IEEFA: Consultants poised to make more than $1 billion from bankrupt Puerto Rico utility

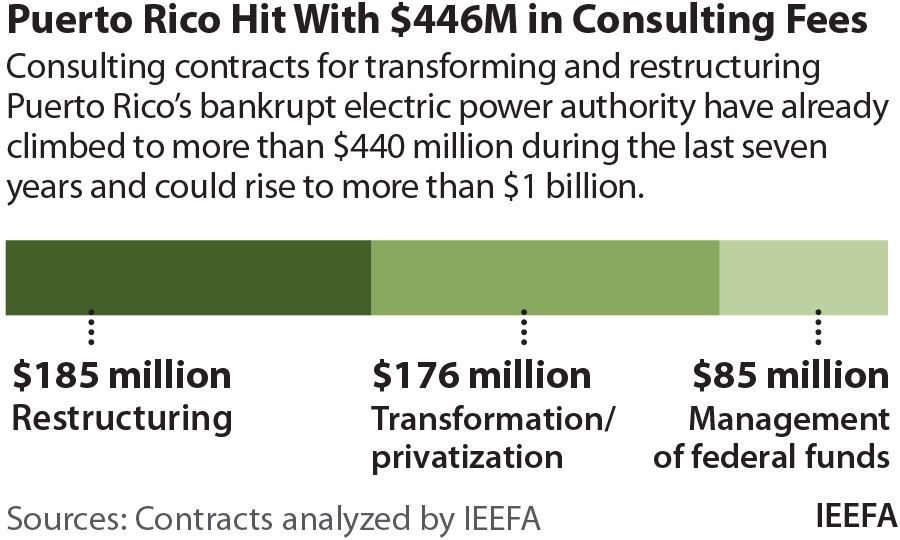

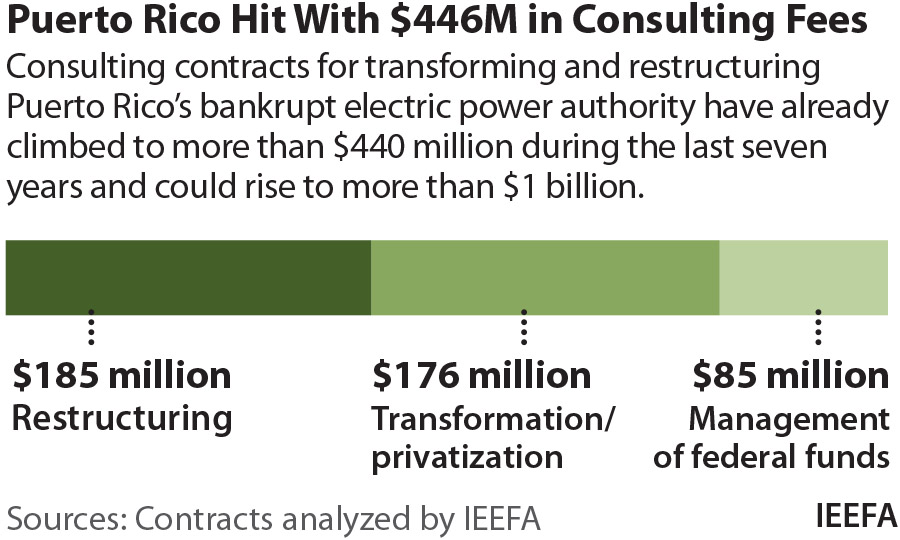

April 29, 2021 (IEEFA) ⎼ The transformation and financial restructuring of Puerto Rico’s bankrupt electric power authority have generated more than $440 million in consulting contracts during the last seven years and could cost island residents more than $1 billion before completion, according to a study released today by the Institute for Energy Economics and Financial Analysis.

April 29, 2021 (IEEFA) ⎼ The transformation and financial restructuring of Puerto Rico’s bankrupt electric power authority have generated more than $440 million in consulting contracts during the last seven years and could cost island residents more than $1 billion before completion, according to a study released today by the Institute for Energy Economics and Financial Analysis.

