A Double ‘New Normal’ Hobbles the Natural Gas Industry: Low Prices and Public Opposition to More Pipelines

The U.S. natural gas industry is facing a daunting set of “new normals” that in combination are presenting significant obstacles for infrastructure expansion.

These shifting dynamics, well documented in a new report by the global engineering firm Black & Veatch, are on especially sharp display today in New England, where several controversial new natural gas pipelines are on the drawing boards.

And Black & Veatch isn’t the only putting out reports that has the natural gas industry worried. Just last week, Massachusetts Attorney General Maura Healey issued a study concluding that additional pipeline capacity is not needed to preserve electric system reliability in that region. Healey’s report was praised by environmental advocates and criticized by pipeline development companies—one clear manifestation of a new normal that includes the importance of growing opposition to such project.

TWO BOTTOM-LINE REALITIES ARE CRIMPING THE NATURAL GAS INDUSTRY TODAY:

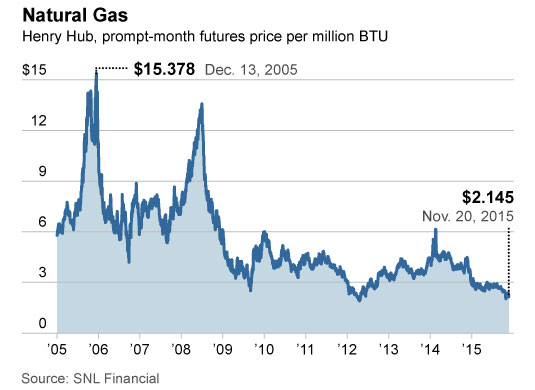

- First, prices are very low because of the shale-gas boom, and they’re probably going to stay that way. Natural gas futures prices through 2022—a measure of market expectations—for both the Henry Hub, the traditional national benchmark price for natural gas in Louisiana, and Dominion South, the hub for selling much of the gas from the Marcellus Shale in Appalachia, show this trend. Futures prices at the Henry Hub today are barely above $2; a few years ago they topped $10. While these low prices have had a profound effect on the electric generation industry the U.S.—moving the proportion of natural gas generation of electricity from 20 percent in 2005 to 32 percent today—they’re also squeezing profit margins for natural gas producers. The production industry, as a result, is consolidating, cutting costs, and striving for greater efficiencies. Some companies may even be facing bankruptcy.

- Second, public opposition to proposed new natural gas pipelines presents the industry with a significant financial risk. As prices have stayed low, the industry has been counting for survival on shipping more and more gas to both current and proposed combined-cycle natural gas electric-generation plants, especially in the eastern U.S. The customer base that would support new natural gas pipelines has shifted, from the traditional large industrial users and local gas distribution companies to utilities, and potentially to new liquefied natural gas (LNG) export facilities (more on that below). What the industry didn’t expect—and has had to manage before —is the fierce and organized public opposition that has risen up against the large number of new pipelines that would cross New England, the Southeast, and the Midwest as a result of the industry’s strategy. Landowners, civic leaders, and environmental advocates are marshaling a movement reminiscent of the public outcry against the recently canceled Keystone XL pipeline for which public accountability became the decisive financial risk.

Back to the Black & Veatch report, in which survey respondents across the industry this summer ranked “delays from opposition groups” and “regulatory uncertainty” as the biggest hurdles facing industry expansion.

Here’s how Black & Veatch describes the manifestation of recent public opposition:

“Groups opposed to increased supply from shale gas production have tried to disrupt FERC [Federal Energy Regulatory Commission] pipeline proposal meetings through mounting protests and social media campaigns. This creates additional hurdles for maintaining project timelines and has the potential to derail pipeline projects because of rising development costs and missing key milestones in contract obligations.”

In other words, the industry knows that pipeline opponents are armed with knowledge about how the regulatory system works, that these opponents can and will use that knowledge, and that they are here to stay.

Although the survey showed also that many natural gas producers are still bullish about the prospects of building new LNG export terminals in the U.S., the report’s authors have a more clear-eyed view of the diminishing prospects for these projects. Here’s a key observation:

“The global LNG market is tipping into a state of structural oversupply as we move to 2020. Worldwide, according to the International Energy Agency, supply of LNG already exceeds demand. Global LNG production capacity stood at 14 trillion cubic feet in 2014, already higher than demand of nearly 12 trillion cubic feet.”

What this means, of course, is that opponents of the proposed LNG terminals have strong economic arguments to make against overbuilding, arguments that are buttressed by a global oversupply of LNG that is likely to continue, in part due to gas coming to market from Iran and the potential for Egypt to enter the market.

Sandy Buchanan is IEEFA’s executive director.