Key Findings

Operational coal power stations in the National Electricity Market average 38 years old, close to the average historical retirement age of 42 years.

The reliability of coal power plants deteriorates as they near retirement – historical experience for plants that have closed indicates that leading into retirement 34% of their capacity is unavailable on average.

Proposals to extend the life of ageing power plants often fail to plan for poor coal reliability, which could lead to major electricity supply shortfalls. For example, analysis by Frontier Economics of a policy to delay coal closure assumed coal generation levels on average 9,300 gigawatt-hours per year (equivalent to the power consumption of 2 million households) higher than one would expect based on the historical availability of retiring plants.

To cover such a power supply shortfall using gas would strain the domestic supply of gas and lead to spikes in the price of electricity and gas.

Executive Summary

A large proportion of coal power stations in Australia are approaching an age when retirement becomes necessary. There are currently 15 operational coal-fired power stations across the National Electricity Market (NEM), with a total capacity of 21 gigawatts (GW) and an average unit age of 38 years. They are all scheduled to exit the system by 2051 per announced closure dates, or by 2040 per the Australian Energy Market Operator (AEMO)’s Step Change scenario.

In recent years several proposals or measures have been introduced to prop up the financial viability and technical feasibility of coal-fired power plants in the NEM in a bid to delay their closure. These are typically justified on the basis of ensuring power system reliability. Recently, Frontier Economics put forward modelling proposing delayed closure dates for a number of coal generators over the mid-2030s to mid-2040s, when they could be replaced by new nuclear reactors, justifying this pathway on the basis of lower cost. The Queensland government has also developed a new five-year plan with a focus on propping up coal plants, reportedly planning to extend the life of its Callide B plant beyond 2028, and potentially also extending the life of other state-owned plants in Queensland. However, these proposals and modelling exercises often don’t adequately consider the risks and costs associated with heavy reliance on coal power stations at an age approaching or exceeding 40 years.

The existing coal fleet in the NEM is ageing, and nearing the age when Australian coal power plants have typically retired. Since 2000, 13 coal-fired power stations have closed in the NEM, totalling 8GW of capacity. Their average age on closure was 42 years. By 2030, almost two thirds of current operating NEM coal capacity will exceed this historical average retirement age.

The reliability of coal-fired power stations typically declines as they age, due to the progressive degradation of critical plant components. Age-related wear and tear can increase the frequency of technical issues and outages as the plants need to reduce output or temporarily shut down units to undertake necessary repairs. Furthermore, operators often make strategic decisions to scale back asset management and capital investment in ageing coal plants, opting against major upgrades due to their limited remaining operational life and the shortened window to capture a payback on upgrade investments. Consequently, the overall reliability of coal-fired power plants – measured by their availability (the average proportion of a power plant’s maximum generating capacity that is ready to inject power to the grid if requested) – diminishes as they approach retirement. Our analysis of the historical data for the closed power stations in the NEM found that the average availability of the closed coal power stations in the 10 years before they retired was just 66%.

Because of the deteriorating reliability of coal generators older than 40 years, a strategy to rely on coal power plant extension in the mid-2030s to mid-2040s poses a serious risk to electricity reliability. The modelling by Frontier Economics features assumptions about coal plant availability that are inconsistent with the historical experience of Australian coal plant near to or exceeding the typical retirement age. Once we correct for the likely poorer availability of coal power plants in the 2030s and 2040s (by adjusting the utilisation or capacity factor down to 66% instead of the modelled range of 72% to 81%), a substantial electricity supply shortfall is evident. This ranges between 6,800 and 13,000 gigawatt-hours (GWh) per year over the first 10 years of the shortfall (2034-43 inclusive) – or 9,300GWh per year on average over the period. To put this in perspective, that is equivalent to the annual electricity consumption of 1.4 million to 2.8 million typical homes over 2034-2043 – or 2 million homes on average across the period.

To bridge such gaps with additional renewable energy and battery storage would require several years lead time in advance of the expected shortfalls in 2034 due to the time involved in constructing such new plants. In addition, for such investments in new plant to be commercially attractive, there would need to be a consequent scale-back in any proposed government-subsidised nuclear build.

