Cross-border electricity trade among BBIN countries offers mutual benefits

Key Findings

India could use the Green Energy Corridor to increase hydropower imports from Nepal and Bhutan to attain the renewable energy target of 2030.

Cross-border electricity trade already exists at bilateral levels. For example, Bangladesh, Bhutan and Nepal have bilateral cooperation models with India. Bangladesh also signed a Memorandum of Understanding for hydropower import from Nepal, using transmission lines from India.

Since Bangladesh, Bhutan, India and Nepal have variations in the availability of energy resources and demand patterns, exploiting the untapped potential of greater cooperation can help them generate the least-cost electricity, address seasonal energy scarcity and advance the promotion of renewable energy.

American author Helen Keller said, “Alone we can do so little; together we can do so much”. Keller’s words fit remarkably well in the South Asian energy context. Despite the vast potential for energy cooperation that the region provides, very little has materialised.

Bangladesh, Bhutan, India and Nepal, known as BBIN countries, have identical socio-economic features with ample opportunities to complement each other in the energy sector. As these countries have variations in the availability of energy resources and demand patterns, exploiting the untapped potential of greater cooperation can help them generate the least-cost electricity, address seasonal energy scarcity and advance the promotion of renewable energy.

Given that the Indian Energy Exchange (IEX) already offers options like energy trade in the day ahead market and India’s approval of the procedure for the cross-border electricity trade in February 2021, BBIN countries shall now spearhead measures to enhance regional energy cooperation.

Energy landscapes in BBIN Countries

Despite socio-economic similarities, the energy landscapes of BBIN countries vary significantly.

For instance, fossil fuels dominate Bangladesh’s power sector. It has a total installed power generation capacity of 23,482 megawatts (MW), excluding off-grid and captive generation systems. Renewable energy has a share of less than 3%. The remaining is fossil fuels-based capacity, including the cross-border import of 1,160MW from India. According to the power systems master plan 2016, electricity demand could reach up to 60,000MW in 2041.

In 2022, Bhutan had an installed power capacity of 2,335MW. Hydropower has a whopping share of more than 99% of Bhutan’s national grid. In 2021, Bhutan generated 11,059 gigawatt-hour (GWh) of electricity and exported a major portion (73.9%) of it to India. In the absence of diversification in the energy mix of the national grid, Bhutan needs to import electricity during the lean season when the lack of sufficient water affects hydropower generation. According to Bhutan’s Department of Hydropower Systems’ forecasts, the country’s energy demand could grow from 5,000GWh in 2022 to approximately 25,270GWh by 2030. As a result, Bhutan would need to ramp up power generation capacity quite drastically.

On the other hand, as of November 2022, India had a combined power system capacity of over 409 gigawatts (GW). While fossil fuels still dominate the power sector, India has a total renewable energy capacity of more than 166GW, including hydropower. Renewable energy and hydropower represent an impressive 40.66% of India’s grid. Furthermore, India has stipulated a huge target of achieving 500GW of renewable energy by 2030. Under the business as usual (BAU) scenario, India’s Central Electricity Authority projects electricity demand in the country to grow at around 5% until 2036-37.

The last of the BBIN countries, Nepal, had an installed generation capacity of 2,191MW in mid-April 2022. Nepal relies on hydropower for 96.2% of its installed capacity. Thermal and solar plants contribute 3.7% and 0.1%, respectively. Like Bhutan, Nepal also faces a power crisis during the winter when water flow decreases. The Nepal government’s Water and Energy Commission Secretariat forecasts electricity demand at BAU to grow at 4.5% till 2040 when the country will need 19,151MW. This is more than 8.5x the present installed capacity.

Seasonal variation in energy demand and untapped hydropower potential in the region

