EPH’s transition plan faces heightened scrutiny after new bond issuance

Key Findings

EPH’s international bond issuance is the group’s first since Russia’s invasion of Ukraine, taking place at a time when its Russian gas-exposed subsidiaries are facing near-term bullet maturities in April 2024 and February 2025.

In IEEFA’s view, EPH’s energy transition plan lacks a clear climate-aligned implementation and investment strategy, which raises long-term transition risks.

The majority of the group’s debt, including the new bonds that are rated at investment grade, will come due in the next five years; energy transition progress over this period may determine its continued access to funding.

Czech energy group Energeticky a prumyslovy holding, a.s. (EPH) has turned to international bonds to raise funds, placing its transition plan under the spotlight. The company’s guaranteed five-year €500 million senior unsecured bonds were issued on 13 November 2023 at 6.651%, or 350 basis points above mid-swaps. The bonds have an investment-grade rating status of BBB- by S&P Global Ratings and Fitch Ratings, one of the two debt categories generally perceived to have relatively low to moderate credit risk. But the ratings border speculative grade or “junk” bonds with relatively high credit risk.

The transaction under the new €3 billion Euro Medium Term Note Programme sees EPH’s issue at the holding company (holdco) level targeting non-domestic investors. The group has a debt financing target of 70% bonds and 30% bank loans. The pricing of the transaction reflects a risk premium versus its investment-grade peers. The completion of the transaction, together with EPH’s new term and revolving facilities totalling €3.745 billion (with maturity of up to five years) signed in June 2023, shows EPH’s strong banking relationships and access to capital markets.

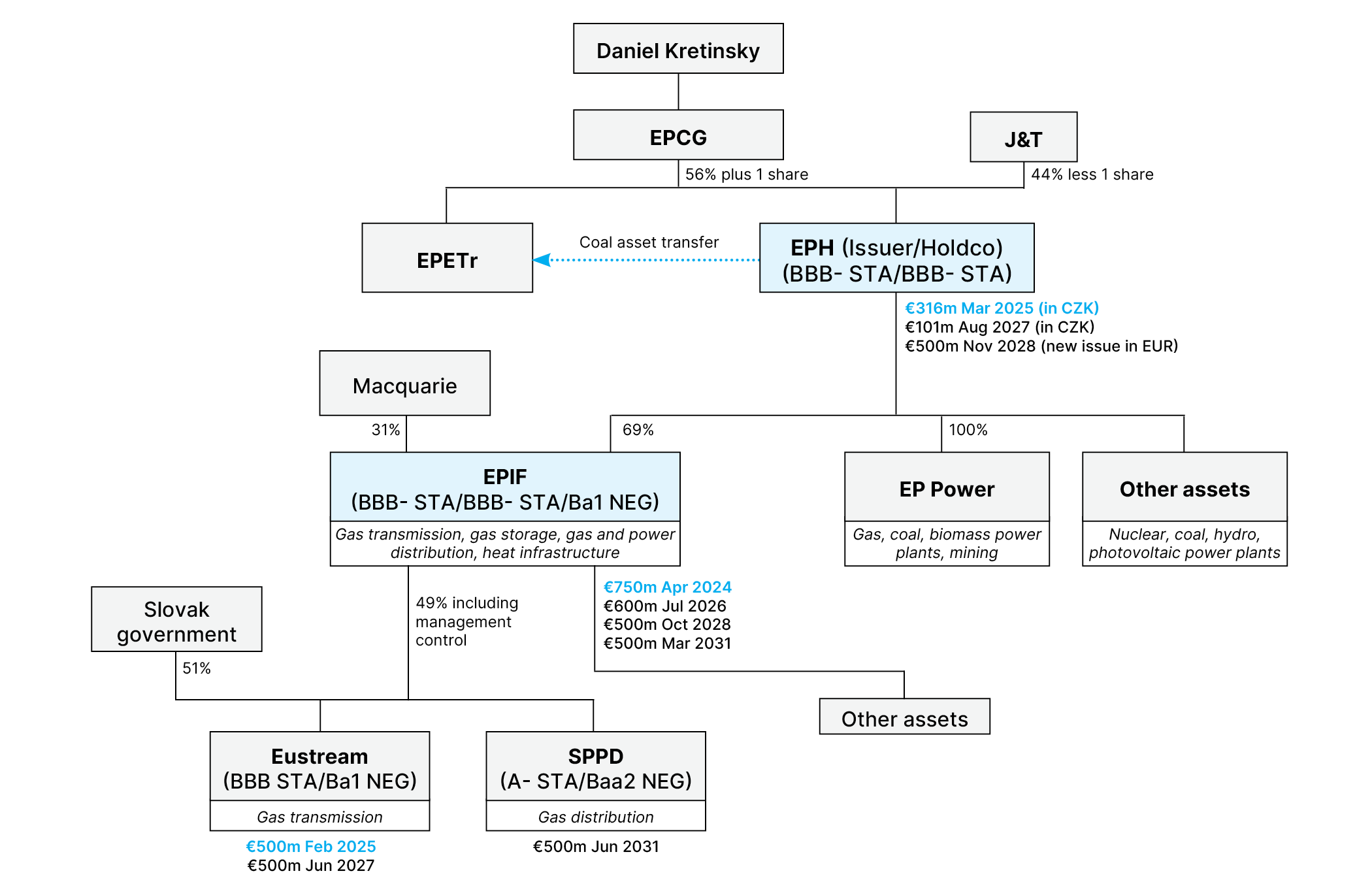

Figure 1: EPH organisational structure

Outstanding bonds illustrated (excluding private placements) are as of 30 June 2023, but include the new issue in November 2023; the bonds highlighted blue are those maturing within the next 18 months.