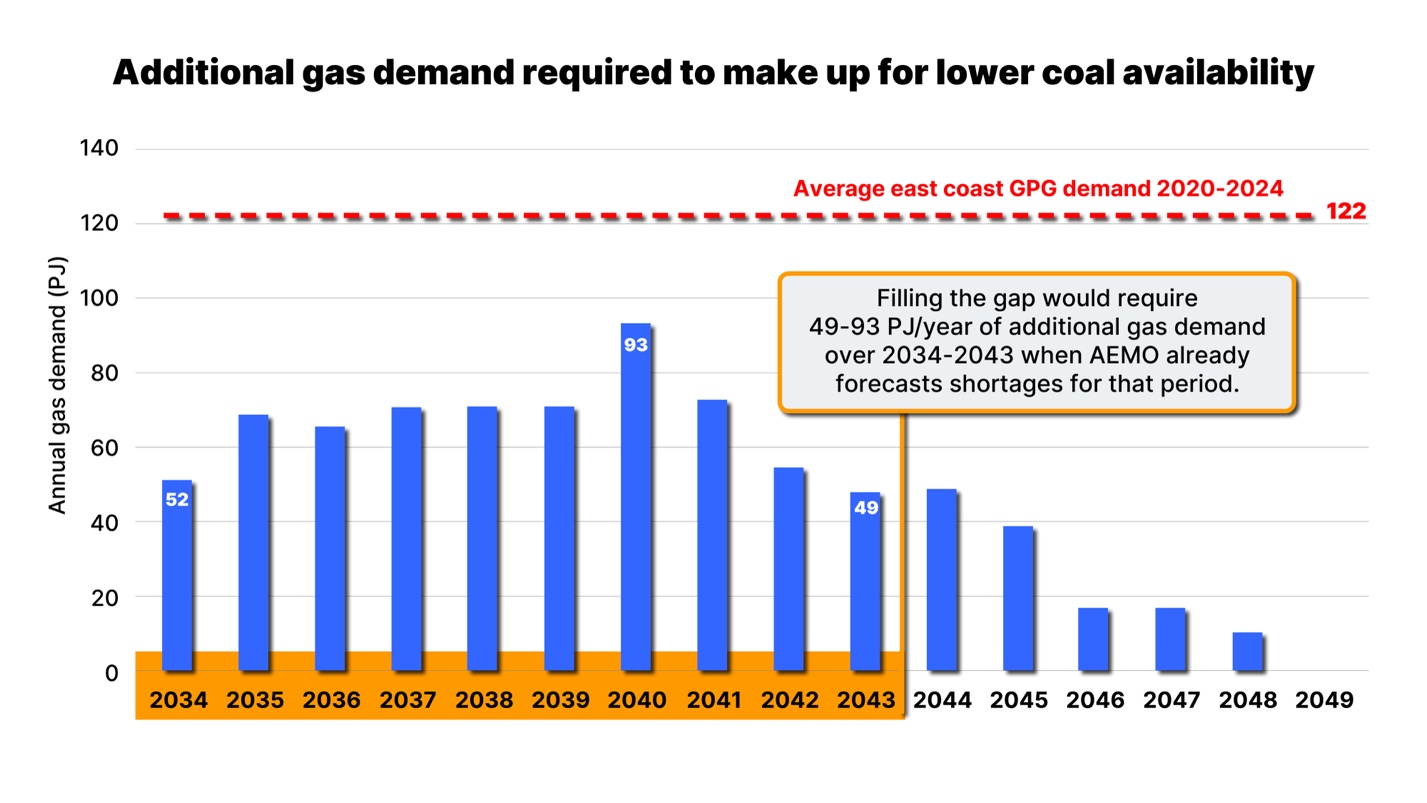

The alternative option of ramping up output from gas-fired power plants would face considerable practical constraints. Existing and new gas plants would need to significantly increase their generation, but there are questions over the source of this additional gas. Filling the gap with gas-powered generation would require between 49 and 93 petajoules (PJ) per year of additional gas over 2034-43 (67PJ per year on average). This represents a substantial increase in east coast gas demand for power generation, equal to between 40% to 76% of the average past five-year annual gas use for electricity generation of 122PJ per year. Such a surge in gas demand would be highly inflationary and challenging for energy security, given that AEMO forecasts significant shortages of gas supply for that period.

Source: IEEFA analysis, AEMO data on historical gas demand from GSOO 2025. Note: GPG = gas-powered generation.

Low coal availability also increases the risk of power price rises. Low coal availability levels can drive wholesale prices upwards during outage periods, because other more expensive forms of generation often will step in when coal outages occur. This has been observed recently by the Australian Energy Regulator (AER) and AEMO. A study by Jacobs for the Clean Energy Council found that household power bills in the NEM could rise by $449 per year by 2030 if we had greater reliance on gas and coal and if renewables were built more slowly. Household bills could rise by $606 per year by 2030 if this occurred and a major coal-fired power plant failed unexpectedly.

An extended reliance on old power plants and their associated mine sites also poses risks to worker and community safety. As power plant equipment ages it becomes more prone to catastrophic failures that can lead to dangerous accidents. This has been seen in historical fires at Hazelwood, Yallourn, Morwell and Northern, and in technical issues leading to dangerous explosions seen at Muja AB, Yallourn, Hazelwood and most recently Callide C.

A strategy of extending the life of coal power plants depends on owners making substantial investments in refurbishment. Historically some owners have rejected refurbishment projects as not cost-effective; others have undertaken refurbishment projects that ended disastrously. High costs were seen with proposed or finished refurbishments at Muja AB, Hazelwood and Liddell, with project costs ranging from $400 million to $1.3 billion (in 2025 dollars). For both Hazelwood and Liddell the refurbishment cost was deemed too expensive and problematic to be worth pursuing. For Muja AB, refurbishment did go ahead, but the project had many technical issues and cost overruns, and the plant only operated for a short time at an extremely low utilisation rate – reportedly 20% – before closing.

Banks are reluctant to finance coal power plant projects, meaning refurbishment projects may struggle to access financing from the private sector. In a recent refinancing round, Delta Electricity, the owner and operator of Vales Point power station, found that all 15 banks approached were unwilling to provide finance to support the ongoing operation of the coal power station due to policies relating to management of environment, social and governance issues.

The risks associated with coal extension could be exacerbated if the generation technology chosen to replace coal cannot be installed in the required timeline. This is of greater concern if the generation technology chosen to replace coal has long and uncertain lead times – as is the case with nuclear power. Nuclear timelines often blow out significantly. The average historical time overrun across four recent nuclear projects in Europe and the US was 11 years. If the ramp up of nuclear power generation occurred 11 years later than expected in the Frontier Economics modelling, there would be a significant potential energy supply gap, ranging from 9,600GWh to 94,500GWh per year between 2036 and 2051. To fill this potential gap would require either further life extensions to coal, compounding the aforementioned risks, or it would require an increase in other electricity generation sources. As new operators of electricity generators would not have a strong incentive to invest for the long term given the planned introduction of nuclear power, it could create a “dead zone” for investment, making it challenging to secure energy supply in this period.

Relying more heavily on coal power for longer carries a range of associated risks and costs, including risks to reliability, power prices, safety, extension costs and financing risk, as well as major implications for emissions. Delaying coal exits is a risk we can’t afford.