Driving Bangladesh Bank’s low-cost green refinance schemes

Key Findings

As higher energy tariffs send a strong signal for the rapid implementation of energy efficiency and renewable energy measures, the demand for low-cost green finance will soar in the country.

With the utilisation rates of green funds remaining low, Bangladesh Bank can consider prefinancing green projects. Together with financial institutions, it can assess project proposals at an early stage and eliminate any uncertainty industries experience with the schemes.

Financial institutions should have sufficient capacity to understand different clean energy projects as financing a new industry and financing an old industry for retrofitting with energy-efficient equipment requires different appraisal processes. Similarly, bankers should know the net-metering guidelines for rooftop solar.

Bangladesh Bank should organise awareness-raising events for major stakeholders to address their concerns by ensuring that the interest rate for clean energy projects is up to 5% with a flexible loan tenure (up to 10 years). It should also debunk misinformation regarding a cumbersome documentation process.

Clean energy solutions require a significant commitment of capital from the private sector. Bangladesh Bank’s low-cost green refinance schemes, offered at up to 5% interest rates, can enable the private sector to channel this capital towards clean energy projects. These low-cost schemes increase the viability of clean energy projects as opposed to loans offered at market rates. However, information asymmetry, lack of awareness and lengthy disbursement processes prevent the proper utilisation of these schemes.

With the Bangladesh government mulling a hike in gas prices and industries reeling from previous energy price spikes, the latter would need to utilise low-cost green refinancing schemes for clean energy projects to offset increasing costs. This would necessitate addressing prevailing barriers.

Demand for Green Finance will Surge

The Bangladesh government may raise gas tariffs for industrial processes and captive power generation by 151% and 145% respectively, owing to expensive liquefied natural gas imports (proposed tariff: Bangladeshi Taka (Tk) 75.32/m3 (US$0.062/m3); previous tariffs: Tk30/m3 (US$0.246/m3) for industrial processes and Tk30.75/m3 (US$0.25/m3) for captive power). If approved, existing industries will pay the revised tariff for consuming gas beyond the sanctioned loads while new industries will pay the revised tariff for total consumption. Moreover, the persisting revenue shortfall in the power sector may compel the government to raise power tariffs.

Burdened by the challenge of rising costs while trying to remain competitive in the market, operational industries will shift their focus to energy efficiency and rooftop solar. Besides, new industries will consider a ‘whole-system-design’ approach to minimise their energy consumption by installing the most efficient technologies and harnessing natural light.

As higher energy tariffs send a strong signal for the rapid implementation of energy efficiency and renewable energy measures, the demand for low-cost green finance will soar in the country.

Green Refinance Schemes are Lucrative, but Utilisation Rates are Low

Bangladesh Bank launched a refinancing scheme for green products in 2009, initially known as the green refinance scheme for solar energy, biogas and Effluent Treatment Plant (ETP), with a modest funding size of Tk2 billion (US$16.4 million). Later on, it enlarged the funding base to Tk10 billion (US$82 million) and fixed the highest interest rate at 5% from the previous 10%. It widened the ambit of eligible projects, including energy efficiency, green building, green industry and different renewable energy technologies.

The central bank also offers a low-cost Green Transformation Fund (GTF) of Tk50 billion (US$0.41 billion), which export- and manufacturing-oriented industries can avail at up to 5% interest for green projects. The refinancing scheme for Islamic banks and financial institutions of Tk1.25 billion (US$10.25 million) is also suitable for clean energy projects.

