IEEFA: Global investment is racing to meet the IEA’s Net Zero by 2050 roadmap – how will this impact India?

The International Energy Agency’s (IEA) Net Zero Emissions (NZE) roadmap by 2050 is compatible with the Paris goal of restricting the temperature increase to below 1.5 degree Celsius. As per the NZE roadmap, the use of unabated fossil fuels declines sharply to just over a fifth of the total energy supply. More than two-thirds of the energy supply in 2050 will come from renewables and around a tenth from nuclear.

The NZE roadmap is a global game changer. It sets out firmly the direction investment needs to go in for countries to restrict global emissions and achieve their Paris Agreement goals.

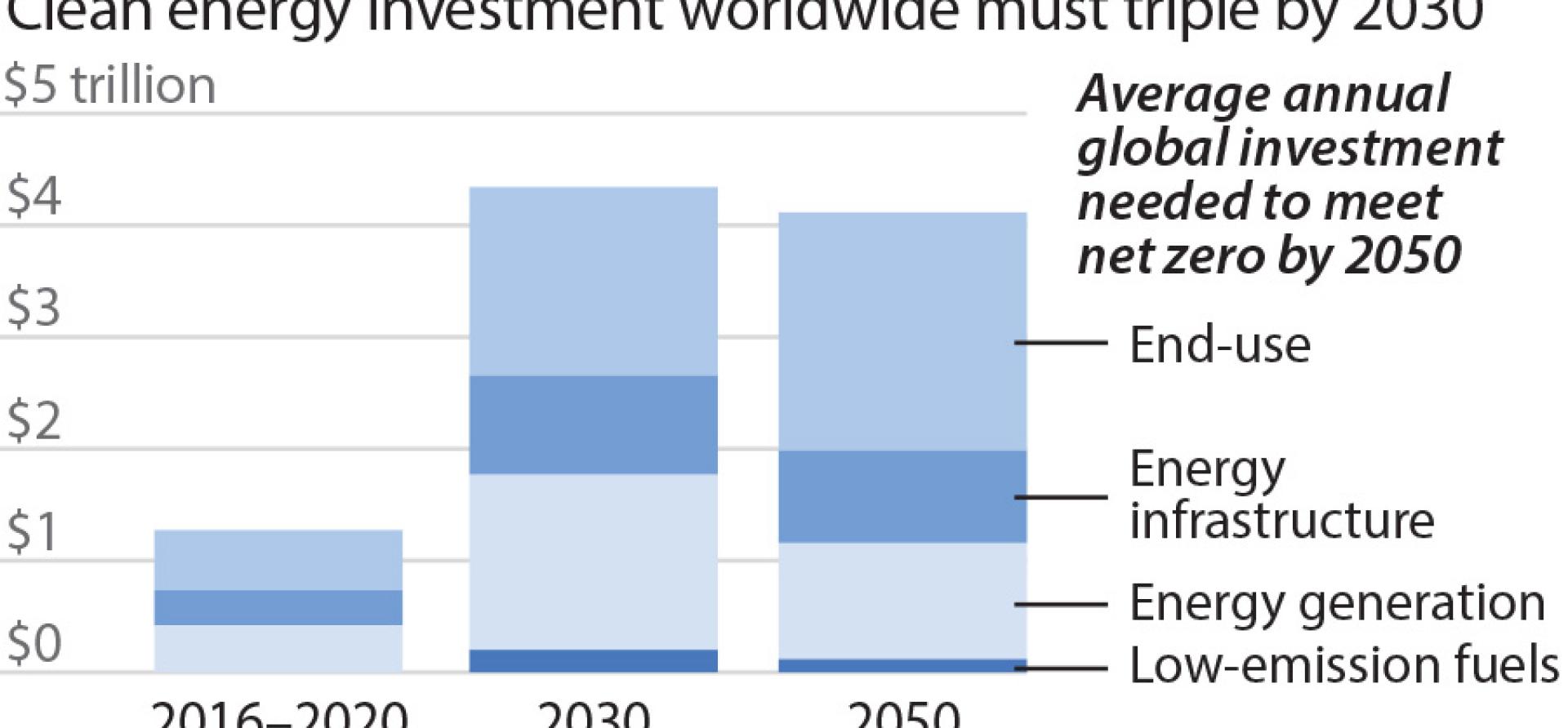

Total annual energy investment will have to surge to US$5 trillion by 2030, with annual investment in electricity generation rising from just over US$500bn over the last five years to more than US$1600bn in 2030. Further, the NZE roadmap requires annual investment in transmission and distribution grids to expand from US$260bn in 2021 to US$820bn in 2030. Also, the number of public charging points for electric vehicles (EVs) will have to rise from ~1 million to 40 million during the same period, requiring annual investment of almost US$90bn by 2030.

Global capital is already fleeing fossil fuels and moving towards more profitable clean energy as board room decisions are made more on economic than climate grounds. Increasing numbers of lenders are switching and redirecting their finance and insurance away from fossil fuels exposures. In the first quarter of 2021, assets in investment funds focused partly on the environment more than tripled in three years, amounting to US$2 trillion.

A growing proportion of global investors want to back projects that help curb environmental damage. An increasing amount of money is now going into stock mutual and exchange-traded funds with environmental goals as part of their mandates. In the last year, banks and financial institutions with large funding portfolios in fossil fuel assets, such as BlackRock, JPMorgan Chase, Korea Development Bank and Japan Bank for International Cooperation, have announced coal exit policies.