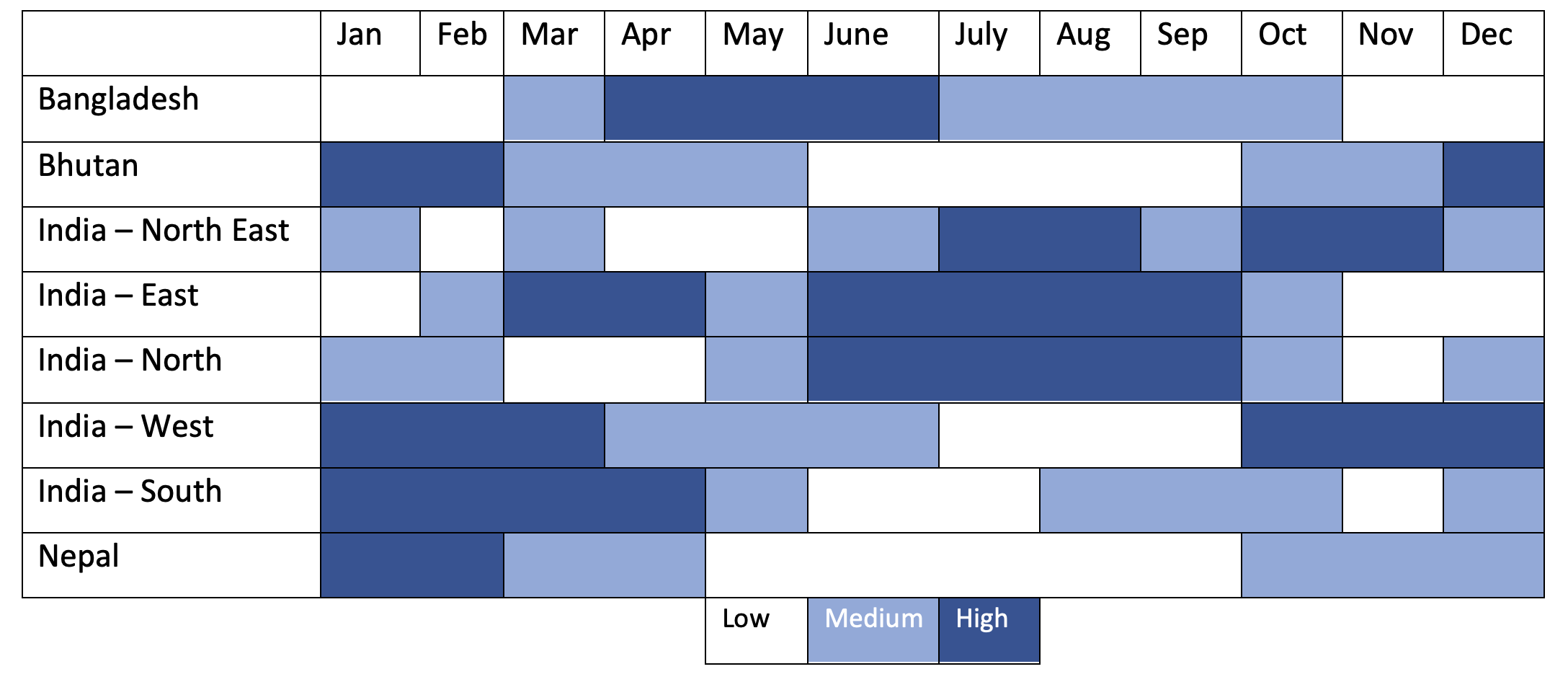

The BBIN region offers variability in demand for energy. For example, during December, January and February, Bhutan has a high demand for electricity as opposed to low demand from June to September of the year (see figure below). Comparably, Nepal has high energy demand from January to February. As a result, Nepal and Bhutan, predominantly dependent on hydropower, face power capacity shortages due to water scarcity during winter.

The scenario for Bangladesh is the opposite, as it has high energy demand from April to June and a significantly lower requirement from November to February. Some regions of India have high electricity demand from January to March or October to December.

Hence, countries in the BBIN region can complement each other and meet individual energy requirements based on their demand profiles and current power system capacities.

Figure 1: Monthly demand pattern for electricity in BBIN Countries

Moreover, Nepal has an economically feasible hydropower potential of around 40GW, of which it has only harnessed 5% so far. Similarly, Bhutan’s technically and commercially feasible hydropower potential stands at 23GW. However, it has only tapped less than 10% of its potential.

On the other hand, Bangladesh encounters challenges in increasing the share of renewable energy in its grid. Therefore, building new hydroelectric power plants, both in Nepal and Bhutan, could pave the way for Bangladesh to increase its renewable energy share. Likewise, India could also benefit from building hydropower bases in Nepal and Bhutan, especially in the months when several of its regions have higher demand.

Regional cooperation lays the foundation for cost-effective energy procurement

With the rising cost of fossil fuels in the international market, Bangladesh has been experiencing a sharp increase in electricity generation costs. Average power generation costs shot up from Bangladeshi Taka (Tk) 6.61/kilowatt-hour (kWh) (US$ 0.064/kWh) to Tk8.84/kWh (US$ 0.085/kWh) during the fiscal year (FY) 202-21 to 2021-22. Reportedly, the average electricity purchase cost from Independent Power Producers (IPPs) was as high as Tk11.55/kWh (US$ 0.11/kWh) during FY2021-22.

In contrast, the average electricity prices for May 2022 and December 2022 were Rs6.76/kWh (US$ 0.083/kWh) and Rs5.23/kWh (US$ 0.064/kWh), respectively, on the IEX. As such, procurement from the day-ahead market through the IEX could allow Bangladesh to choose cheaper electricity and move forward for the least-cost power generation.

As energy demand is likely to rise significantly in Nepal and Bhutan, they could follow a similar approach of procuring from the day ahead market.

India could use Green Energy Corridor to increase hydropower import

The India Green Energy Corridor project, implemented by eight states, will support the intra-state transmission of renewable energy. The Green Energy Corridor can reduce intra-state transmission charges and power costs. This will allow the evacuation of renewable energy from states rich in renewables, thus enhancing the share of renewable energy.

India could use the Green Energy Corridor to increase hydropower imports from Nepal and Bhutan to attain the renewable energy target of 2030.

BBIN could build on existing frameworks

The BBIN region does not need to start all afresh. Cross-border electricity trade already exists at bilateral levels. For example, Bangladesh, Bhutan and Nepal have bilateral cooperation models with India. Bangladesh also signed a Memorandum of Understanding for hydropower import from Nepal, using transmission lines from India. And given that the IEX platform can facilitate electricity trade, the BBIN region only needs to build on the existing set-up for cross-border electricity trade.

It is imperative, though, that the countries' policymakers work with a vision to achieve mutual benefits of energy security, transition to renewable energy and meet climate pledges. In addition, there should be commitments from the counterparts to develop the cross-border electricity trade ecosystem further, including investment in transmission projects.

This article was first published in the February 2023 edition of Power Line South Asia magazine (page 50-51).