Source: Company bond prospectus, company reports, IEEFA

The group plans to finance at the levels of EPH and EP Infrastructure (EPIF), which is 69% owned by EPH and 31% by a consortium managed by Macquarie Infrastructure and Real Assets. But EPIF isn’t faring as well when it comes to accessing capital. It is more directly exposed to Russian gas flows through its Slovak gas transmission system operator subsidiary eustream. Since Russia’s invasion of Ukraine, EPIF has not tapped the bond market, but it has an upcoming maturity of €750 million due April 2024. Eustream will also face a maturity of €500 million in February 2025.

S&P Global Ratings and Fitch Ratings rate EPIF as investment grade on par with EPH, citing eustream’s “limited downside risk” and the “persistence of Russian gas flows so far”, respectively. A different view is taken by Moody’s Investors Service, which rates EPIF as speculative grade with a negative outlook. It has downgraded the debt ratings by two notches since Russia’s invasion of Ukraine, citing geopolitical risks. Moody’s does not rate EPH.

If EPIF’s profile is not well received by lenders, cash flow at EPIF and its subsidiaries may be depleted or EPH may need to provide support and replace its non-wholly owned subsidiaries’ debt, straining EPH’s holdco debt profile.

EPIF issued a green bond financing framework in August 2023. This may send a somewhat different signal by attempting to lure green investors towards EPIF’s projects. But no green bonds have been issued to date: EPIF has not established a track record of developing and executing credible green projects through green bond financing.

EPH intends to also create a green bond financing framework—IEEFA believes a credible one would be a positive move. EPH’s energy transition plan involves gradually transferring its lignite- and coal-intensive assets in Germany, but only to sister company EP Energy Transition (EPETr) by the end of 2025. Financial ringfencing requirements and management separation between the two related groups are not clearly outlined.

According to EPH’s latest sustainability report, it has pledged to be carbon-neutral (Scope 1 and 2) by 2050 and aims for a 60% CO2 emissions reduction by 2030 compared to 2020 levels (the target does not include emissions of entities acquired after 2020). The decarbonisation pathway is not independently verified.

IEEFA believes the transition plan disclosed in the bond prospectus does not show a clear science-based pathway supported by a comprehensive implementation and investment strategy. Even with the transfer in Germany, EPH remains highly reliant on fossil fuel activities, including mostly gas-fired plants; a 599-megawatt (MW) coal-fired plant in Sardinia, Italy; and a recommissioned 595MW coal plant in France. The company spent €100 million on EU taxonomy-aligned activities in 2022. The spending represented less than one-seventh of its capital expenditures in 2022 and much less than the €500 million in bonds newly issued in November.

In the longer term, surplus gas infrastructure could pose issues for EPH’s business model as countries deploy more renewable energy and scale up energy efficiency solutions. Refinancing risks may arise by 2028 (when the large majority of the company’s debt, including the new bank facilities and the newly issued bonds, will mature) if EPH and its related entities fail to show credible transition progress.

Answers to concerns around the company’s energy transition plan and its implications may become clearer with better transparency over time, in light of the recently launched disclosure framework by the Transition Plan Taskforce and the adoption of European Sustainability Reporting Standards. And some market-led guidance has been recently developed. The Climate Bonds Initiative suggests a transition plan framework should entail science-based, 1.5 degree-aligned ambition, action and accountability.

Credit ratings may somewhat be limited by their time horizon, raising ambiguity about how a broader long-term transition plan is factored into credit considerations. S&P Global Ratings cited “high climate transition risk” for EP Corporate Group (EPCG), EPH’s privately owned parent company; Fitch Ratings applauded EPH’s coal exit plan as a “positive credit development”. The agencies also attempt to factor in—from a governance perspective—the influence of EPCG and its owner Daniel Kretinsky.

But the extent to which these considerations weigh on EPH’s investment-grade ratings has not always been clearly quantified. This has become more opaque as S&P dropped ESG scores from credit ratings. Fitch Ratings, which publishes its similar ESG Relevance Scores, makes a contrasting commitment to gradually publish its Climate Vulnerability Signals targeting climate risk with a long-term lens, for the entire corporate portfolio.

Controversies around EPH and Kretinsky have often gone under the radar. But as the company expands its investor base, the credibility of its transition plans is increasingly subject to scrutiny. This may have implications for its long-term funding access through multiple channels, including business, technology, regulation, reputation and market.