Recently, oil and gas giants Shell and Exxon experienced huge setbacks in court and from investors over their inaction on climate policies. A Dutch court ordered Shell to halve emissions and Exxon lost two board seats to activist investors. Also, with the ongoing erosion of fossil fuel shareholder wealth, there is a call for board members to diversify portfolios and shift investments to clean energy.

India is experiencing the effects of the shift of capital away from fossil fuels

India is also experiencing the effects of the shift of capital away from fossil fuels. In 2020, in order to boost more domestic coal production, the government invited bids for the public auction of 41 coal blocks to encourage private investment. However, absence of any international interest in these bids showed that such fossil fuel assets are no longer viewed as lucrative investments. In recent years, states like Maharashtra, Gujarat and Chhattisgarh and public and private sector developers like NTPC and Tata Power have announced pivots away from coal.

In February, the IEA published the India Energy Outlook 2021 which presented various scenarios including the Sustainable Development Scenario (SDS), wherein India will witness an early peak and rapid subsequent decline in emissions, consistent with a longer‐term drive to net zero. This scenario illustrates the NZE roadmap for India, but the IEA has shifted the global goal post from 2070 to 2050. This implies that transition to renewable energy and firming capacity will have to accelerate relative to that mapped out in the SDS scenario.

Figure 1: Share of Fuel in Total Electricity Generation (IEA SDS Pathway)

Source: IEA India Energy Outlook 2021

The expected annual investment for deployment of renewable energy, battery storage, electric vehicles and network expansion and modernisation of the grid is US$110bn in the SDS for India. This is ~3 times the current annual investment (US$40bn) in these sectors. However, to achieve the NZE roadmap, the corresponding investment requirement will be much higher than the SDS.

Given investors are guided by the profit maximisation principle, as well as the desire to avoid high-emissions stranded assets, investment will flow where the returns are maximised. A look at the share price performance and return of Adani Transmission, Adani Green and Coal India Ltd. between July 2018 and June 2021 reveals Adani Green’s share price has increased 10 times and Adani Transmission’s by 8.5 times. Coal India, on the other hand, has halved its share price relative to 3 years ago.

Figure 2: Adani Green vs. Adani Transmission vs. Coal India (absolute price) – June 2018 to June 2021

Source: Refinitiv

Figure 3: Adani Green vs. Adani Transmission vs. Coal India (total return) – June 2018 to June 2021

Source: Refinitiv

Globally, the shift away from fossil fuels is accelerating in response to net zero emissions pledges last year by China, Japan and South Korea, a ratcheting up of climate ambition by President Biden’s administration and the recent announcement by the G7 countries of an exit from all international coal financing by their export credit agencies by the end of this year. An increasing number of banks and financial institutions are setting enhanced climate targets and shifting their investment to green energy.

Figure 4: Greening of the Big Banks

Source: Bloomberg Green

Note: These are the top 5 lenders to the global fossil fuel industry since 2016

While India is rightly focused on enhancing its energy security and for development reasons cites increasing use of its domestic fossil fuel resources, the availability of international capital is drying up for investment in high emissions sectors. India is a capital taker and so the new capital is being invested in more bankable renewable energy, firming capacity and grid modernisation. Investment into fossil fuels is a recipe for stranded assets and many banks and financial institutions in India face increasing pressure from international investors to no longer invest in fossil fuels.

International capital for investment in high emissions sectors is drying up

In India, there is also the false promise of ‘second life’ coal. Any new investment into the highly capital-intensive greenfield, speculative investment in carbon capture and storage (CCS), underground coal gasification (UCG), coal-to-gas, coal-to-oil, or coal-to-fertilisers projects, or any similar ‘second life’ pipedreams is a myth predicated on huge carbon emissions and should be avoided for the environmental and financial risks involved.

With the availability of renewable energy at Rs2/kWh level in India and further with deflationary prices of renewable energy, battery storage and electric vehicles, the competitiveness of fossil fuels will be further compromised. The contrast to the inflationary nature of fossil fuel firms is illustrated by the likely 15-20% wage rise facing Coal India Ltd in 2021. There is a temporary rise in the price of solar modules and thus solar energy in India in the face of import duties and commodity price rises to-date in 2021. However, to IEEFA the long-term pricing of solar energy is likely to see a record low of Rs1/kWh within the next decade. If the events of the first six months of 2021 are any reflection of the future, then transition will happen much earlier that expected.

With the G7 countries’ international coal finance exit, the likely introduction of an EU carbon border adjustment mechanism (possibly replicated by the U.S.) and the ratcheting up of climate goals by the U.S., the direction of funds has changed irreversibly. India is no exception and while there may be a last tranche of investment into fossil fuel development available, the shift away from fossil fuels and rising stranded asset risks will continue to gather momentum.

Further, profound changes in technology are being driven by all the new investment rushing into the clean energy space. Economic, social and governance (ESG) investing has become a part of the mainstream of the global financial system and increasingly more ESG-labelled funds are coming up in India. ESG funders are constantly ratcheting up their ambitions and goals in the clean energy financing space.

With the Reserve Bank of India (RBI) now joining the Network for Greening the Financial System (NGFS), policies should be designed to fully incorporate environment and climate risk management in our country’s finance sector, steering limited public and private sector investments toward a green recovery for a more sustainable economy.

Vibhuti Garg, Energy Economist and Lead India, IEEFA

Related items:

IEEFA: IEA’s net zero emissions by 2050 maps the huge increase in global ambition

IEEFA: Global finance is mobilising to meet East Asia’s net-zero ambition

IEEFA: Finance needs to be at the centre of India’s ‘net zero’ discussion