How to Tell Truth from Fiction in an Energy Development Proposal (Part 1)

“Never trust announcements. Never trust groundbreakings. Only trust ribbon-cuttings.”

That’s a wise piece of advice a seasoned Army Corps of Engineers analyst gave me several years ago when we were talking about whether a proposed $6.9 billion coal-to-liquids plant on the Ohio River—which had been announced with great fanfare and received political support at every level in Ohio—was really going to be built.

Neither of us thought it would happen. And we were right: the project, championed by an outfit called Baard Energy, was cancelled and the parent corporation was dissolved, but not until after $800,000 in state subsidies was wasted for purchase options on the purported site.

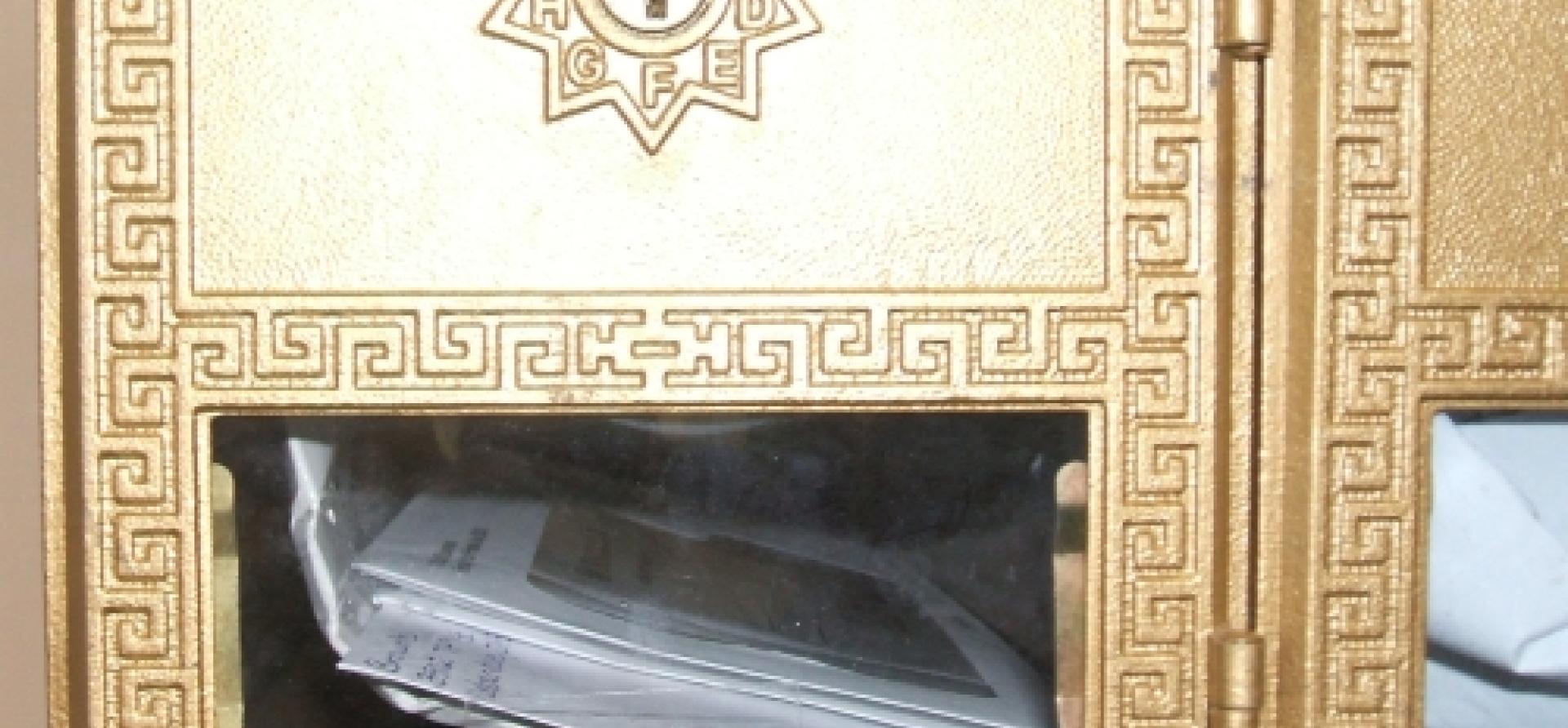

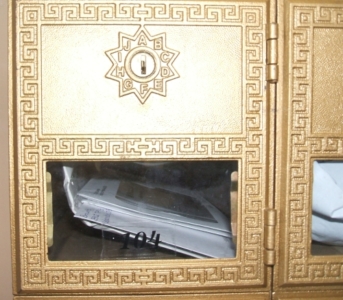

This rented mailbox turned out to be the “corporate headquarters” of a company proposing to build a $6.9 billion coal-to-liquids plant in Ohio in 2010. Photo credit: Robin Everett

It’s remarkable how many energy-related projects are announced, and sometimes even break ground, without ever getting to that ribbon-cutting stage. Such proclamations tend to come in waves. Developers hop on what they see as the latest energy bandwagon, whether it be ethanol, coal-to-liquids processing plants, gas-to-liquids plants, or a dozen varieties of waste-to-energy incinerators.

In cases where local governments, residents, and community leaders have serious qualms about these proposals, it’s good to know how to do the basic financial research that will indicate whether the plan is legitimate.

In this two-part commentary, I’ll start today by outlining the key questions that are worth asking about any project. Tomorrow, I’ll talk about how to get a good handle on the research required to find answers to important questions, which—by the way—you can never assume have already been answered by the responsible government agency or potential financier.

In 30 years of working on issues like these, I’ve found that the best and the most valuable research is often done by citizens and journalists, or citizen-journalists, who do some digging on their own.

Here are some good questions to ask:

- Does this company have the financial wherewithal to build this project? Many developers and “front-men” pushing projects that require millions of dollars to succeed turn out to have little or no financial resources of their own. They’re often hoping to borrow money, find investors, get government subsidies, and in various ways risk put other people’s money at risk. These schemes can work in theory, but a company or individual that has no resources and no solid track record is generally not worth betting on.

