BHP’s Latest Numbers Offer a Window on an Industry in Decline

The recent half-year production numbers out of BHP Billiton are more than a snapshot of one giant energy company: They’re a window on the world’s larger ailing coal-mining industry.

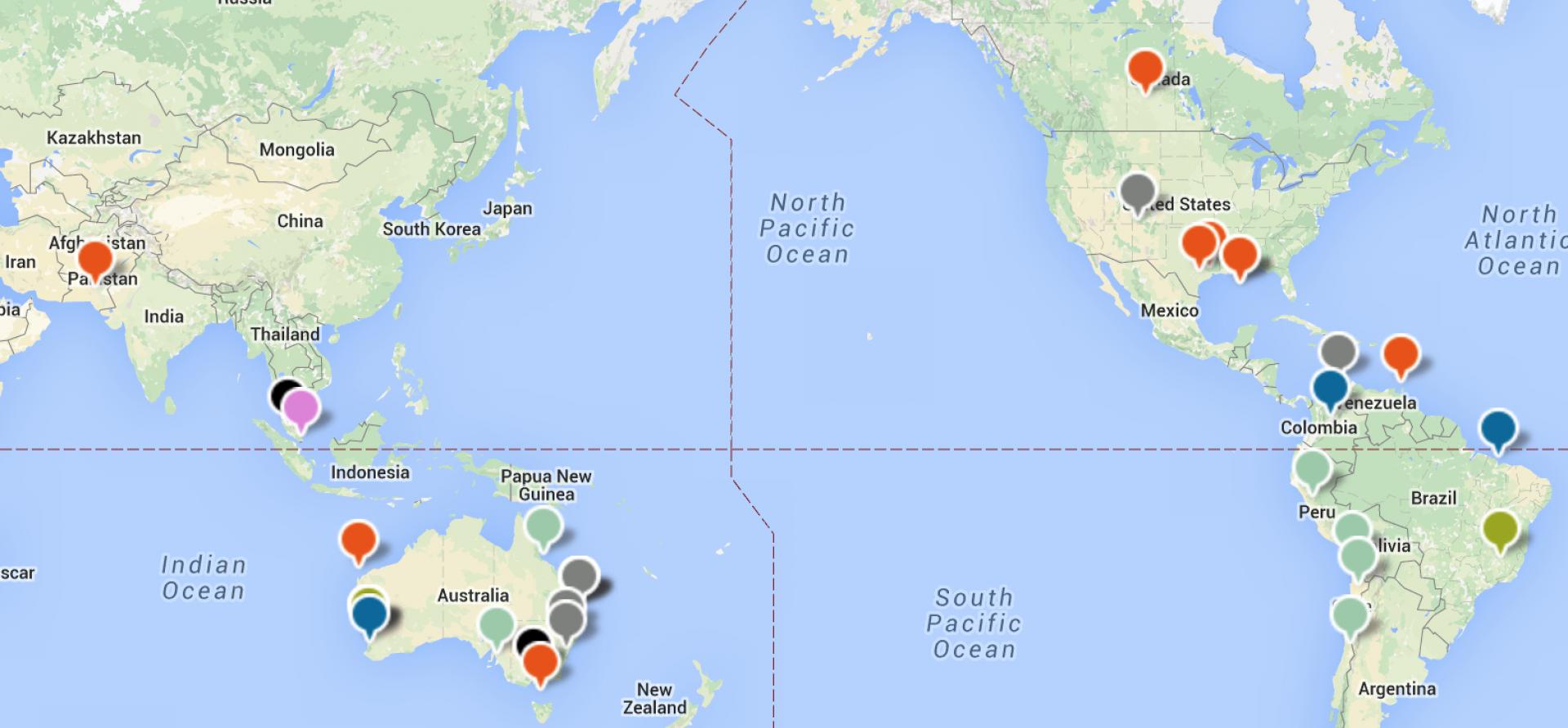

The figures show that BHP—like other big miners that include Rio Tinto, Vale S.A., and Anglo American—is gradually exiting its under-performing coal group.

BHP executives are no doubt well aware that any new coal project proposal will face a significantly increased level of scrutiny given the dramatically reduced commercial viability of such endeavors. As a result—and as can be seen in these new numbers—the company is scaling capital expenditures back significantly in a trend that will not easily be reversed.

One of the most notable takeaways from this latest report comes from what wasn’t said: BHP made no mention of new coal projects beyond those already under construction.

Also of note:

- The company puts its 2014-15 thermal coal production at 73 metric tons for the year, showing no growth over 2013-14.

- During the second half of 2014, the company received on average US$60/tonne for thermal coal, down 19 percent from the previous year.

- Prices were down by a similar magnitude for metallurgical coal, and price weakness in general shows no sign of a let-up this year.

- The company says its US$1.5 billion expansion of Hay Point Coal Port in Queensland, Australia, is only now being completed —nine months behind scheduleIEEFA views this as reflection of lack of growth in demand..

- The company has yet to receive payment on the December 2013 sale of its Navajo Coal Co. mine in New Mexico, a sale that wisely halved BHP’s exposure to U.S. coal.

- The company’s proposed spinoff of a new company called South32 that enables it to gracefully exit its 30-metric-ton-per-year South African thermal coal production operation and its 8 metric-ton-per-year Illawarra coking/thermal coal unit in New South Wales, Australia. The spin-off will most likely be approved at a shareholder vote in May.

All of these developments reflect the larger truth that coal production, as a going concern, is not what it used to be.

In the case of BHP, in particular, IEEFA expects the company to stall or adopt a go-slow approach on any new coal-production proposals related to its sizeable holdings in Indonesia or in Caroona in New South Wales.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia