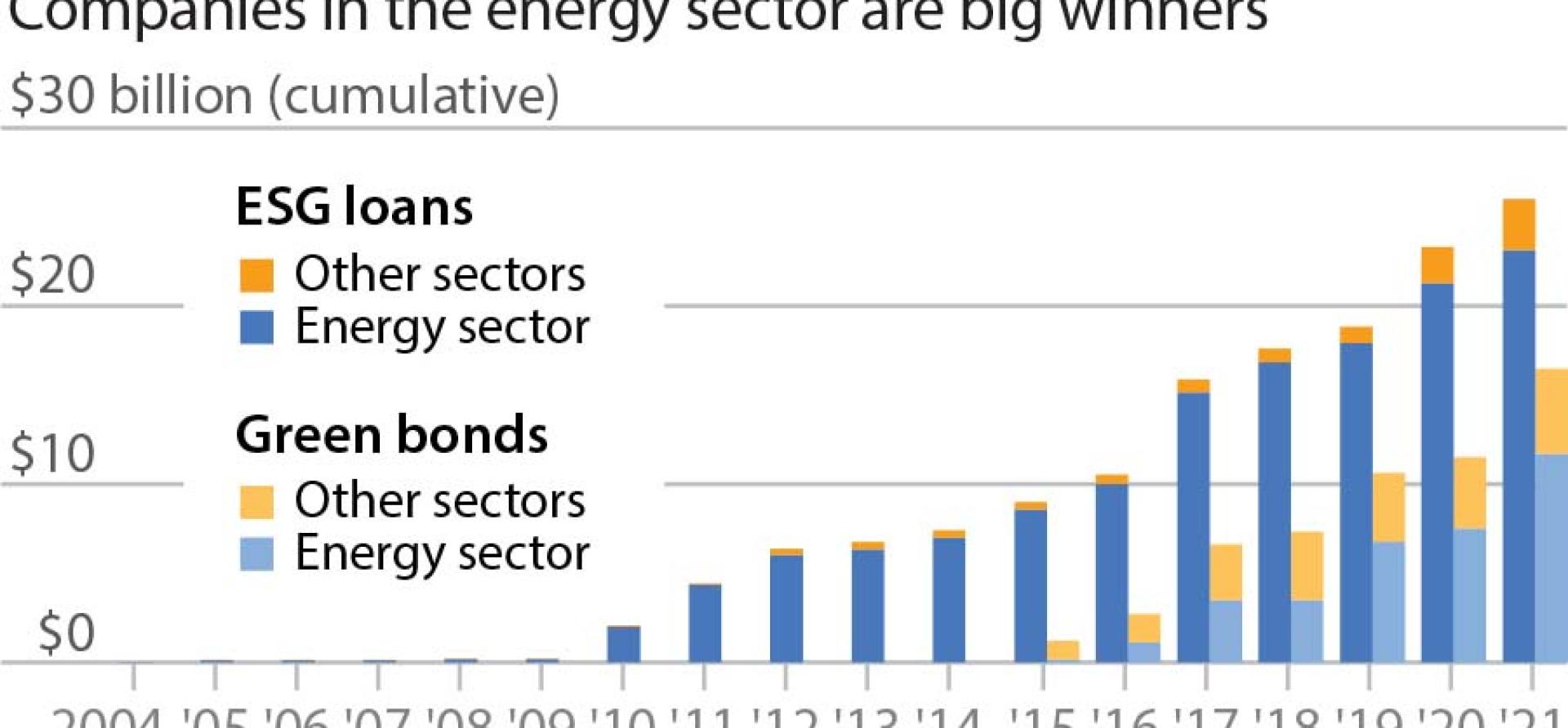

Bloomberg expects ESG assets under management to hit US$53 trillion by 2025, a third of global assets under management. Green bonds, sustainability linked bonds, social bonds and transition bonds are among instruments issued globally to capitalise on the rising importance of ESG.

Information about the ESG aspects of a business, customarily not included in financial reporting, is fast becoming a trend. Increasingly, investors are asking companies to disclose their ESG footprint as per various voluntary standards and frameworks, such as Global Reporting Initiative (GRI), CDP, Sustainability Accounting Standards Board (SASB), International Integrated Reporting Council (IIRC) and Task Force on Climate-Related Financial Disclosures (TCFD).

These standards become the basis for how companies select relevant ESG metrics and key performance indicators (KPIs), what they measure, and what information goes in the ESG reports they create. Via these standards, investors better understand the ESG footprint of companies, their ESG strategies and their progress on this front in a format that also facilitates comparison across companies and sectors.

Regulators around the world are rolling out mandatory ESG disclosure standards

Regulators around the world are rolling out mandatory ESG disclosure standards, in response to investors’ expectations of greater non-financial disclosure as well as the rapidly expanding landscape of ESG standards, ratings and investment instruments. By August 2021, 86 countries had issued sustainable finance and ESG disclosure policies, having expanded from just 18 countries in 2010 to 47 in 2020.

India has joined the movement with its Business Responsibility and Sustainability Reporting Standards (BRSR), which mandate the country’s top 100 listed companies must disclose their ESG footprints from April 2022 onwards.

Corporate boardrooms globally are moving rapidly towards incorporating an ESG strategy in response to the growing ESG data requirements of investors. A fundamental first step in the process is taking a sustainability materiality assessment to determine the most material ESG metrics for companies, then weaving an ESG strategy around them.

Another important aspect within the ESG ecosystem is ESG ratings, which with other data products help investors integrate ESG in their investment decision-making. An ESG rating measures a company’s exposure to long-term ESG risks. Credit rating agencies such as Moody’s, S&P and Fitch provide ESG ratings and data products, as do other agencies such as MSCI, Bloomberg, Refinitiv and Sustainalytics. In India, CRISIL recently launched ESG scoring for 225 listed companies. Edelweiss launched an ESG scorecard and ratings for India’s top 100 companies. The top international credit rating agencies provide ESG scores for leading Indian companies.

The importance of ESG ratings is growing and the industry is rapidly expanding

The overall momentum around ESG is positive but several issues remain. Among these are: the unregulated nature of ESG products; inconsistent ESG standards and frameworks; company specific issues such as lack of expertise and tools and methodologies to collect and report on ESG issues; and a growing risk of “greenwashing”, giving misleading information to investors and other stakeholders about the green character of a company.

The importance of ESG ratings is growing and the industry is rapidly expanding to cater to the varied needs of investors. Currently, the activities of these rating providers is not regulated in India or other parts of the world. Increasing reliance on such unregulated ESG rating providers raises concerns about the potential risks it poses to investor protection and financial markets overall.

In this context, the Securities and Exchange Board of India (SEBI) has recently floated a consultation paper to regulate the activities of the country’s ESG rating and data providers. The paper, among the first of its kind in the world, proposes several regulations to put those providers under greater scrutiny.

By Shantanu Srivastava, Energy Finance Analyst, Institute for Energy Economics and Financial Analysis (IEEFA)

This article first appeared in Renewable Watch