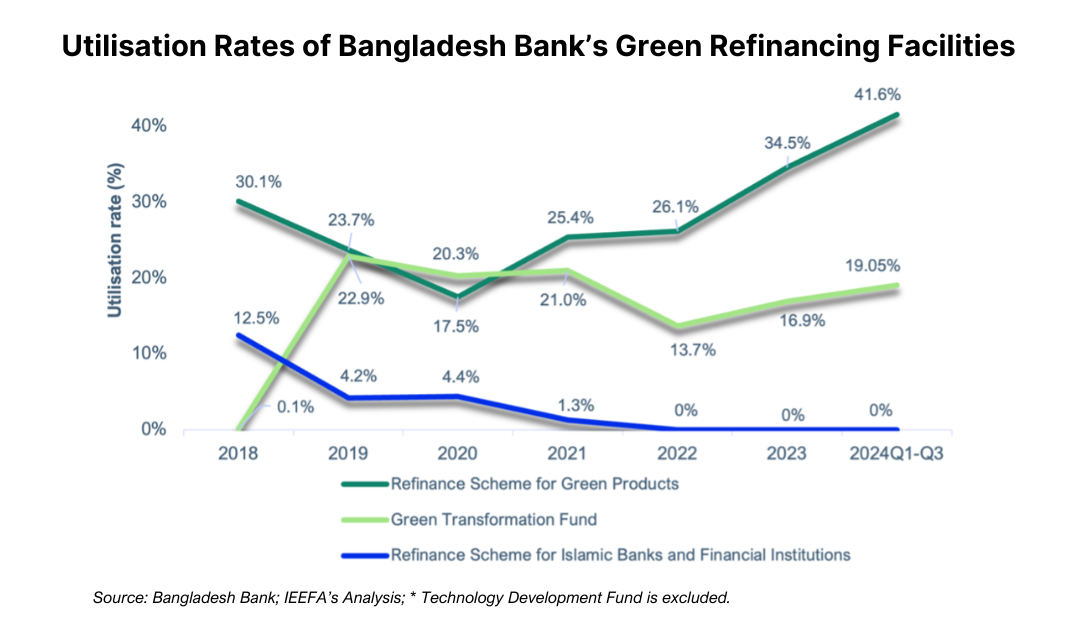

However, data shows that between January 2018 and September 2024, entrepreneurs had a tepid response to green refinance schemes. The highest disbursement rate of the refinance scheme for green products reached 41.6% during the first three quarters of 2024 while the GTF’s disbursement rate was only 19.05%. The refinancing scheme for Islamic banks and financial institutions registered zero disbursements during January 2022-September 2024 (see Figure 1).

Given the funding sizes of Tk10 billion and Tk50 billion, respectively, the refinance scheme for green products and GTF can serve the growing need for clean energy projects, excluding grid-scale renewable energy plants. As the interest rate on traditional loans in the country is around 14-15%, these two schemes offering green finance at 5% interest are highly lucrative.

Accelerating the Flow of Green Finance

There is information asymmetry among industries that refinance schemes are costly, and the loan tenure is not appropriate for clean energy projects. They find the central bank’s refinancing process lengthy, with there being a requirement for many documents. Industries have other concerns too. They first apply to financial institutions for loans at market rates and then financial institutions proceed to Bangladesh Bank for refinance schemes. If Bangladesh Bank does not approve applications for refinance schemes, industries would need to bear the high interest rates that may render their projects unviable. Additionally, capacity development of financial institutions is necessary to accelerate the flow of green refinancing schemes.

Raising Awareness

The central bank should periodically organise awareness-raising events for major stakeholders to address their concerns by ensuring that the interest rate for clean energy projects is up to 5% with a flexible loan tenure (up to 10 years). It should also debunk misinformation regarding the documents and lengthy process.

The Sustainable and Renewable Energy Development Authority (SREDA) – the nodal agency responsible for advancing clean energy in Bangladesh – should bridge the information gap that affects the use of low-cost green funds. The Bangladesh Solar and Renewable Energy Association (BSREA) can publish periodicals with updated terms and conditions of green refinance schemes for its members and stakeholders.

Prefinance instead of Refinance

With the utilisation rates of green funds remaining stubbornly low, Bangladesh Bank can evaluate the scope of prefinancing green projects. Together with financial institutions, it can assess project proposals at an early stage and eliminate any uncertainty industries experience with the schemes.

Developing Capacity of Financial Institutions

Financial institutions should have sufficient capacity to understand different clean energy projects as financing a new industry and financing an old industry for retrofitting with energy-efficient equipment requires different appraisal processes. The latter necessitates an understanding of energy audit reports and making decisions based on energy-saving potential. Similarly, bankers should know the net-metering guidelines for rooftop solar.

Bangladesh Bank, SREDA and BSREA can work together to strengthen the capacity of bankers for clean energy project evaluation and financing. This capacity development should include ways of comparing different technologies, their energy-saving potential and quantifying their financial returns.

Soaring energy and power costs are expected to drive the demand for green finance at a faster rate than before. This demand, if met by optimally utilising existing schemes, will deliver double dividends. Not only can industries reduce their energy bills, but the country will also save money, which otherwise would be spent on fossil fuel imports.

This article was first published in The Daily Star.