- Do they have an actual office, with actual employees? It’s amazing how many times someone pitching a project doesn’t even have a place of business. I’ve seen situations where companies have listed office addresses that don’t exist, or list three different offices in the same community, or take squatter’s rights on an empty office and put a paper sign out front. In the case of Baard Energy, the coal-to-liquids company that said it wanted to build that high-tech power plant on the banks of the Ohio, the address on corporate filings for its headquarters turned out to be a rented storefront mailbox in Vancouver, Wash.!

- Do they have contracts to sell their “energy” to a reputable customer? Promoters often claim to have developed a project that will fill a niche market with a guaranteed big payoff. Maybe it’s a plan to produce a money-saving new jet fuel for the airline industry. Maybe it will magically turn plastic into power-plant fuel. Maybe it’s for real. Maybe it isn’t.

- Do they have similar facilities are up and running in other locations or has the technology been proven somewhere else? It’s not unusual for a developer to visit one city and announce that another city has recently agreed to build a similar plant, or that this type of technology is running productively in another country. Maybe it’s true. Maybe it’s not.

- If the developer has applied for public subsidies, is there any indication that the project could move forward without taxpayer support? Government subsidies can be critical to advancing a project that is in the public interest, and risking public funds to create community benefit is a common practice can work. But subsidy requests should be put to this test: if the project is so weak that it doesn’t stand a chance of starting without a big public commitment it’s probably not a good use of the Public Treasury.

- Have they secured funds from a bank, investor, or other lender? If a company says it has a loan commitment from a bank, or that is has approval to issue tax-exempt bonds, or that it has a venture capitalist all lined up to inject millions of dollars into the project if it can only get a permit, that company will be willing to demonstrate that is has such support. Ask to see it.

Tomorrow, in “How to Tell Truth from Fiction in an Energy Development Proposal (Part 2),” I’ll describe seven specific ways to get to the bottom of whether an energy project proposed for your community is rooted in reality or is just another a smoke-and-mirrors scheme.

Sandy Buchanan is IEEFA’s executive director.