Consultants based in Puerto Rico accounted for only 3 percent of all contracts

The IEEFA study found the vast majority of consultants hired to retool the commonwealth’s electrical system were based on the mainland U.S. Consultants based in Puerto Rico only accounted for $14 million, or roughly 3 percent of all contracts. A handful of the consultants charged more than $1,200 per hour for services on the island, where the median annual household income barely tops $20,000.

“Puerto Rico agencies and the Financial Oversight and Management Board (FOMB) frequently employ the rhetoric of savings, cost-effectiveness and prudent financial management,” said Cathy Kunkel, an IEEFA energy analyst and lead author of the report. “But not when it comes to contracts for professional services.”

Over the past seven years, the Puerto Rico Electric Power Authority (PREPA) and other government agencies, including the FOMB, have spent at least $440 million on consultants, with five U.S. mainland firms receiving 40 percent of the total. More than $1 of every $3 spent on contracting has gone to law firms.

An IEEFA analysis of contracts found systemic problems with the services, including:

- Major operational decisions made by consultants with no prior history of working in Puerto Rico;

- Consultants responsible for determining consulting fees;

- Duplication of efforts; and

- Misaligned financial incentives for consultants.

EARLIER THIS WEEK, GOV. PEDRO PIERLUISI ISSUED AN EXECUTIVE ORDER aimed at enhancing transparency around Puerto Rican government contracts for professional services. Tom Sanzillo, IEEFA director of financial analysis and a co-author of the report, found the executive order to be “superficial and likely ineffective.” He noted that the executive order:

- Does not require a formal request for proposals (RFP) process for contracts;

- Does not implement any cap on professional services fees; and

- Does not apply to contract renewals or to “services previously contracted and which, according to the judgment of the head of the agency, need to be continued” — a category which arguably applies to the bulk of electrical system restructuring and privatization contracting.

Sanzillo also noted that LUMA Energy, the private operator hired to manage Puerto Rico’s transmission and distribution system, falls outside the scope of the order. LUMA’s initial budgets propose cutting labor costs while increasing amounts spent on professional and technical services contracts.

The study makes seven key recommendations:

- The Puerto Rico Legislature should adopt and enforce a consultant fee structure, including a cap on hourly rates, that is consistent with the island’s economic condition.

- The law that created the FOMB should be amended to eliminate the requirement that the people of Puerto Rico pay all board expenses.

- Any electrical system transformation contracts should include performance metrics based on long-term goals established by the Puerto Rico Legislature, including affordable rates at less than 20 cents per kilowatt-hour and achieving the commonwealth’s renewable energy standard.

- The Puerto Rico Energy Bureau or FOMB should immediately post an online accounting of all fees spent on PREPA’s transformation and debt restructuring.

- The FOMB and PREPA should immediately disclose the full budget that underlies the FOMB’s December 2020 estimate that PREPA will spend $500 million to complete its debt restructuring.

- PREPA’s debt should be fully audited. Despite seven years of negotiations, there remains no resolution to the issue of whether this debt was legally incurred and, if it was, whether the diligence conducted by the commonwealth, PREPA and its advisors violated any laws.

- Congress should authorize an Independent Private Sector Inspector General for PREPA to act as an on-site monitor to prevent waste, fraud and abuse.

“At least $440 million has been spent on consulting fees, but after seven years, there’s little to show for it,” Kunkel said. “We have found a structural misalignment of incentives that have allowed off-island consultants to make fundamental decisions about the electrical system and its debt without accountability to the people of Puerto Rico.”

Full report: Paying for Failure

Versión en español: Pagar por el fracaso

Comunicado de prensa en español: Consultores listos para ganar más de $1,000 millones de la corporación de servicios públicos de Puerto Rico en bancarrota

Author contact

Cathy Kunkel ([email protected]) is an IEEFA energy policy analyst.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.