Shute Creek – world’s largest carbon capture facility sells CO2 for oil production, but vents unsold

Key Takeaways:

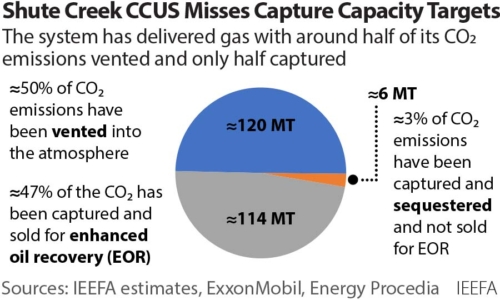

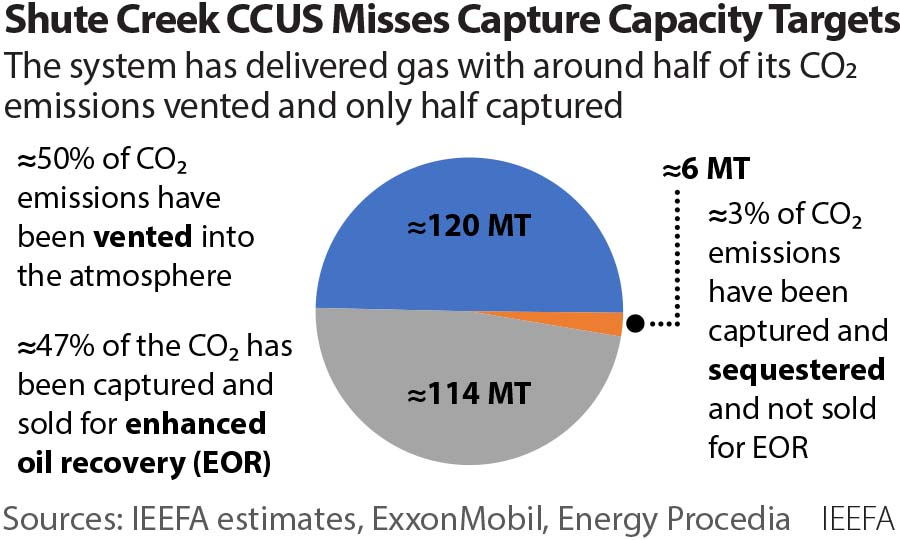

It is estimated that the Shute Creek CCUS plant has produced gas with only about half of the CO2 captured over its lifetime.

Oil and gas companies use CO2 for enhanced oil recovery (EOR), pushing more oil from depleted reservoirs – and promote it as a climate-friendly solution.

The CO2 that cannot be sold for EOR is more often vented. The "sell or vent" business model does not work.

1 March 2022 (IEEFA) – ExxonMobil has consistently failed to reach carbon dioxide (CO2) capture capacity in its long-running Shute Creek carbon capture utilization & storage (CCUS) project and has vented captured CO2 back into the atmosphere when it couldn’t be sold to companies extracting more oil from depleted reservoirs, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

In brief:

- ExxonMobil’s Shute Creek, the biggest Carbon Capture Utilization and Storage (CCUS) project in the world and one of the longest running, has failed to reach its CO2 nominal capture capacity during its 35-year lifetime.

- The facility commenced operations in the era before climate change was a widespread public concern with the principal purpose of selling captured CO2 for Enhanced Oil Recovery (EOR).

- EOR – using CO2 to produce more oil from depleted reservoirs – has been re-labelled by the oil and gas industry as CCUS and is now being promoted as a climate-friendly solution.

- CCUS is being used by oil and gas companies primarily for EOR. Around 73% of all captured CO2 from carbon capture projects globally is used in EOR. Producing more oil is not “climate friendly.”

- Shute Creek gas is very high in CO2. To produce ‘natural’ gas, CO2 must be removed. The CO2 was sold to oilfield developers for EOR, improving the economics of the project.

- Based on ExxonMobil’s disclosures, IEEFA estimates that the Shute Creek CCUS plant has produced gas with around half of the CO2 vented and only around half captured over its lifetime.

ExxonMobil’s Shute Creek CCUS facility was commissioned in 1986 with the principal economic driver to sell captured CO2 from its gas processing plant to oil companies for the purpose of pumping it into depleted wells to recover more oil – or enhanced oil recovery (EOR). The oil recovered is then refined and burnt, producing CO2.

Over its 35-year history, Shute Creek has captured around 40% of all anthropogenic (human-induced) CO2 captured in history – approximately 120 million tonnes – which is around 34% less than its specified capture capacity.

IEEFA’s report notes that with one project accounting for about 40% of all anthropogenic CO2 captured during 50 years of the technology’s existence, it is clear that carbon capture and storage (CCS) has not been successfully scaled up despite its longevity.

Report author gas/LNG analyst Bruce Robertson says with projects designed to capture CO2 generally attracting a significant amount of government subsidies and tax credit incentives, the business model of fossil fuel projects with CCS needs closer examination.

“Oil and gas companies with carbon capture facilities are selling captured CO2 for EOR and what can’t be sold is more often vented,” says Robertson. “CCS/CCUS effectively extends the life of fossil fuel companies, giving them a licence to ramp up production.”

Co-author of the report analyst Milad Mousavian says the ‘Sell or Vent’ way of doing business shows CCUS projects like ExxonMobil’s Shute Creek are essentially about producing more oil, not emissions reduction.

“ExxonMobil could not sell all the captured and marketable CO2 from its Shute Creek facility over many years,” says Mousavian. “Sales of CO2 for EOR tend to do better in a high price environment. A ‘Sell or Vent’ business model is flawed given the volatile nature of oil prices.”

Despite having the largest capture capacity in the world, IEEFA estimates that on average, the Shute Creek CCUS facility has fallen short of its capture capacity target by around 34% over its lifetime, which translates to approximately 66 MT of CO2 failing to be sold for EOR and consequently being released into the atmosphere.

“In our view, the oil price volatility risk may have been underestimated in the Shute Creek case. This could be detrimental to the financial feasibility of other CCUS projects.”

Robertson says governments, companies and investors should take note.

“CCUS projects could prove to be unsustainable both economically and environmentally. Each project’s emission reduction projections and performance must be questioned. This is a point that IEEFA has made repeatedly,” he said.

Note: In order to assure that the analysis was based on accurate ExxonMobil data, IEEFA sent its data files to the company, requesting confirmation several weeks before publication. The company had not provided IEEFA with a response before this report was published.

Read the report: Carbon Capture to Serve Enhanced Oil Recovery: Overpromise and Underperformance

Media contacts: Kate Finlayson ([email protected]) +61 418 254 237 or Vivienne Heston ([email protected]) +1 (914) 439-8921

Author contacts: Bruce Robertson ([email protected]) and Milad Mousavian ([email protected])

U.S. contact: Tom Sanzillo ([email protected]), director of financial analysis at IEEFA

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Related items:

IEEFA U.S.: Federal blue hydrogen incentives: No reliable past, present or future

IEEFA U.S.: Investors hesitate to fund San Juan Generating Station CCS retrofit

IEEFA U.S.: Carbon capture goals miss the mark at Boundary Dam 3 coal plant

IEEFA: Emissions and Qatar are neglected risk factors in Woodside’s Scarborough project

IEEFA U.S.: Ratepayers face risks with Project Tundra’s retrofit of aging N.D. coal-fired plant